Quick Value 6.28.21 ($TG)

Tredegar - small-cap specialty chemical at less than 10x FCF

Market Performance

Markets bounced back significantly over the past week and shook off the (brief) concerns around inflation, etc.

Market Stats

The volatility index (VIX) has continued a downward trend with occasional flare ups.

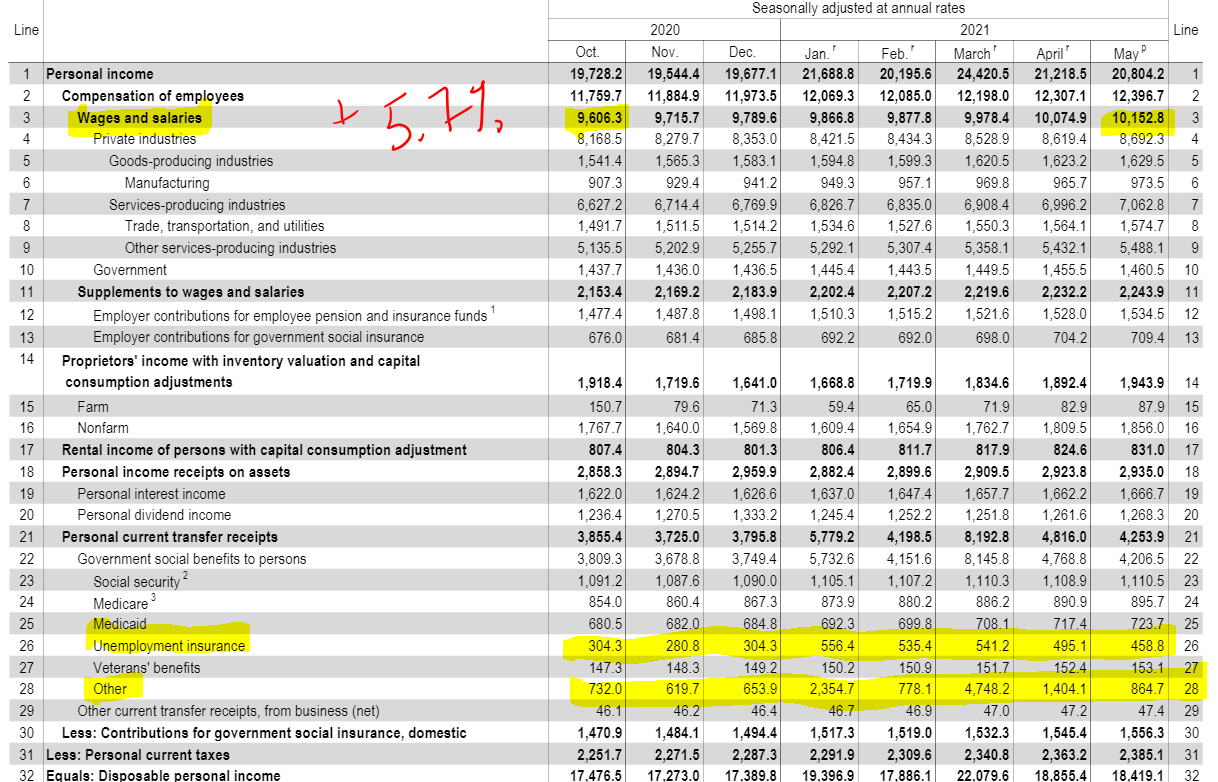

Personal Income and Spending report indicated May 2021 wages and salaries were up 5.7% from October 2020 levels…

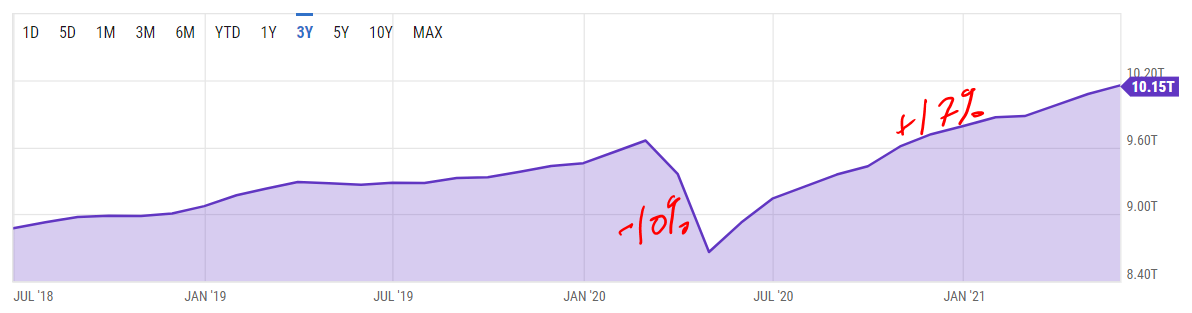

Since the pandemic began, wages dropped ~10% and have since recovered by more than 17%.

