Quick Value 6.22.20 (OTIS)

Otis Worldwide Corp ($OTIS)

Market Performance

[Index | % change WoW ]

S&P 500 | 3098 +2%

Dow Jones | 25871 +1%

Russell 2000 | 1419 +2%

Russell Microcap | 537 +3%

10-Year | 0.7% unch

Gold | 1755 unch

Oil | 39 +8%

VIX | 35 -3%

Market Stats

A few notable developments from last week…

May retail sales were fairly good — while still down 6.1% from last year, it shows how quickly things have been rebounding (17.7% from April to May)… a trend that is certainly continuing so far into June…

Online sales continue to take share from physical with 9% MoM and 31% YoY growth in May… nonstore sales went from 12% of total retail sales in May 2019 to 16.5% in May 2020

Housing looked promising as well with building permits and housing starts jumping 14% and 4% from April to May

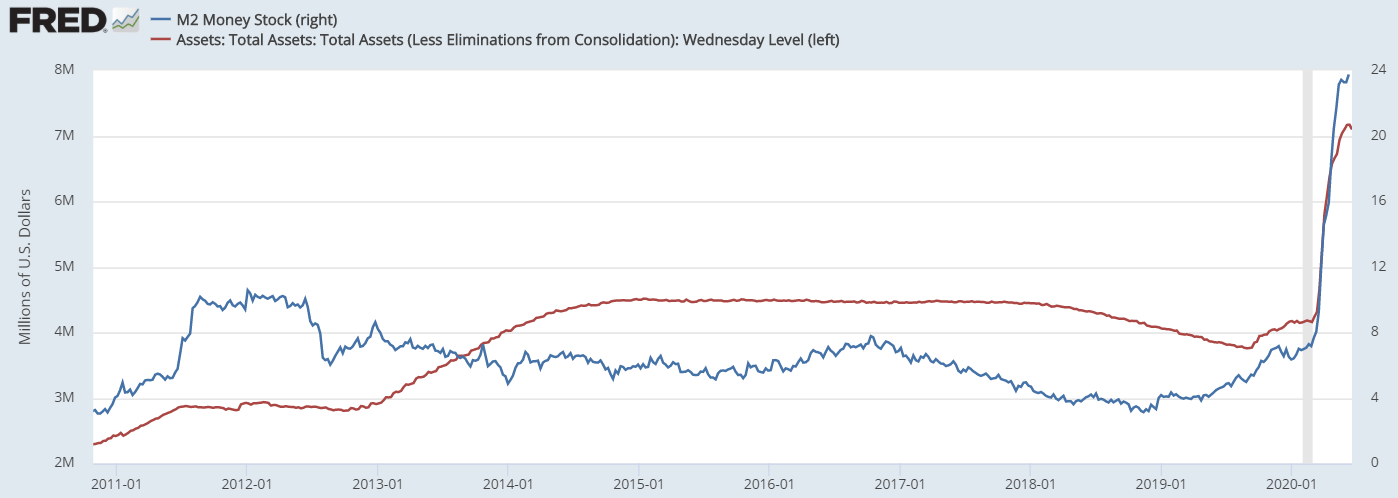

Money supply continues its elevated growth (>20% year-over-year) as Fed support continues its asset purchases…

Jobless claims continue at an elevated level of 1.5m per week in new claims and 20m or so continuing claims…

Quick Value

Otis Worldwide ($OTIS)

Otis was very recently spun off from former parent United Technologies (which itself recently merged with defense company Raytheon. Here’s how they describe themselves:

Otis is the world’s largest elevator and escalator manufacturing, installation and service company. We are a leader in the approximately $75 billion global elevator and escalator industry. We expect the new equipment industry to grow in line with gross domestic product (‘‘GDP’’), with the service-related segment outperforming the rest of the industry. We believe that growth in our industry is supported by favorable trends,including increasing urbanization and continued emergence of global middle classes. We believe that we are well positioned to benefit from these long-term trends as a result of the strength of our brand, our track record for innovation and our global maintenance footprint.

