Quick Value 7.3.23 ($NCR)

ATM spin-off will create a literal cash company

Have a great 4th of July!

Today’s Quick Value covers ATM maker NCR which is set for a yearend spin-off of their ATM business. I’m watching this one closely…

If you’ve enjoyed the past 5 years’ worth of Quick Value posts, consider subscribing to the full newsletter. In fact… anyone that signs up for the higher Annual subscription through the end of the week will get a lifetime comp to the newsletter. Cheers.

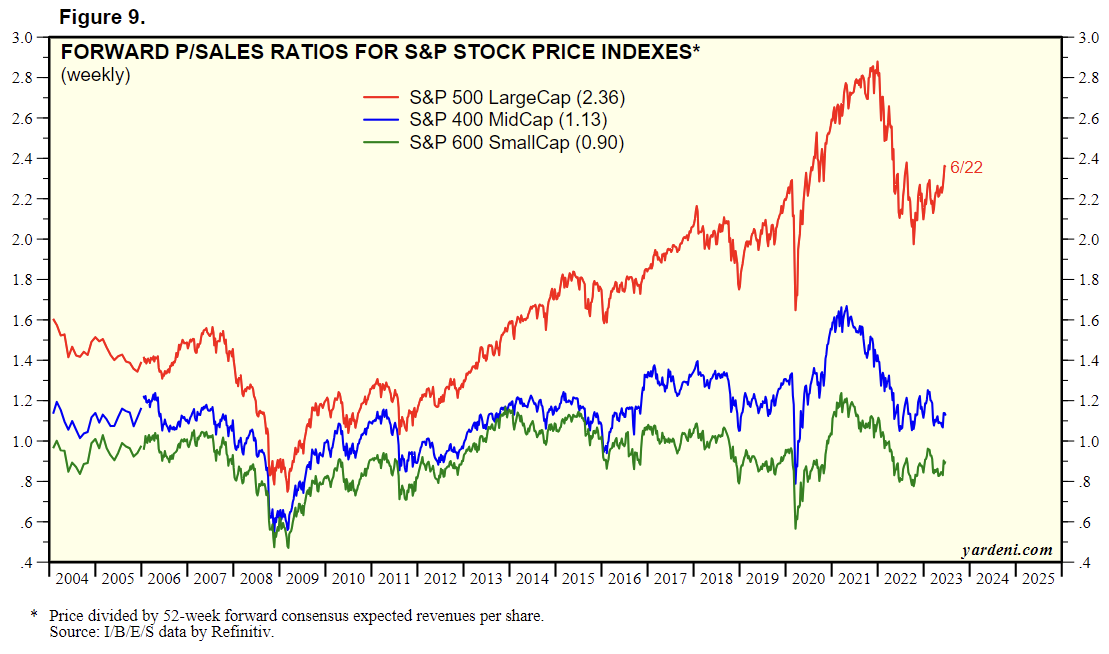

Market Performance

Market Stats

Small caps continue to trade at a wide discount to large caps (and valuations haven’t recovered much post-pandemic)

Quick Value

NCR Corp ($NCR)

