Quick Value 7.12.21 ($BTI)

British American Tobacco -- Major tobacco player at 8.5x earnings and looking for growth

Market Performance

Market Stats

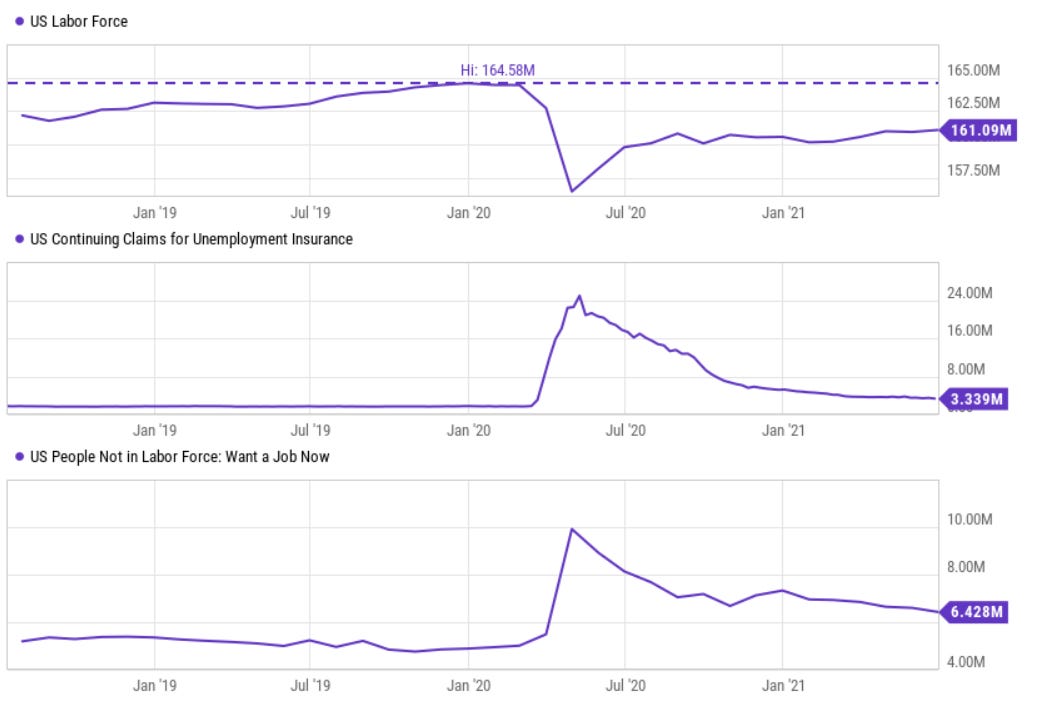

Unemployment data to ponder… There are roughly 3.5m fewer people in the labor force compared to pre-pandemic highs… vs. pre-COVID peaks, 1.7m are still unemployed and ~1.4m are currently in search of work… With the massive influx of “Help Wanted” signs out there, makes you wonder why these levels aren’t reversing faster.

Quick Value

British American Tobacco ($BTI)

I’ve seen comments floating around about BTI as an interesting stock at the moment so decided to take a quick look. Here are my notes…

Growth in alternatives / vaping…

Plenty of emphasis has been on the alternative / e-cigarette category lately. Phillip Morris ($PM) has a fast growing global brand in IQOS and Altria ($MO) owns a large stake in vaping company Juul. (Reminder that Altria/PM split with Altria keeping US business and PM keeping international business.)

BTI owns a fast growing, non-combustibles business (“New Categories”) but it still represents a fairly small portion of sales… It grew 15% in 2020 and 37% in 2019 but is still ~6% of total revenue.

Traditional cigarettes (“Combustibles”) saw volume decline 4.5% in 2020 with revenue down slightly less at 1.1% — volume down, prices up.

On the bright side, BTI hopes to take its New Categories segment to 5bn (GBP) in revenue by 2025… Leading to solid overall revenue and earnings growth. Turns out a small but fast growing segment can quickly outweigh a flat-to-modest-decline segment.

Financial overview…

BTI trades at ~$38.50 in the US and 2800p in the UK. This makes for a 64bn (GBP) market cap.

