Quick Value 7.26.21 ($PLUS)

ePlus inc - IT value-added reseller at 14x earnings

Market Performance

I nearly forgot we had a big ~2% sell-off on Monday the 19th! Markets had a nice week up 1-2% across the board…

Market Stats

Housing Market is still strong with new builds up and existing home sales up…

Retail Sales continue to grow at a rapid pace… Below is a chart of retail sales growth stacked over a 2-year period (i.e. 6/30/21 compared to 6/30/19)… These are big growth rates even when ignoring the COVID period…

Quick Value

ePlus Inc ($PLUS)

I’ve owned a few of the “value-added resellers” of computer hardware, software, services in the past and have loosely followed the industry since. (Often kicking myself for not owning CDW.)

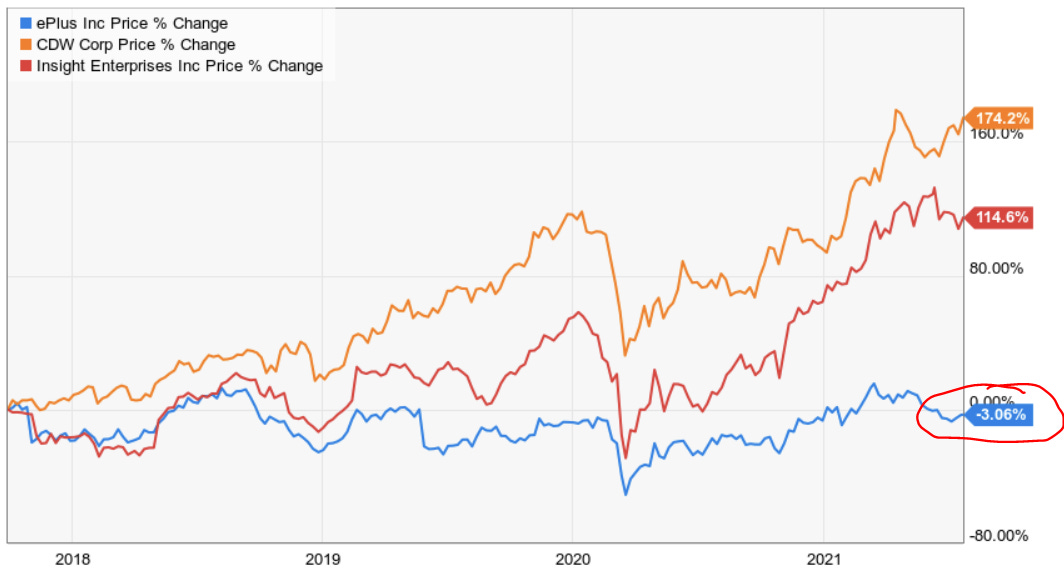

PLUS is fascinating in that shares are down over the past 4 years while competitors CDW and Insight ($NSIT) have done quite well.

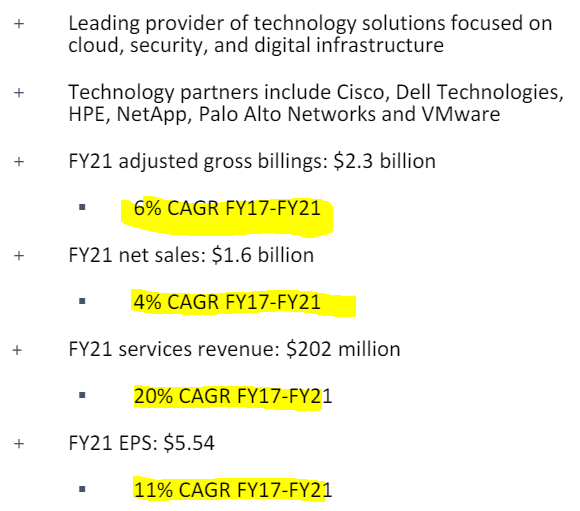

On top of that, fundamentals at PLUS have been pretty good — with 4% annual revenue growth and 11% EPS growth from Fiscal 2017 to 2021…

So what’s going on here?

On the surface, it looks like earnings are up and the multiple of earnings is down.

