Quick Value 7.17.23 ($VST)

Vistra - taking a closer at Energy Harbor acquisition; shifting to nuclear generation; trading at <6x EBITDA

Lots of charts in this week’s post. Vistra produces and sells electricity/nat gas to residential and business customers; trading at <6x EBITDA, they’re chasing a lofty (11x) valuation of a competitor by shifting the mix to clean energy (in part from a large acquisition).

Next week is for paid subscribers and unless a newly filed Form 10 diverts my attention, I’ll be covering a microcap that’s been hanging around my watchlist for ages.

Sign up for the full newsletter below!

Market Performance

Market Stats

Markets up significantly so far this year. “Markets appear convinced the Fed can pull of a soft landing” from WSJ.

Quick Value

Vistra Corp ($VST)

Maybe this Quick Value idea is cheating a bit since I’ve owned it in the past. I first bought shares during the winter storm Uri sell-off back in 2021; shares rebounded and I moved on.

In March 2023, they announced an acquisition of a nuclear energy business that was well-received by investors and I’ve been meaning to take a look…

What they do…

Vistra is the post-bankruptcy retail and power generation piece of the former Energy Future Holdings. At the time, they were heavily exposed to the unregulated Texas power market with mainly fossil fuel generation assets (coal and natural gas plants).

They’ve made some moves to change the business. First, buying Dynegy to expand outside of Texas. And now the pending acquisition of Energy Harbor Corp to expand into the Midwest/NE and add a significant amount of nuclear generation. The acquisition is set to close in 4Q23.

Looking at Vistra more closely… they operate 2 business lines (under 6 reportable segments):

Retail — This business sells electricity and natural gas to 3.5m customers across 20 states. Think of it as serving the customer, handling the billing, and sourcing the power to deliver to them.

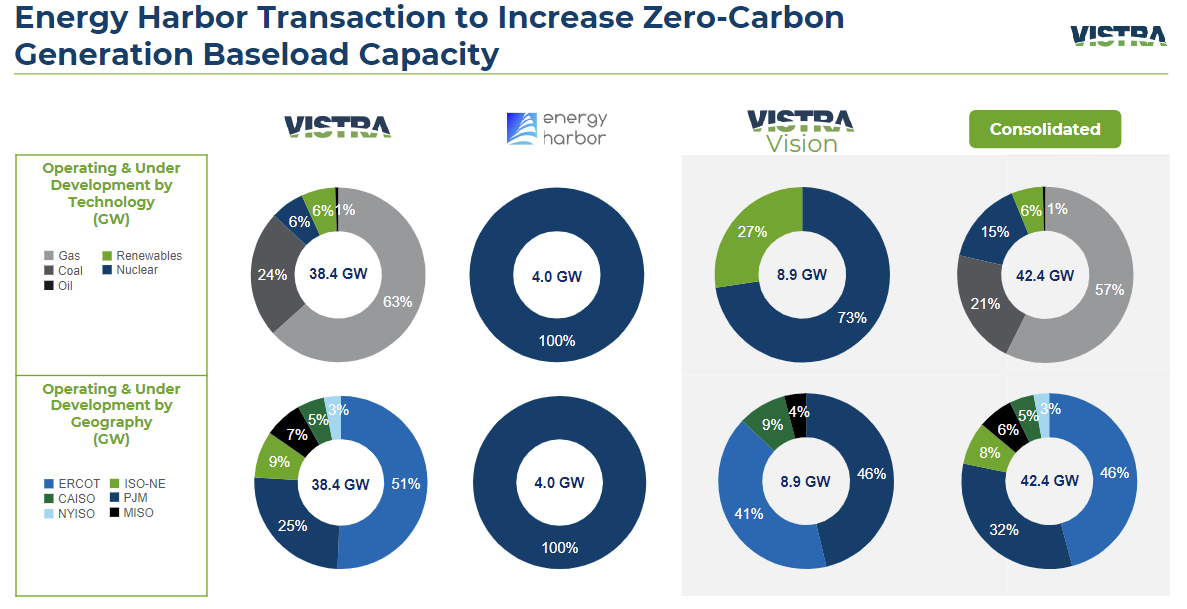

Generation — This business operates power plants to generate electricity and natural gas which then gets sold to both the Retail segment and external customers. Total generation capacity of 38.4 GW across gas (63%), coal (24%), and nuclear/renewables (12%).

A quick word on the Energy Harbor deal — Total purchase price is $3bn cash and a 15% stake in “Vistra Vision,” a newly created segment of Vistra which will consist of their nuclear/renewables assets and the retail segment. EH generates 4 GW of 100% nuclear generation.

The deal adds ~$900m EBITDA and carves out the clean energy portion of Vistra (maybe a bit of foreshadowing here).

Why it’s interesting…

1) Mix shift to nuclear

Merchant power producers aren’t exactly a market favorite. Unlike regulated utilities, they don’t have guaranteed returns on their assets which means they are at-risk to both competitor pricing and commodity input costs for generating fuel.

So why does the shift to nuclear matter?

For starters, it’s a cheaper (cheapest?) source of power when compared to fossil fuels. Second, it’s clean energy from an emissions standpoint. And lastly, investors of the ESG-variety seem to really like the nuclear story (see Constellation Energy commentary below).

With the Energy Harbor acquisition, Vistra not only improves their internal mix of generation sources but they also become a leader in nuclear generation. Total generation from “clean” sources goes from 12% overall to 21%.

2) Valuation gap to CEG

I have to imagine this is a driving force behind the acquisition. Constellation Energy (CEG) quickly traded up to ~11x EBITDA after spinning off from Exelon in early 2022 while Vistra has been going for less than 7x for most of its trading history.

Why the valuation gap?

Constellation is one of the cleanest energy producers in the country with a huge nuclear portfolio while Vistra is not.

3) Buybacks, buybacks, buybacks

The insane focus on buybacks started back in November 2021 (post Uri) when they kicked off a $7.5bn capital return program — $6bn in buybacks from 2021-2026 and $1.5bn in planned dividends ($300m per year)

Vistra repurchased $300m in 1Q23, $1.95bn in 2022, and $471m in 2021 ($2.7bn cumulative since Nov 2021). They’re planning to buyback at least $1bn annually while also paying $300m in dividends (~3% yield).

How does share count look?

Down from 521m at 6/30/18 to 378m at 3/31/2023… an 11% reduction per year.

Summing it up…

The EH transaction effectively creates 2 companies within Vistra — one that houses the clean energy and retail portfolio and the other with fossil fuel generation assets. Maybe they’re implying a sale or separation of those businesses down the road? Hmm…

Valuation math is a bit harder with the minority stake of Vistra Vision so we’ll have to watch for separate reporting of those earnings. If we valued Vision at 10x EBITDA (similar to Constellation) = $23.5bn; and Tradition at 5x EBITDA = $10bn. Net debt will be ~$15.7bn post-close. And assume another 10% reduction in share count this time next year (336m shares outstanding).

So that’s $20bn for Vision (85% of $23.5bn) + $10bn - $15.7bn - $2bn preferred equity = $12.3bn equity value or $37/share.

Plenty of upside if they can get the sentiment change and keep debt under control (leverage moves up to ~3.7-3.8x post-close)…