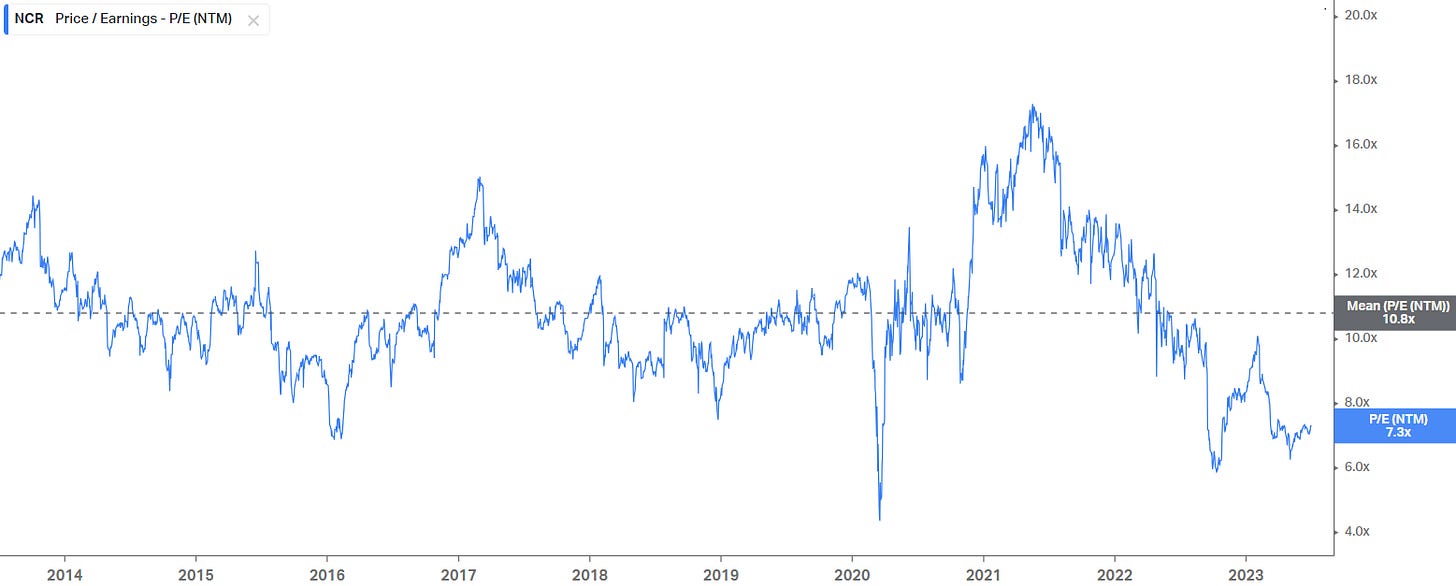

NCR has been a perennially cheap stock — cyclical, low growth, overpaid acquisitions, a multitude of other reasons perhaps.

Despite the low valuation and nowhere share price, they generate plenty of cash and are planning on splitting the company up by yearend.

What they do…

This is a long tenured company, founded in 1884, and mostly known as National Cash Register. Starting around 2011, they began making a series of large acquisitions to shift away from the lumpy/cyclical nature of hardware sales and into recurring software/services with better margins.

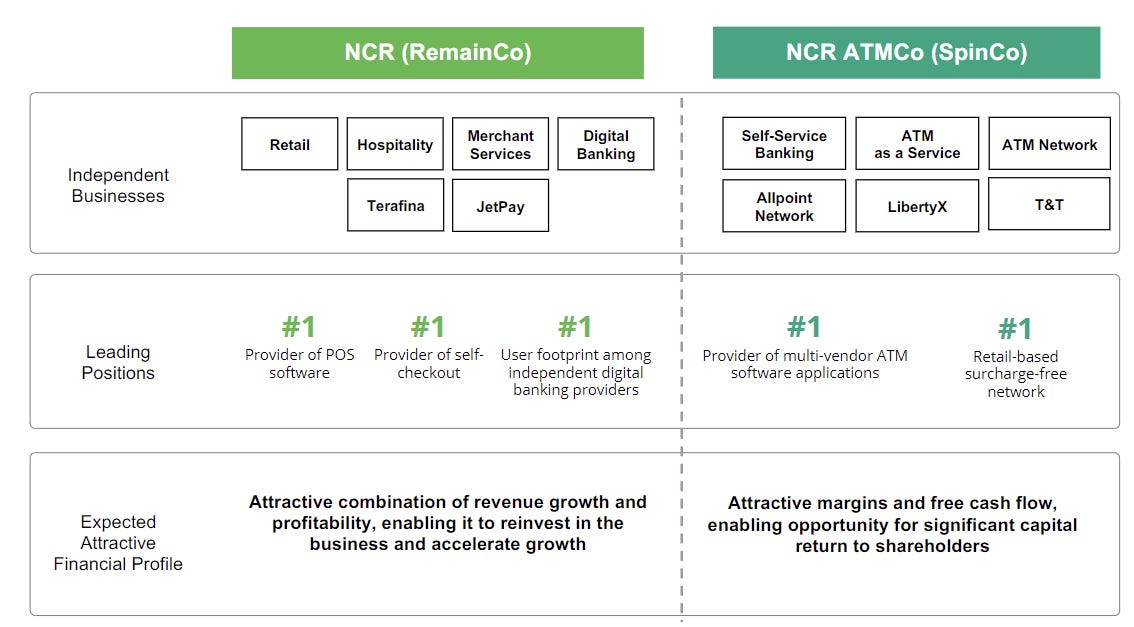

Today, NCR operates under 5 segments — Retail, Hospitality, Digital Banking, Payments & Network, and Self-Service Banking.