Savings have been persistently high with the savings rate continuing >10%. With a lifetime average of 9% — the US has been running at above average savings every month since March 2020. This compares to 5% or less during the 2000s and 6-8% during the 2010s.

Quick Value

Tredegar Corp ($TG)

Tredegar is a small-cap specialty chemical company. They operate 3 businesses:

Aluminum Extrusions. Under the Bonnell name, they make treated and untreated aluminum extrusions (beams and other products) for the construction, automotive, and specialty markets.

Surface Protection. This segment makes films and overwrap films for various products and industries — example would be an overwrap film for bathroom tissue and paper towels.

Flexible Packaging Films. Known as Terphane, this segment makes films mainly for packaged foods and industrial applications.

Aluminum has historically been more than 60% of total sales.

Quick recap of the past year…

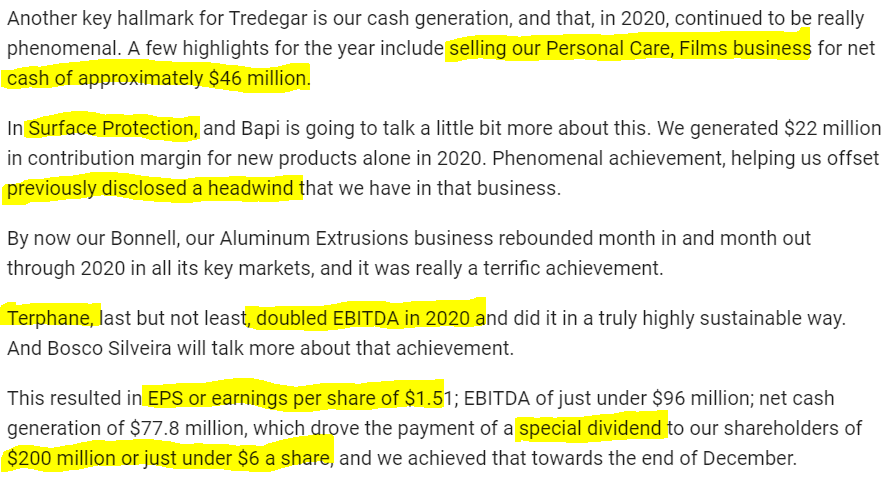

Management laid out the highlights of the past year during the annual meeting.

Sold Personal Care business for $46m

Paid $6 per share special dividend

Generated $1.51 in EPS and $96m EBITDA

Significant customer attrition at Surface Protection

Five year financial summary…

This business has had flattish revenue over the past 5 years with spotty, but mostly positive, cash flow. Only recently has Tredegar started to generate consistent FCF, averaging $54m from 2017-2020.

Valuation…

At $13.90 per share and 34m shares outstanding, Tredegar is a $470m market cap. With net debt of $122m, it’s an enterprise value of $592m.

Average FCF has been $54m so roughly 9x P/FCF.

By my estimate, trailing EBITDA as of 1Q21 looks like ~$85m for an EV/EBITDA multiple of 7x with 1.4x leverage.

The Surface Protection and Packaging Films segments have qualities of other specialty chemical companies — good growth and 20-30% or better EBITDA margins. Surface Protection lost a major customer which will likely cut EBITDA by close to half while Films saw EBITDA grow >40% in 1Q21. The Aluminum business looks like more of a commodity business with fluctuating revenue/earnings and closer to 10% margins.

Quick take…

By the looks of it, Tredegar has some nice specialty businesses (despite the customer headwind in 2021) — these businesses typically command a premium multiple.

Despite that, there is still some underlying cyclicality to the entire company. It’s pretty obvious when looking at revenue and cash flow volatility over the past 5-6 years.

They are coming off the heels of a large special dividend paid via debt financing. Free cash flow has gone toward repaying debt and paying for a modest dividend (current yield is 3%) over the years. It’s hard to know what direction they’ll take as they don’t hold investor calls and the company is controlled by the Gottwald family (insiders).