Quick Value 7.19.21 ($CLF)

Value in steelmaking...

Market Performance

Market Stats

I caught 3 interesting tidbits of data over the past week…

Consumer sentiment has taken a dip lower and was way lower than the 86 expected level by economists…

Inflation (CPI) continues to rise — excluding food and energy, inflation was up 4.5% last month… if you compare May/June 2021 to May/June 2019 to look through the slowdown from COVID, inflation is still rising at a 2.5-3% annual rate… much higher than Fed target of 2%

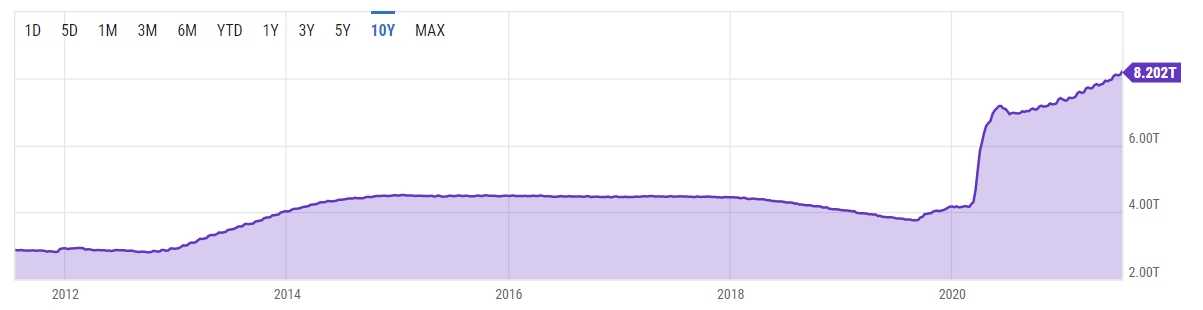

Money supply growth and the Fed balance sheet — Still on the rise! Federal reserve assets now top $8tn as the Fed continues their $120bn/month asset purchase program… Money supply has slowed from the mid-20% growth rates but is still way above long-term averages…

Quick Value

Cleveland-Cliffs Inc ($CLF)

There is quite a bit going on here so this is going to be a quick synopsis / summary of notes on the situation…

Cliffs is a natural resources company that was previously in the business of making iron pellets used as a feedstock for blast furnaces in the steel making process — they primarily sold to big steelmakers like AK Steel. I say “previously” because in 2020, they went on a hunting spree and acquired AK Steel and the US steel operations from Arcelor Mittal to become a vertically integrated steel maker.

The steel making industry consists of large blast furnaces (US Steel, AK Steel, etc.) and electric arc furnaces (EAF) used by the mini-mills like Nucor and Steel Dynamics. EAF is less capital intensive and has been taking share from blast furnaces for many years.

…that should catch us up to today…

Cliffs has an aggressive and controversial CEO (Lourenco Goncalves) making big changes in the industry

In 2020 — completed acquisition of AK Steel for $3bn and Arcelor Mittal USA for $3.3bn — these added $535m and $700m in 2019-level EBITDA…

Cliffs holds a potential competitive advantage in controlling a key feedstock for the steelmaking process

Steel prices are up significantly over past year — prices are near $1800/ton vs. historically in the ~$600-700/ton neighborhood

Leading to robust financial performance in 2021 — and raising questions about the sustainability of performance into 2022 and beyond

Management is using all cash flow to repay debt from the 2 latest acquisitions — they intend to be debt-free at some point in the next 1-3 years (no specific timetable given)

2021 guidance calls for $5bn in EBITDA — nothing close in company history compares…

There are about 500m shares outstanding and a $20 share price for a $10bn market cap. There’s about $5.7bn in net debt as of Q1 2021 and that ignores any pension liabilities or preferred stock outstanding. Call it a $16bn enterprise value.

Following Q1 results, management raised 2021 EBITDA guidance from $4bn to $5bn. This is under an assumption of $1175/ton pricing for the remainder of the year. They realized ~$900/ton in Q1 and $880/ton in 2020 (pro-forma for the latest acquisitions).

If 2021 results hold, then this is trading at ~3.2x EV/EBITDA. Estimates don’t think that’s a possibility… 2022/2023 EBITDA estimates look like $3.4bn and $2.3bn…

Best of breed competitor Nucor ($NUE) is staring at a similar drop-off from 2021 to 2023 but that stock is currently trading at >8x 2023 estimates vs. less than 7x for Cliffs… Both Nucor and Steel Dynamics ($STLD) carry very little leverage. Could be an interesting dynamic if Cliffs does the same…