Quick Value 6.29.20 (MKL)

Market Performance

[Index | % change WoW ]

S&P 500 | 3009 -3%

Dow Jones | 25016 -3%

Russell 2000 | 1379 -3%

Russell Microcap | 528 -2%

10-Year | 0.65% -5bps

Gold | 1780 +1%

Oil | 38 -3%

VIX | 35 unch

Market Stats

What happened in the macro world last week?

The big news here was the Federal Reserve restricting any share repurchases and capping dividend payments in 3Q20

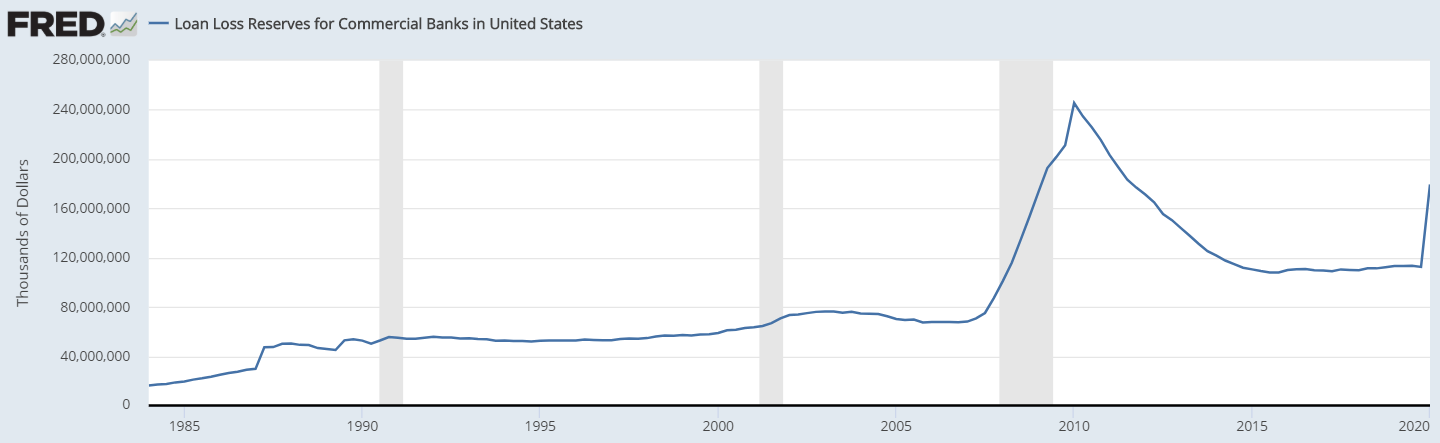

Loan losses at banks are already approaching 2008-2009 Financial Crisis levels as of Q1 2020 —

Does this paint a bleak picture for banks as investments today or allude to their attractiveness?

Purchasing Managers’ Index (PMI)

Both the manufacturing and services PMI indices jumped significantly from the May release — both coming in around 25% growth. While index levels are still below 50 (indicating contraction) — these are 2 pretty large jumps from March to April to May to June

