Quick Value 6.7.21 ($OGN)

Organon & Co - Recent Merck spin-off looks attractive

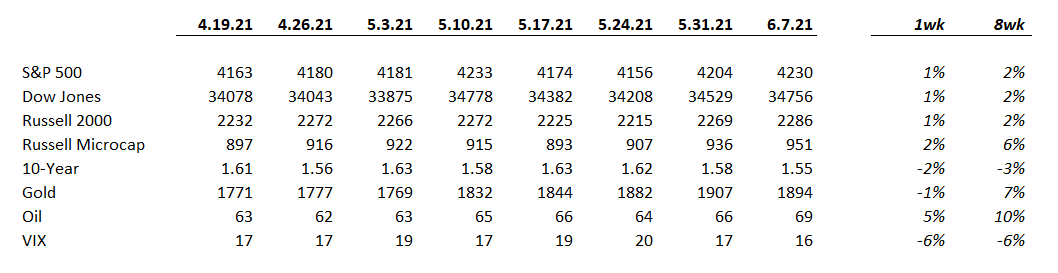

Market Performance

Market Stats

Early estimates for 2022 earnings on the S&P 500 are around $212 vs. the index at 4230. A roughly 20x earnings multiple (19.9x if you’re the glass half full type). That’s an earnings yield of 5% vs. treasuries at 1.55%. Depending on your outlook, that may not be all that expensive.

The relationship between bond yields and stock earnings yields are important.

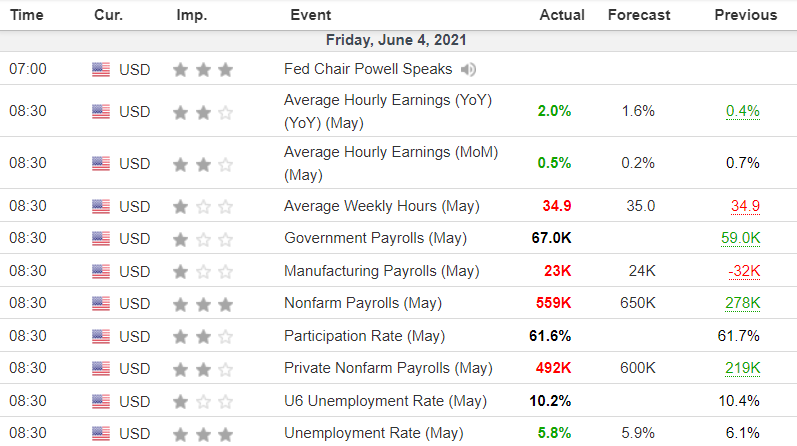

Payroll figures were released on Friday and although slightly below estimates, they were still pretty strong and very clearly not at recessionary levels.

Quick Value

Organon & Co ($OGN)

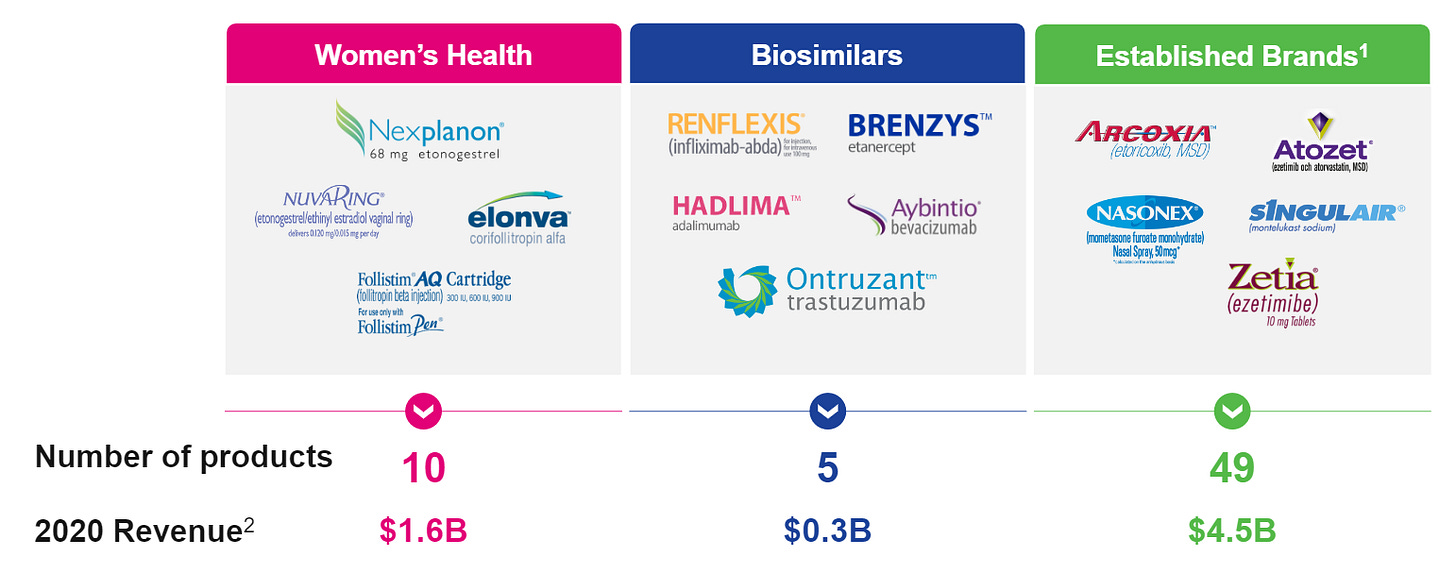

Organon is a very recent spin-off from Merck ($MRK). Merck packed up their women’s health business, biosimilars, and a group off off-patent drugs and levered it up.

This is a slower growth business with lower (if any) blockbuster drug potential. On the flip side, this is a very cash generative business (something I’m fond of).

This is a business that has faced some patent losses and therefore has been in decline for a few years — to the tune of 12% per year from 2018-2020.

Merck recognizes this and is attempting to position the spin-off with patent losses such that Organon is in a position to resume growing in 2022 and beyond.

A product table is always useful in evaluating a pharmaceutical company. There aren’t any huge contributors to the group — it looks like Nexplanon is the largest individual drug at ~10% of sales which is pretty minor compared to other pharma companies. Besides that, the main detractors look pretty small at this point… NuvaRing fell from $879m to $236m in 2019-2020… this drug alone was >50% of the 2019-2020 revenue decline…

How about some of the financial metrics?

Fully diluted shares look to be ~255m. At the current $34.15 share price = $8.7bn market cap. Add $9bn in net debt and the enterprise value is just shy of $18bn. Guidance for 2021 anticipates $2.3bn in EBITDA at the midpoint for a 7.7x EV/EBITDA multiple. Based on guidance, free cash flow in 2021 looks like it should be around $1.35bn.

Organon intends to spend the first 12-24 months post-spin in debt repayment mode. Based on cash flow guidance, they should be able to hit their 3.5x leverage target within a year. Beyond that, it sounds like M&A will be the primary focus. And management sounds comfortable keeping higher levels of debt.

While not perfect comparisons, Organon reminds me of the generic pharmaceutical companies (Teva and Viatris) which trade at 6.5-7x EBITDA. Organon is less levered than Teva and has a better growth profile than Viatris. Another comparison might be Baush ($BHC) which trades at 9.5x EBITDA with 6.4x leverage.