Consolidated sales / EBITDA over the past few years:

2020A — $6.2bn / $896m

2021A — $7.2bn / $1.24bn

2022A — $7.8bn / $1.37bn

2023E — $7.9bn / $1.50bn

RemainCo (NCR)…

RemainCo will keep the Retail, Hospitality, and Digital Banking segments. This business sells POS hardware for retailers and restaurants with software and services alongside. These POS systems range from small business card readers (think Square) to large self-checkout stations at the grocery store.

The Retail business is further split into enterprise POS and self-checkout. Of the $2.2bn 2021 revenue from this segment, $1bn came from self-checkout. Nearly 70% of segment revenue comes from grocery stores and big box retailers, 17% from department stores, and 9% from gas stations.

On the hospitality side, ~80% of revenue comes from “enterprise restaurants” with >50 sites.

This is much more of an “enterprise” POS business as opposed to SMB; but still a pretty competitive market. Toast is a POS software provider specializing in restaurants and has already eclipsed $3bn in revenue (compared to NCR RemainCo at $3.7bn).

Based on the Form 10 filing, it looks like RemainCo has most of the capex/capitalized software costs which makes sense given the main product line is a POS software system. Capex runs at 6-8% of sales annually or $280m in 2022 and potentially higher in 2023.

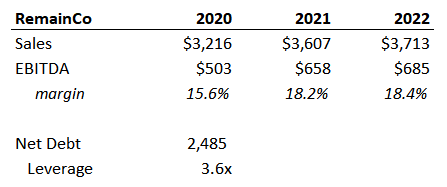

So what could RemainCo be worth?

Using consolidated EBITDA at $1.37bn in 2022 and the $685m disclosed SpinCo EBITDA In the Form 10, that leaves $685m 2022 EBITDA for RemainCo.

They’ll get a $2.5bn dividend from SpinCo which leaves net debt just shy of $2.5bn and possibly less as they repay debt leading up to the spin. Let’s call it $2.4bn with a weighted 5.5% interest rate or $132m interest expense per year.

For simplicity let’s assume capex = D&A which leaves $273m pre-tax income at a 29% effective rate for $80m cash taxes.

Those pieces net $193m in FCF before working capital or $1.25 per share. [Using 155m diluted share count.]

Using a combination of NCR average valuation metrics (1.2x EV/sales, 7.4x EV/EBITDA, 11x FCF) works out to a value of $13-17/share for RemainCo.

ATMCo (SpinCo)…

SpinCo will take the Payments & Network and Self-Service Banking segments. This business sells hardware, software, and services centered around ATMs. They also own/manage a large network of ATMs that banks and fintechs can tap into. ATMCo just completed a large acquisition of Cardtronics for $2.5bn in June 2021.