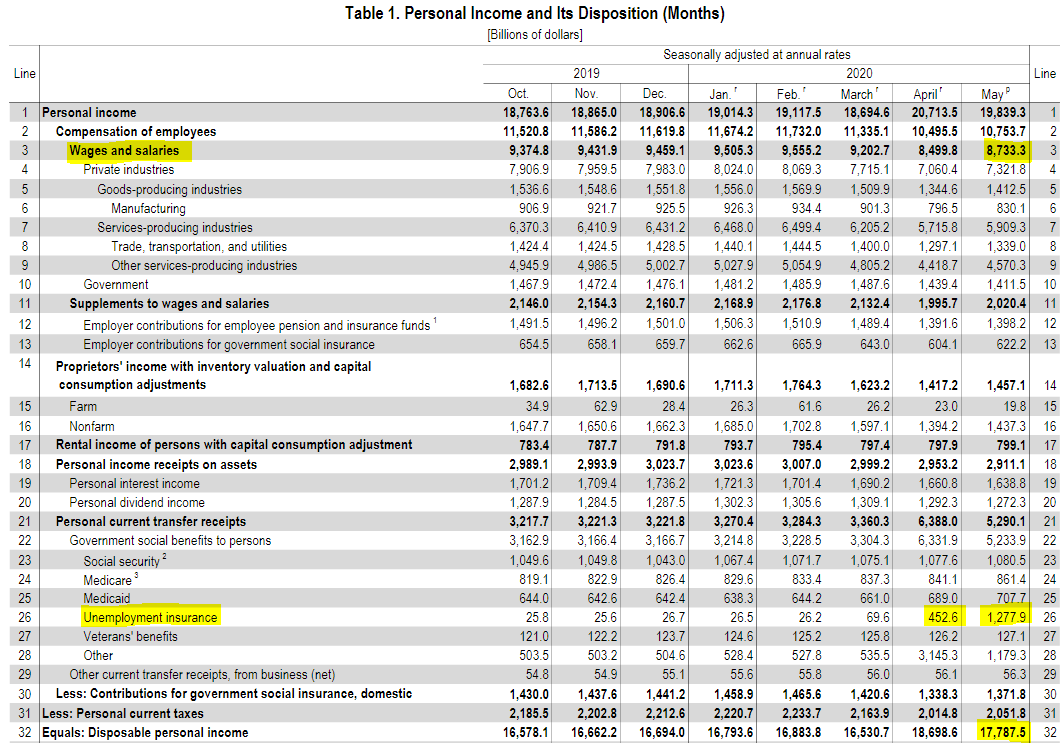

Personal income and savings

This was a much awaited release to me… I’ve commented before that I’m a believer in consumer personal finances being stronger than the market realizes…

Headlines will show that personal income is down ~4-5% from April levels but it’s actually up 7%+ from the $16.6tn level prior to April 2020…

Unemployment income — up from $70bn to $452bn to $1.3tn — is still plugging any holes being created from lower wages and salaries. Although those wages are on the rise likely from PPP fundings in April.

The decrease from April to May is largely due to the “other” category — down from $3.1tn to $1.2tn — likely from the stimulus checks that went out in April

Despite the pickup in consumer activity, the personal savings rate was still high… To get a sense for how much consumers have been saving through this period, here’s a long-term chart of the personal savings rate — literally off the chart!

COVID data

Charlie Bilello tweeted a group of charts on some recent COVID data that I thought was worth sharing…

General observation — deaths dropping, cases ramping, but testing also higher…

There has been much debate about the future direction of the markets with COVID data pointing toward a spike in cases and potential shutdowns coming (again)…

Valid points from both the optimistic crowd and the pessimistic crowd are making it difficult to navigate the current markets too…

My take is that consumers are still benefiting from unemployment + stimulus, the Fed is still aggressively backstopping the markets, and many other data points indicate improving trends… There is potential “upside” risk from here and it’s worth considering both sides of the argument when positioning your portfolio.

Quick Value

Markel Corp ($MKL)

Markel is an insurance company that is often compared to a “mini” Berkshire Hathaway (BRK). Just like Berkshire, they publish a well-written shareholder letter.

