Market Performance

Oil has been the big winner over the past 4/8 weeks. Large stocks have seen a modest increase but small stocks are mostly flat over the past month+

Market Stats

Consumer confidence has started to tick higher the past 4 months after a long flat stretch… Interesting to note that confidence levels are still below even Feb 2020.

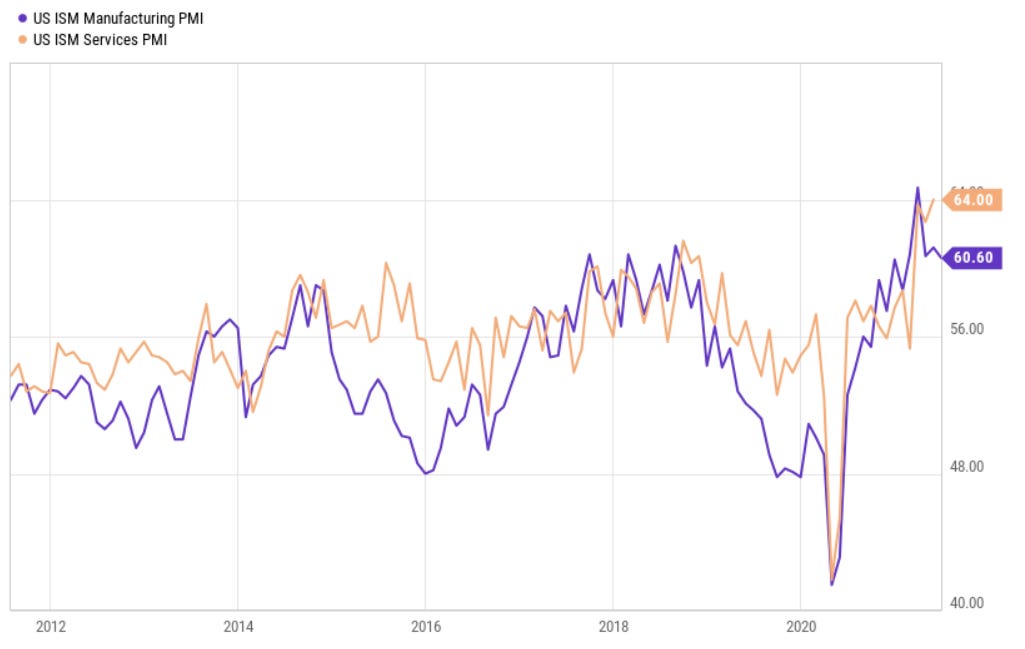

Purchasing indices (PMI) show continued strength… Even compared to the past 10-year+ period.

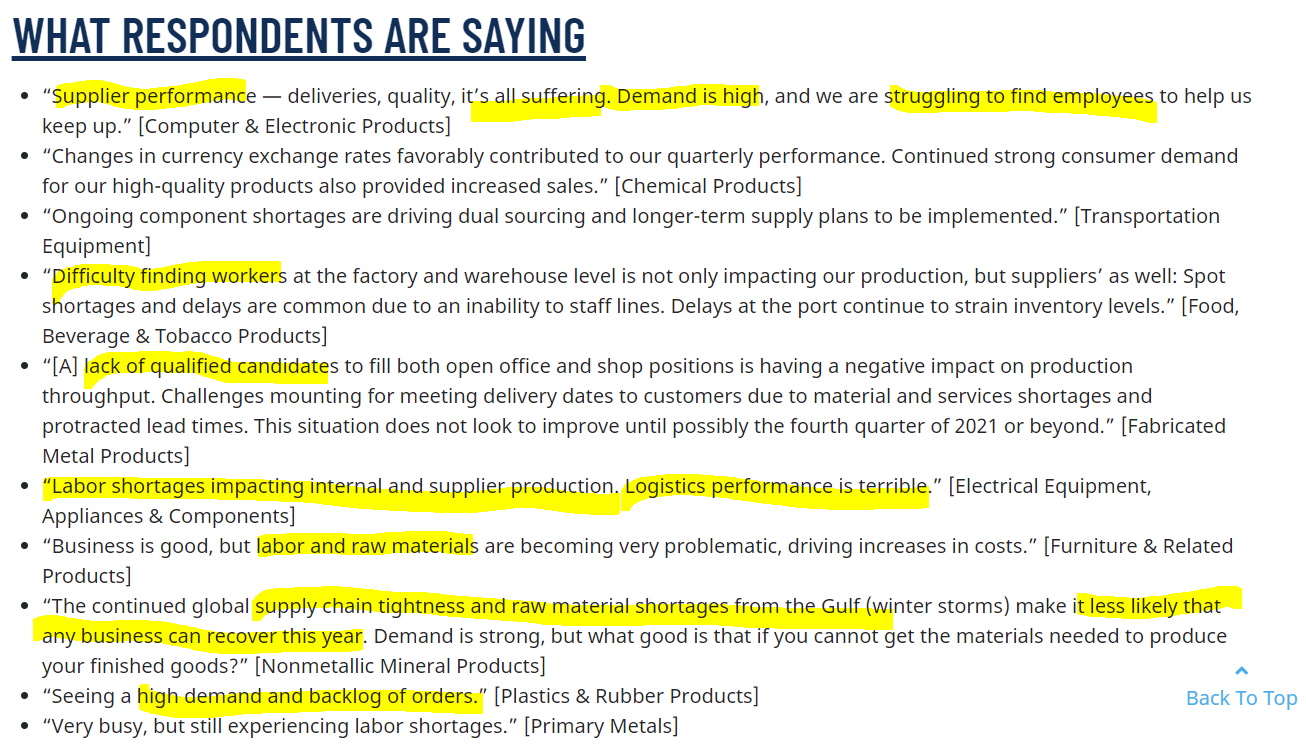

A common theme from purchasing surveys was the shortage around labor and finding people.

