Quick Value 6.5.23 ($LH)

Labcorp - upcoming healthcare spin at ~10x EBITDA

We’re a bit late this week but I’ve been busy buying a company out on the west coast (more on that later, someday)…

I’ve got a lot of new ideas on my plate so this is going to be another free addition. My Form 10 spin-off screener has plenty of new results so I’m going to spend some time there for a while…

Subscribe below to stay up on all the new (and old) ideas + premium write-ups…

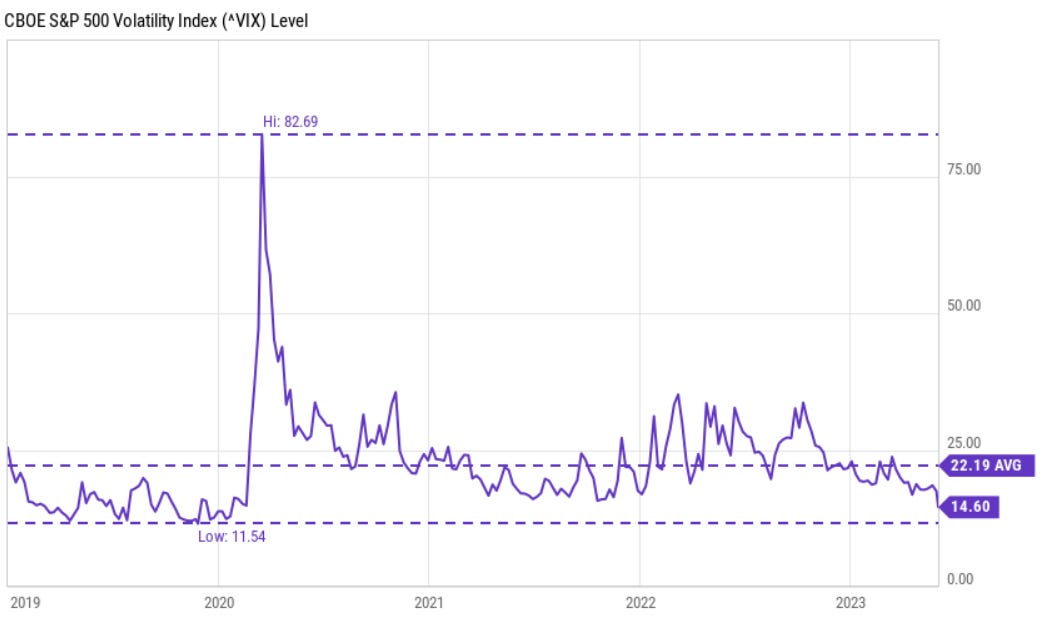

Markets are up lately but to me the big highlight is the VIX, or volatility index, which is down 1/3 this year to 14 or so… markets have been “calm and up” so far this year so it’s not surprising. On the other hand, there are plenty of interesting value ideas out there… maybe we’re getting complacent and the risk of a rapid drawdown is going overlooked?

Pick your spots…

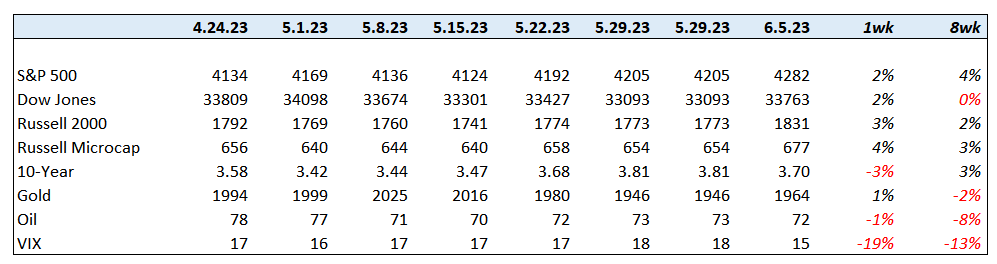

Market Performance

Market Stats

VIX hitting lows not seen since pre-COVID…

Quick Value

Labcorp ($LH)