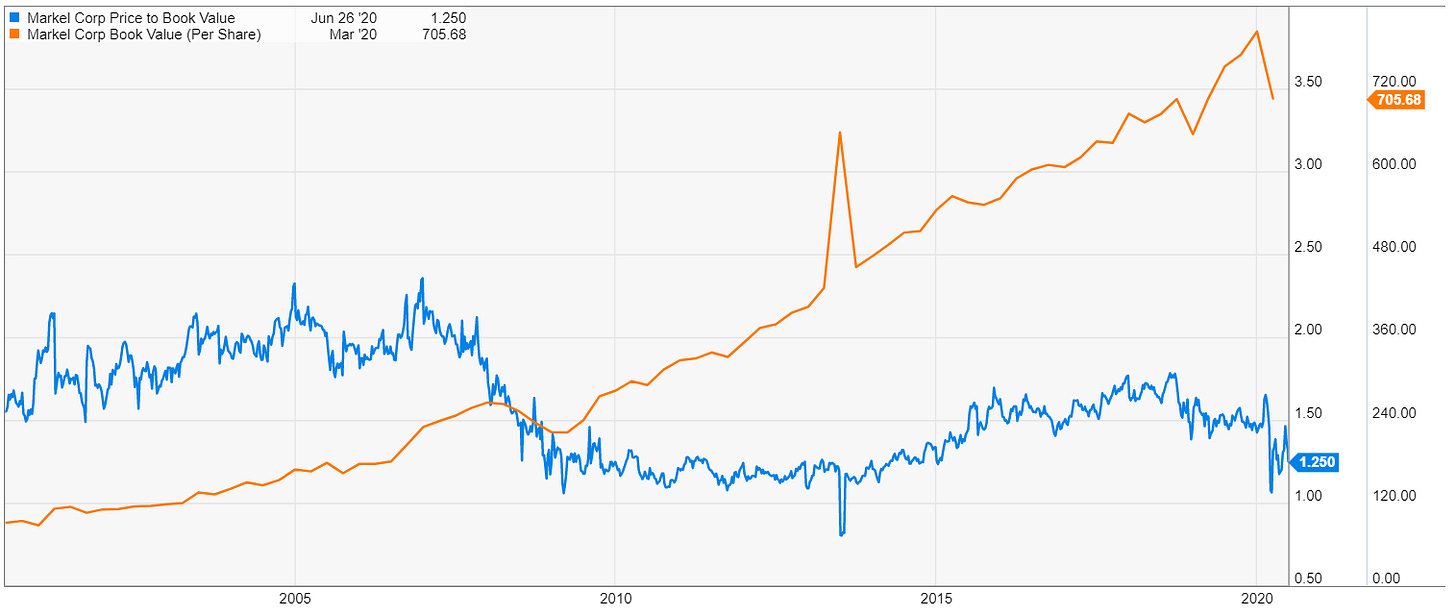

After Q1 — shares are essentially flat over the past 5 years.

There are 14m shares outstanding x $880 stock price = $12.3bn market cap

Net debt is essentially zero with $3.6bn in debt and $3.8bn in cash

Management views the company in 3 buckets — engines as they call them — insurance, ventures, and investments.

Insurance

Between the insurance and reinsurance businesses, Markel writes between $4-5bn per year in premiums across a number of different areas…

They’ve generated an underwriting profit in each of the past 3 years although not in Q1.

Markel Ventures

The foray into owning operating businesses outside of insurance began in 2005 and now consists of a portfolio of several businesses and industries.

2019 revenue of $2.1bn and EBITDA of $264m vs. 2018 revenue at $1.9bn and EBITDA at $170m

They spent $1.9bn over 15 years to acquire these businesses and got ~$900m back from cash generation — not bad for a $1bn net investment

Investments

There is a significant portfolio of equity investments (much like Buffett buys stocks within Berkshire) totaling $20bn at 1Q20.

Markel owns some plain vanilla value and growth stocks like Berkshire, Apple, Amazon, Google, Carmax, Visa, Disney, etc…

Not in love with all of these investments but it’s a diverse group.

Overall, Markel remains a highly cash generative business…

Alright… so with all of that background… Q1 2020 saw a large drop in book value from $11bn to $9.7bn and a subsequent drop in share price ($1300+ to < $900) and, as a result, a lower price to book ratio of around 1.25x currently.

This makes for an interesting backdrop as you have a well-diversified business executing the Berkshire playbook, with a good management team in place, and a temporary setback…

An average price-to-book ratio of 1.5x would equate to a share price >$1050 as of today assuming no rebound in book value

Very infrequently has this stock traded below 1x book value…

Worth a closer look!