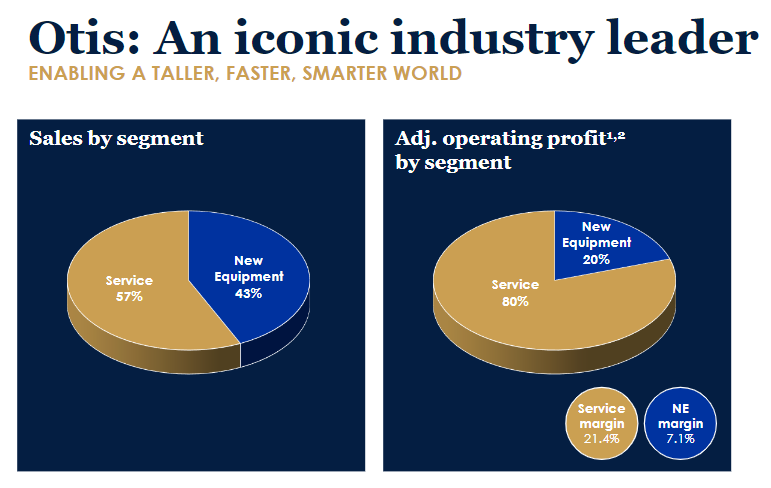

Otis generates sales on new equipment (43% of sales) and service (57% of sales) and those sales are pretty evenly split between the Americas, Asia, an EMEA.

New Equipment. Through our New Equipment segment, we design, manufacture, sell and install a wide range of passenger and freight elevators, as well as escalators and moving walkways for residential and commercial buildings and infrastructure projects. We sell our New Equipment units directly to customers, as well as through agents and distributors globally. We have developed a range of elevator and escalator solutions to meet the varying needs and objectives of our diverse customers. In 2019, our New Equipment segment had net sales of $5.6 billion.

Service. Through our Service segment, we perform maintenance and repair services for both our products and those of other manufacturers, and provide modernization services to upgrade elevators and escalators. We have a maintenance portfolio of over two million units globally, which includes Otis equipment manufactured and sold by us, as well as equipment from other original equipment manufacturers. We sell our services, through our network of over 2,700 service sales personnel, directly to customers in all significant elevator and escalator end-segments around the world, including in residential and commercial buildings and infrastructure applications. In 2019, our Service segment had net sales of $7.5 billion.

The elevator industry has historically been viewed as a fairly good one and is already relatively concentrated between:

Otis

Kone oyj (publicly traded)

Thyssenkrupp (recently sold)

Schindler

Rival Thyssenkrupp recently sold their elevator business in a $19bn deal to private equity, valuing that business at nearly 17x EBITDA. Both Kone and Schindler trade at 14-20x EBITDA.

Otis has 433m shares outstanding and a $57 stock price = $25bn market cap. Net debt is $5.1bn for a ~$30bn enterprise value. Free cash flow in 2020 was expected to be $1-1.1bn (25x P/FCF) before COVID-19 came along.

So we’ve established this is a pretty good business with some excellent recurring sales (mainly on the service side). Here’s the financial model that Otis is hoping to achieve longer-term:

A mid single digit sales grower, with high single digit earnings growth and 110-120% earnings converted into free cash flow. Not a bad setup. Although past performance has been somewhat lackluster — 2% sales growth from 2015-2019 with flat-to-down earnings…

Despite the industry concentration, there is still a good amount of smaller players in the repair & maintenance arena servicing the 16m installed units around the globe — certainly an area of opportunity for Otis.

But what do you pay for a high quality and stable business like this?

Consensus estimates for 2021 call for $2.30 in EPS and $2bn in EBITDA for a 25x PE multiple and 15x EV/EBITDA multiple.

Despite the high multiples, this is viewed as a fairly stable business with potentially few unexpected negative surprises along the way (a positive in public markets).

If earnings grew at 9% for 10 years = ~$5.50 in EPS… So call it roughly 10x earnings 10 years out on a fairly stable business. With a 1% dividend yield that is likely to grow over time — today’s price likely indicates 3-7% annual returns over the next 10 years?

The situation reminds me of the Allegion (ALLE) spin-off by Ingersoll Rand in 2013. Sales and earnings were very much flat for years leading up to the spin-off and I anticipated a low trading multiple because of that… The stability of locks and security products led to higher multiples and a higher stock price where Allegion has remained since and now trades at 25x PE and 18x EBITDA…

Allegion doubled from ~$40 to over $100 per share between 2013-2019 as they found ways to grow the business organically and through M&A… If Otis can do the same, then perhaps shares have more upside from here?