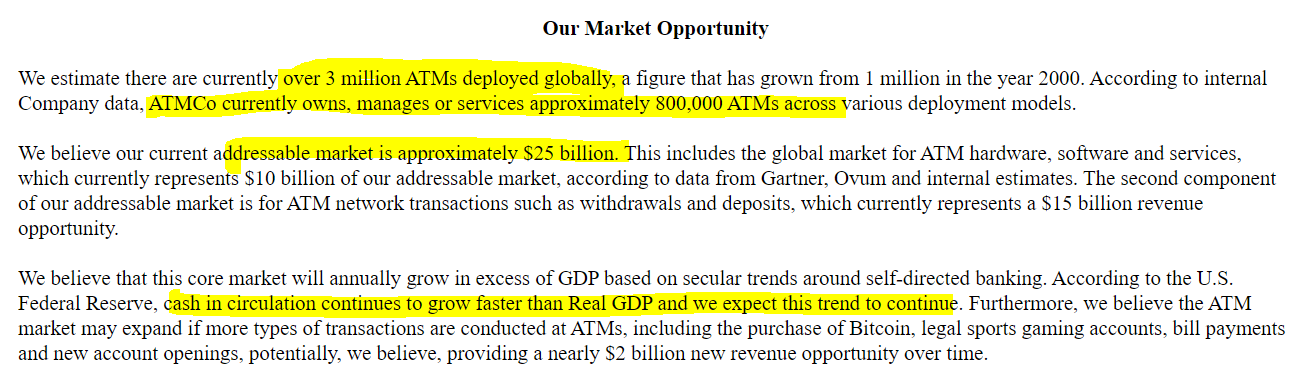

There are >3m ATMs worldwide and ATMCo owns/manages/services 800k of them (27%). Diebold and Euronet are big competitors. Management estimates this as a $25bn market growing above GDP. It strikes me as a fairly consolidated industry but heavily exposed to the overall usage of cash.

This business model seems pretty interesting…

On the ATM side (self-service banking segment), ATMCo derived 32% of revenue from hardware sales and 68% from software/services. Instead of selling ATM hardware to banks, ATMCo is pushing for full outsourcing to them… they install the ATM and manage everything from maintenance, to software, to processing, to cash management; all for a recurring fee.

On the payments side (Cardtronics), they derive revenue from ATM transactions but the push is toward a “surcharge free” network that banks pay a monthly fee to participate in which eliminates ATM fees to the consumer (i.e. a network effect model).

What could SpinCo be worth?

The balance sheet will have ~$2.7bn gross debt at an estimated 8.4% interest or $230m annually. This leaves net debt at $2.3bn or 3.4x 2022 EBITDA. Capex is very light — $30m, $111m, $97m each of 2020-2022 — call it 2.5% of annual sales.

Assuming $685m EBITDA as our starting point less $230m interest expense, $100m capex, and $103m cash taxes (again, assumes capex = D&A) = $252m FCF or $1.63/share. [Using 155m diluted share count.]

Using a similar approach as above, SpinCo would be worth ~$18/share at 7.4x EBITDA or 11x FCF.

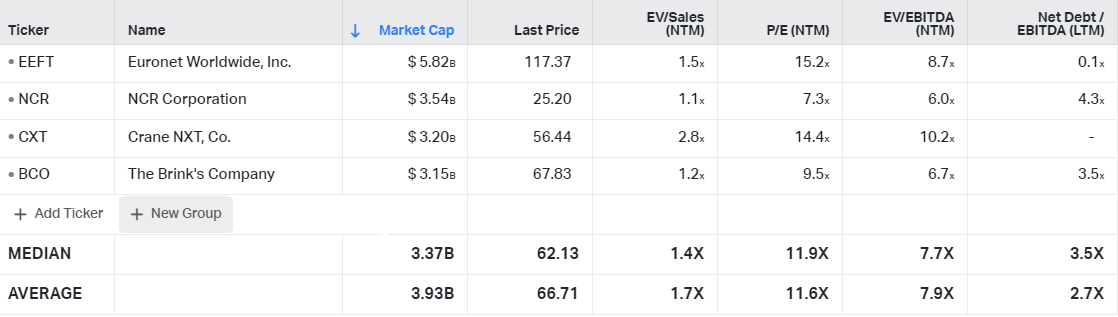

These valuations are generally inline with comps too. There aren’t a ton of great comps but this list encompasses ATM/POS peer Euronet and other cash-heavy companies like Brinks and the Crane NXT spin-off. Obviously, fast growing POS software cos like Toast and Square trade at big revenue multiples. A third, and potentially good comp set might be the payment processors FISV/FIS/GPN… the latter 2 names trade <10x earnings with >4x leverage.

Summing it up…

I’ll need to revisit this name when they host an investor day for each spin to see 2023-2024 outlooks and capital allocation plans. My guess is RemainCo will use cash internally for growth and ATMCo will prioritize buybacks and dividends.

NCR has been a cheap stock for a long time, very rarely breaking above the 10-12x earnings level. I think there’s a number of reasons for this but occasionally shares will trade way below long-run averages like it does today.

This is a cheap stock on its own but I’d like to see more of the plans for each company…

Please keep us updated on this one. Thank you