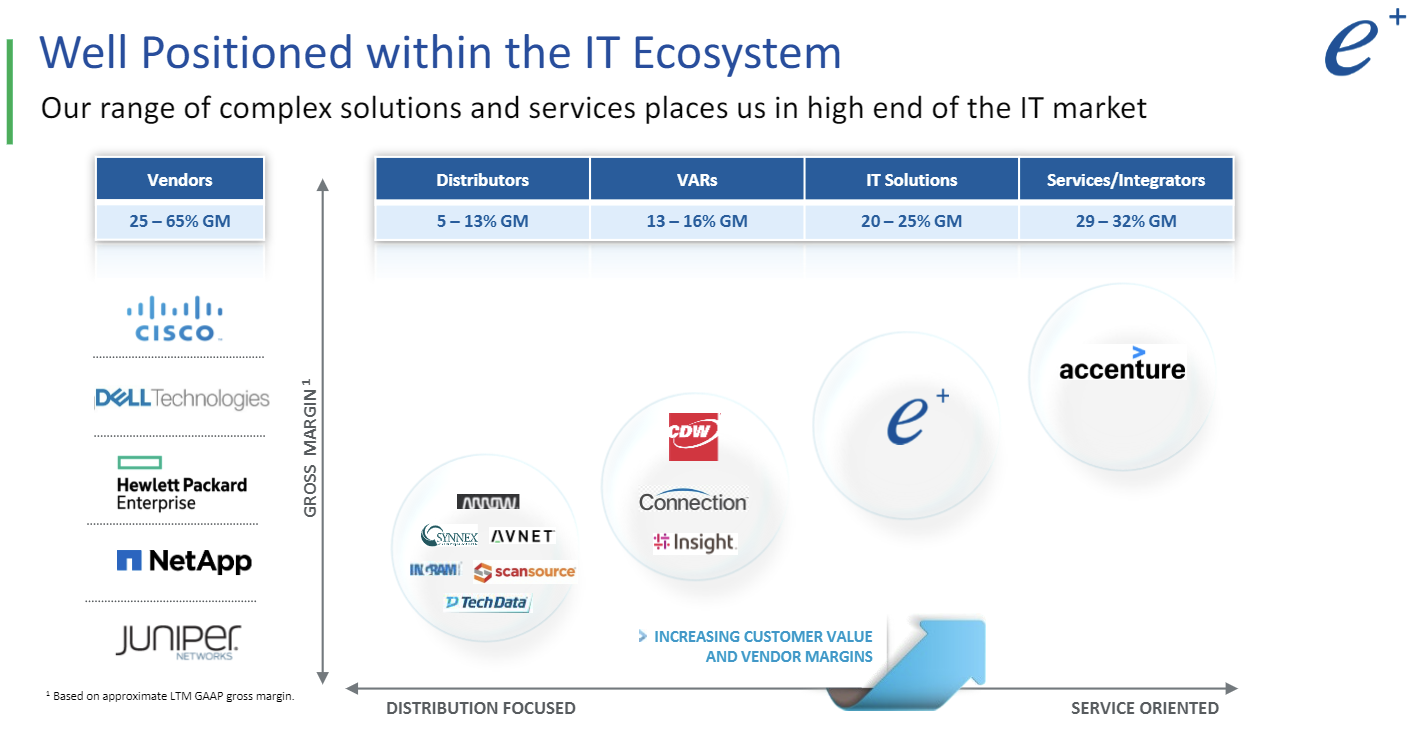

For starters, the name of the game for most of these competitors has been to swim upstream and capture some higher margin “service” offerings as opposed to being distributors of commodity hardware and software. CDW has done a great job of expanding margins for several years. The purpose is to become vendor agnostic and offer solutions to customers in helping them with the optimal IT setup for their company — almost akin to consulting services.

PLUS has been building a growing services division within their technology segment which now makes up ~13% of total sales. They also offer financing to customers in various forms which makes up a smaller portion of revenue and earnings but consumes a chunk of the balance sheet.

There are 13.5m shares outstanding and a $90 share price makes it a $1.2bn market cap. Net debt is a bit messy with the financing segment and heavy working capital needs. EPS was $6.38 in FY21 for a 14.1x earnings multiple — CDW trades >24x and Insight at 14.7x.

At FY21 (3/31/21) — PLUS had $130m in cash and $18m in recourse notes (not backed by the financing portfolio). Overall, the company seems to be sitting on a great balance sheet with potentially more capital available for buybacks or acquisitions. Speaking of buybacks and acquisitions — they spent $40m and $92m, respectively on each of those over the past 3 years, roughly two-thirds of GAAP earnings during that period…

No clear answers as to why ePlus is underperforming the group so significantly. At a quick glance, it could just be some multiple contraction going on… An unchanged share prices means this was trading at a lofty earnings multiple back in FY17 (though not far from where CDW is at today)…