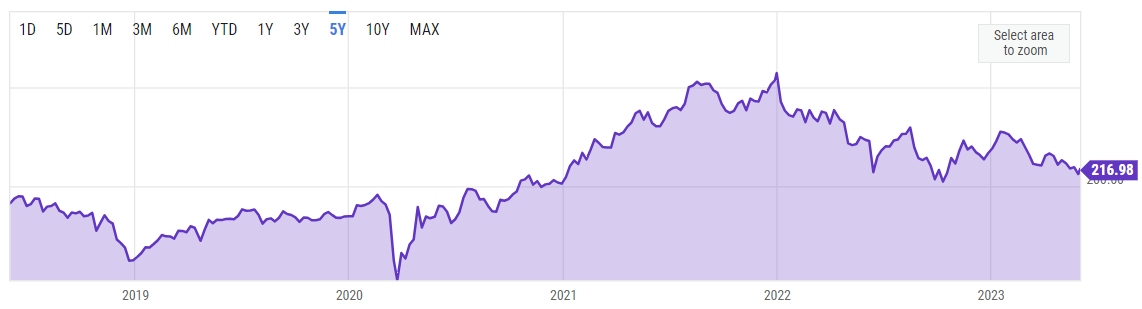

This idea follows a pretty common theme for me: Labcorp is another 5yr market underperformer, and by a decent margin. On top of the 5yr underperformance, Labcorp is spinning off a portion of their drug development business.

What they do…

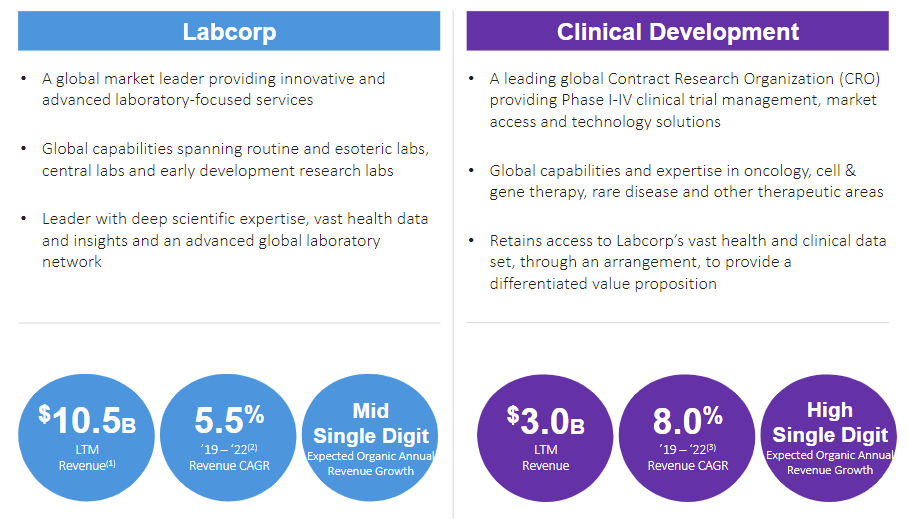

Labcorp is a healthcare company focused on diagnostics and drug development.

The core business of diagnostics (Dx), which will make up most of RemainCo as we’ll see later, consists of various clinical tests like blood tests, urine tests, STDs, toxicology, HIV, etc. Naturally this business benefitted from COVID and earned supernormal profits in 2020-2022.

The drug development segment provides services to help pharmaceutical companies with drug testing and clinical trials, generally known as a Contract Research Organization (CRO).

Here’s a quick look at what the post-spin entities will look like:

1) Upcoming spin-off of clinical research business, to be named Fortrea…

This is where I originally came across the idea, as LabCorp filed the Form 10 for the SpinCo, Fortrea.

A quick side note — one aspect I love about spin-offs that no one seems to talk about is the opportunity to analyze shares of both RemainCo and SpinCo as potentially attractive investments. Do the work on both sides and be ready to pounce when one side of the special sit looks cheap…

In this case, LabCorp had a steadily increasing valuation post-GFC all the way up to COVID. Then earnings went parabolic from the healthcare/testing demand and now they’re lapping those supernormal earnings. Sure, compounded results from 2019-2023 will look great but investors can’t help but see the YoY declines.

