Quick Value 6.21.21 ($DXC)

DXC Technology - IT outsourcing turnaround at 10x earnings

Market Performance

Market Stats

Natural gas prices are on the rise…

Federal Reserve economic outlook as of June 2021…

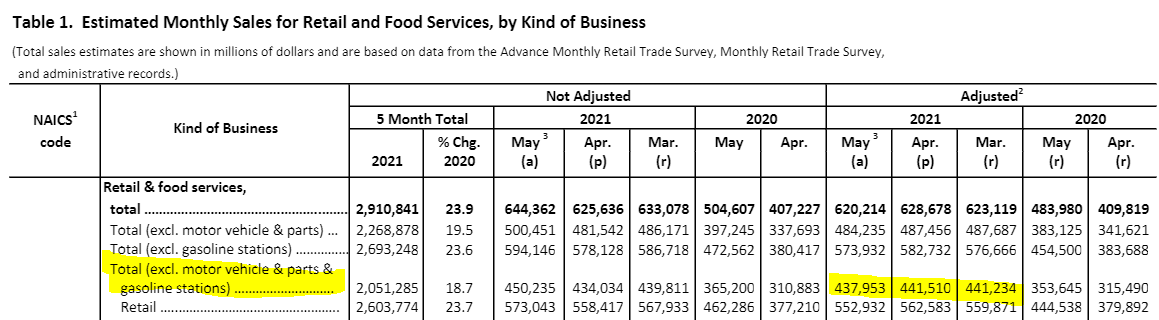

Retail sales in May were down a few points from April but still up considerably from May 2019 and 2020 levels…

Excluding auto sales and gas stations — retail sales have flatlined over the past few months at ~$440bn per month…

Quick Value

DXC Technology ($DXC)

This was a former (unsuccessful) holding of mine. Looks like it’s worth a revisit despite shares having rallied more than 3x since 2020 lows (although still down considerably from pre-COVID levels).

DXC provides outsourced software and IT services globally. It was formed by the 2017 merger of HP’s enterprise services division and Computer Sciences Corporation. Well regarded CEO Mike Lawrie took the helm and shares did quite well (for a while). The business had long struggled with declining revenue and perhaps as things came to a head, CEO Lawrie abruptly resigned in late 2019. Since then, shares have struggled.

New CEO Mike Salvino was a former Accenture executive and has taken some steps to turn the company around. And they recently held an investor day to highlight the future…

As a start, DXC trades at $36 and has 255m shares outstanding for a $9.2bn market cap. Net debt is ~$2.5bn after a few asset sales. Enterprise value of $11.7bn.

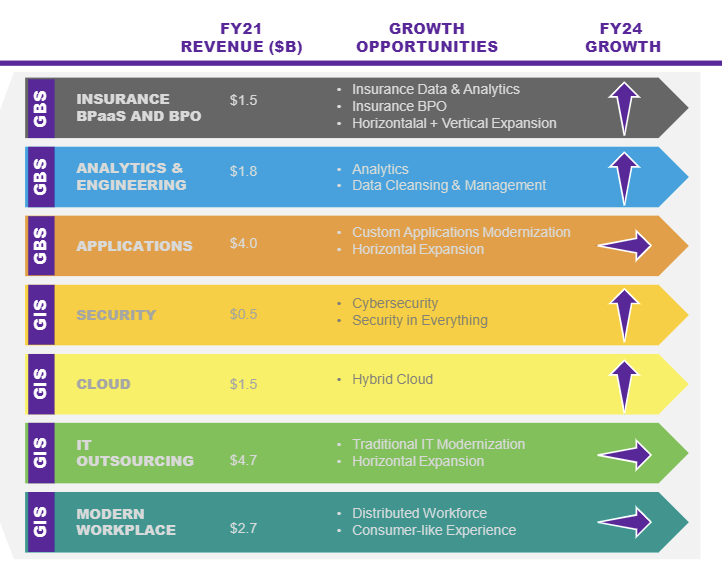

DXC operates across a few verticals like cybersecurity and data analytics. Most have differing growth profiles…

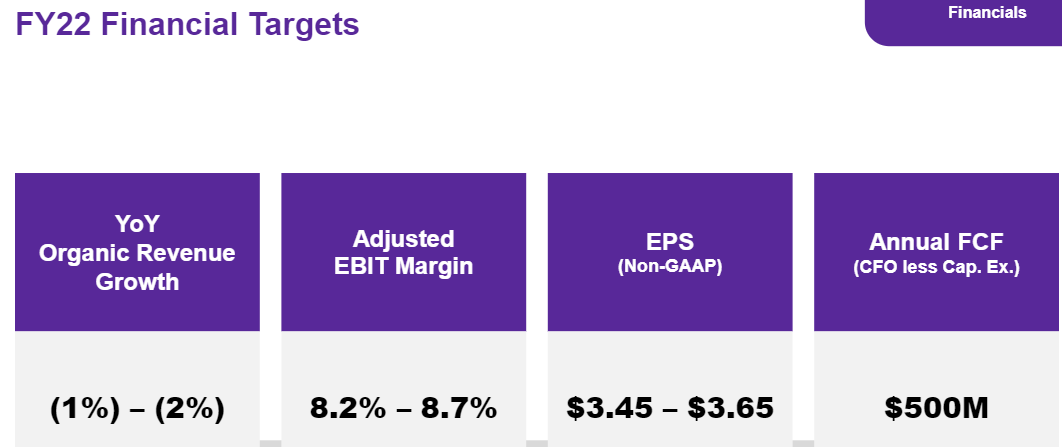

Fiscal year 2021 ended as of 3/31/21 with revenue still in decline but bookings starting to turn the corner. Q3 and Q4 saw sequential organic growth in the business. FY22 targets call for modest revenue decline and ~$3.55 in EPS at the midpoint — putting this at a 10x PE.

As management executes on the plan, they intend to hit positive organic growth and get to $5+ in EPS while tripling annual free cash flow…

Capital allocation should become a larger part of the conversation in FY22 and beyond as debt is now under control… Share repurchases are likely to be a bigger part of the picture in future years…

They’ve notched a few quarters of progress but still plenty of work left to do…