In 2020, they earned 331p per share for a 8.5x earnings multiple — making it considerably cheaper than Altria (~10x) and PM (~16x).

Part of this is due to the higher debt levels at BTI vs both Altria and PM. The 2021 outlook is shooting for lower leverage at 3x. It also anticipates: volume down 3%, revenue up 3-5%, and EPS up “mid-single” digit.

Capital allocation…

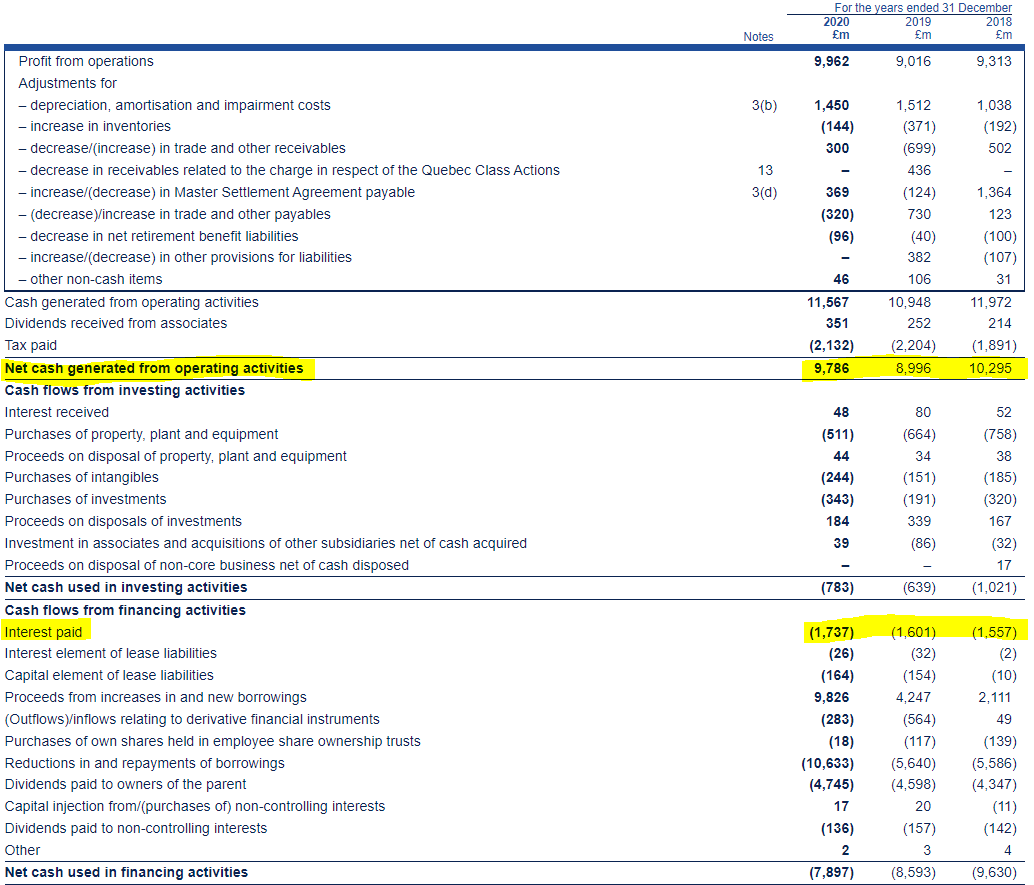

Cash flow reported in IFRS (foreign standards) moves interest payments down to the financing section so to make this apples-to-apples with US companies, it needs to be deducted from free cash flow.

In 2021, BTI generated ~7.5bn GBP in FCF which comes to an 8.5x multiple — pretty close to 1:1 conversion from EPS to FCF.

Of that 7.5bn — close to 5bn is going to dividend payments which leaves a small amount leftover for repaying debt. There have not been any meaningful share repurchases here and based on the leverage, it seems unlikely anytime soon.

Open items…

Some similarities here to the Auto Dealers from last week — all players pushing toward the same goal of non-combustible/higher growth products — can they all have it?

I’m skeptical of an overall 3-5% revenue growth bogey when only ~10% of the business is in growth mode — but at 8.5x earnings this could really pay off if successful

The dividend is a big one at 7.5% but it also leaves little room for discretionary cash toward share repurchases or other things