According to management, SpinCo had a higher growth rate and has a better growth outlook going forward. SpinCo recently held an investor day outlining the 4% industry growth profile and

2) Some themes I’m noticing on capital allocation (as a combined LabCorp)…

FCF spiked in 2020-2022 from COVID testing and as the business normalizes in 2023, management is expecting $1-1.2bn FCF.

Acquisitions — Labcorp has been highly acquisitive, spending >$9bn on M&A since 2015 (vs. current market cap at ~$19bn).

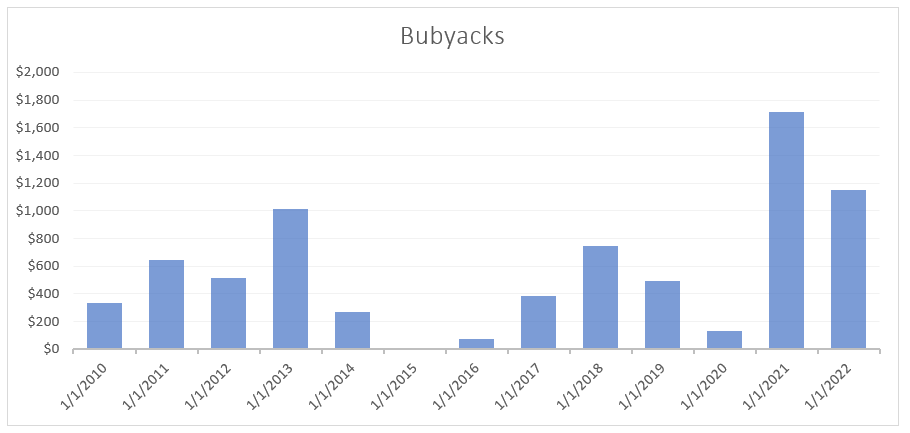

Buybacks — The other major area of capital allocation… Labcorp decided to “give back” most of their supernormal earnings to shareholders from the 2021-2022 years.

In the future, RemainCo expects more of the same — buybacks and acquisitions.

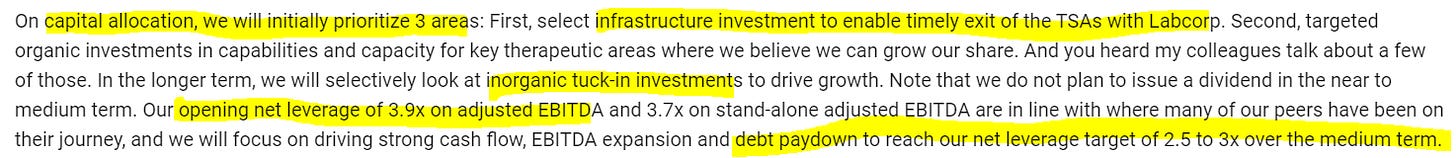

How does SpinCo plan to spend their cash? Sounds like organic growth and debt paydown will be top priorities for a few years…

3) What are the pieces potentially worth…

SpinCo (clinical research)

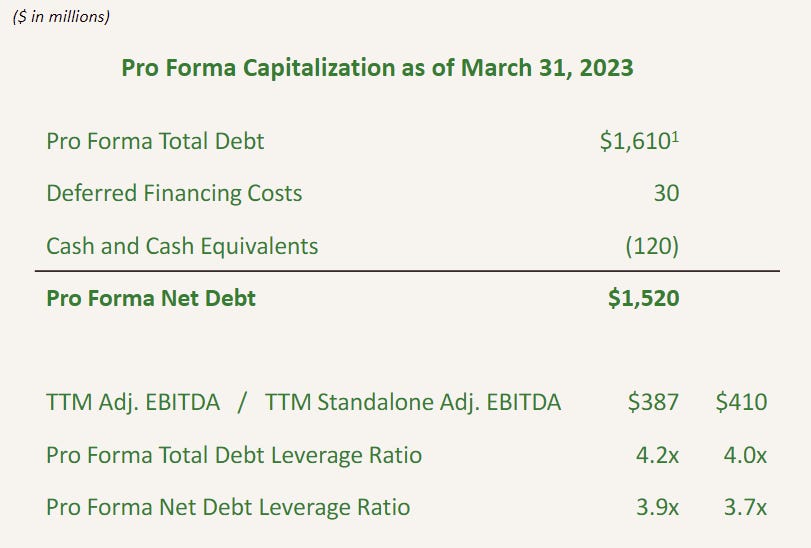

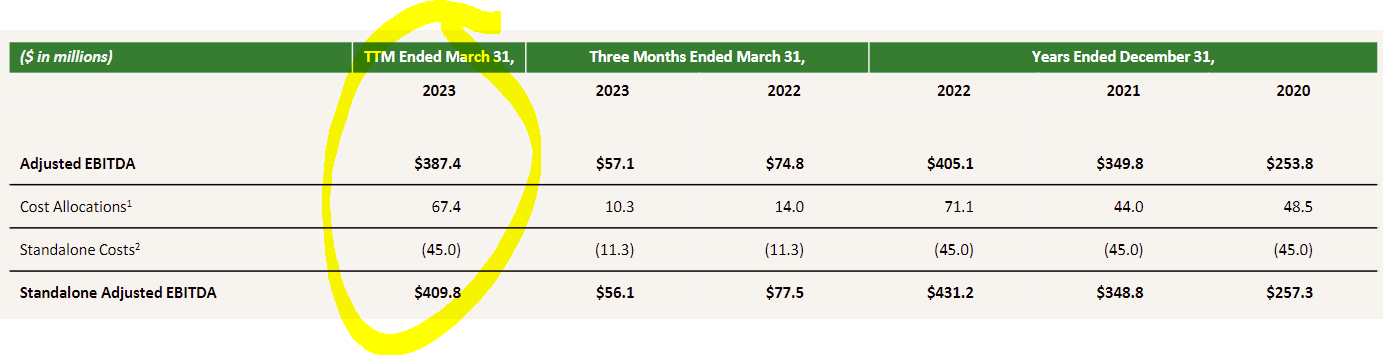

Fortrea is getting spun off with ~$1.5bn in net debt and $387m TTM EBITDA depending on how you want to look at standalone public company costs.

Management is ballparking $45m annually for standalone costs but corporate allocations from Labcorp are higher. Interest expense will run ~$132m annually.

Peers trade at lofty valuations around 12x EBITDA / 16x earnings neighborhood. A discounted 10x EBITDA would value SpinCo at ~$26/share.

RemainCo

Net debt will be ~$3.6bn post-spin. Quest Diagnostics is a main competitor and trades >10x EBITDA, maybe closer to 11x over the past 5yrs on average.

If SpinCo has $387m EBITDA including $46m dis-synergies, or $341m in total; then RemainCo could have $2.3bn EBITDA based on analyst estimates of $2.5bn for the combined company. At 10x EBITDA, that implies a valuation of $218/share for RemainCo.

Adding the 2 pieces together doesn’t yield a ton of upside compared to today’s price ($244/share vs. $217 current share price = 12% upside). So I think you’re banking on a spin sell-off and/or estimates missing the mark.

The biggest negative is working off the COVID sales/earnings… on the surface it looks like fundamentals are coming down rapidly but management is arguing the core business is doing well. Maybe that’s the case but a quick glance says that FCF is flat from 2019-2023.

2 items could make this an interesting post-split setup:

SpinCo will be levered at close to 4x and that worked terribly for ZIMV, though revenue growth is maybe better here. That could lead to a sell off or lower multiple at the spin and thus a higher FCF yield with decent organic growth.

RemainCo will have very low leverage around 1.5x or better. Add in FCF and they’ll have a lot of capital available to deploy into buybacks or acquisitions.