Quick Value

Auto Dealers — Asbury Automotive ($ABG) and Lithia Motors ($LAD)

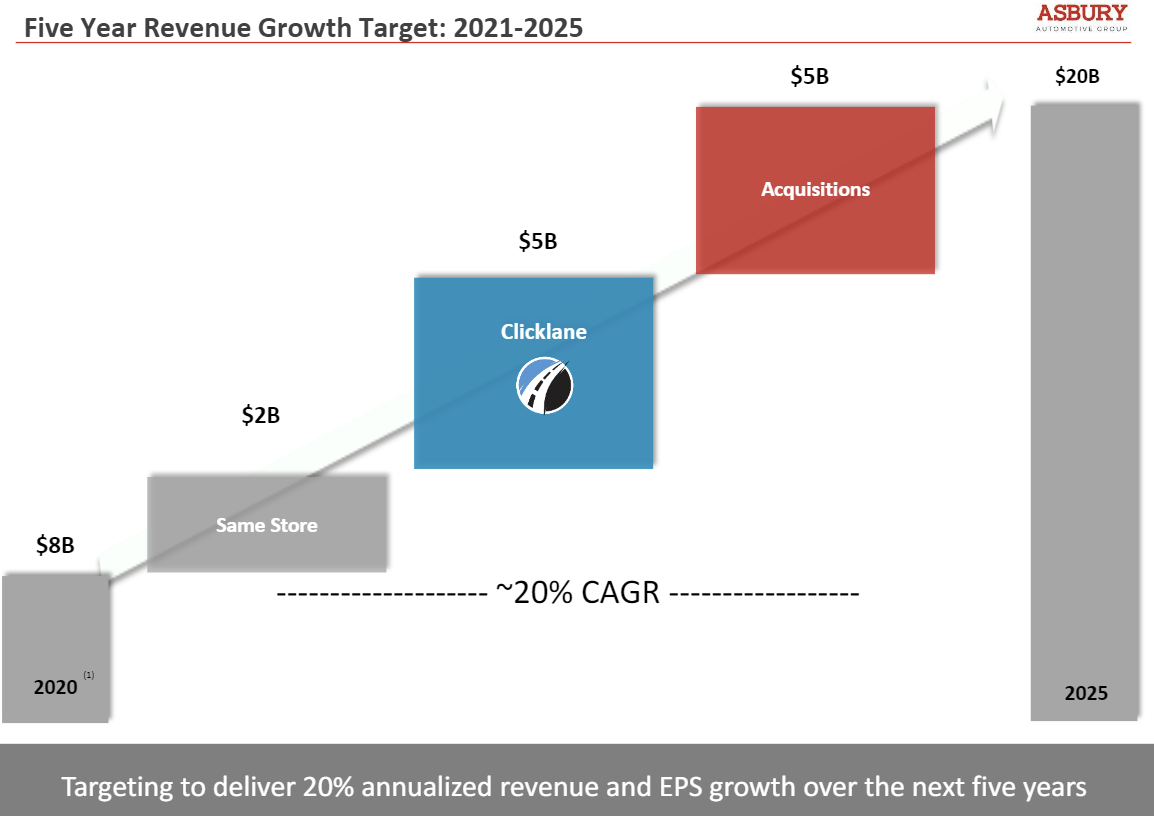

Thanks to @HotlantaCapital on Twitter, I decided to dig deeper into the auto dealers this week… Asbury Automotive ($ABG) was mentioned as a high-performer with a solid 5-year outlook for growth… So I decided to take a quick peak at Asbury and Lithia Motors ($LAD).

These companies sell new cars, used cars, help customers finance them, and offer parts and service to maintain them. On top of that, they are both building out e-commerce offerings to expand reach.

Lithia outlines the auto market as a ~$2 trillion market opportunity…

…and both Asbury and Lithia are looking for massive revenue and earnings performance over the next 5 years driven by tuck-in acquisitions and e-commerce penetration.

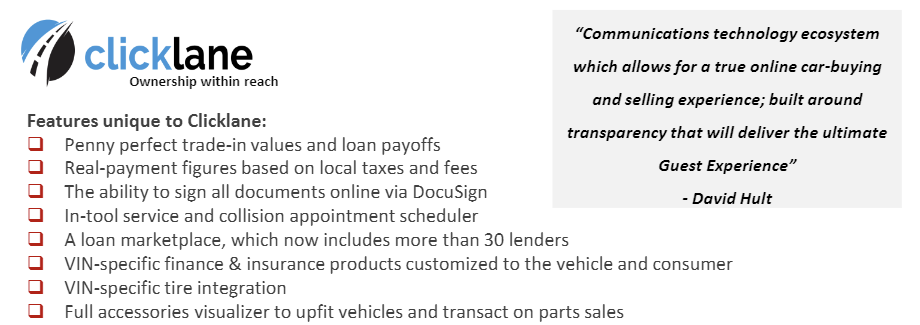

What does e-commerce mean to an auto dealer??

Lithia (Driveway) and Asbury (Clicklane) view it as:

Ability to buy online

Trade-in services

Planning / scheduling maintenance services

Most importantly, it should drive better conversion

Each of the publicly traded players in this market are banking on both success in digital offerings AND a successful acquisition program — something to watch for with increasing competition a likely outcome (Carvana comes to mind).

And it seems the goal should ultimately come back to parts, service, financing, and insurance… These pieces make up some 70%+ of gross profit despite being less than 17% of sales. Maybe that approach is too simple / obvious?

Auto dealer stocks have performed extremely well over the past 5 years with the majority of that outperformance coming off of COVID lows in 2020.

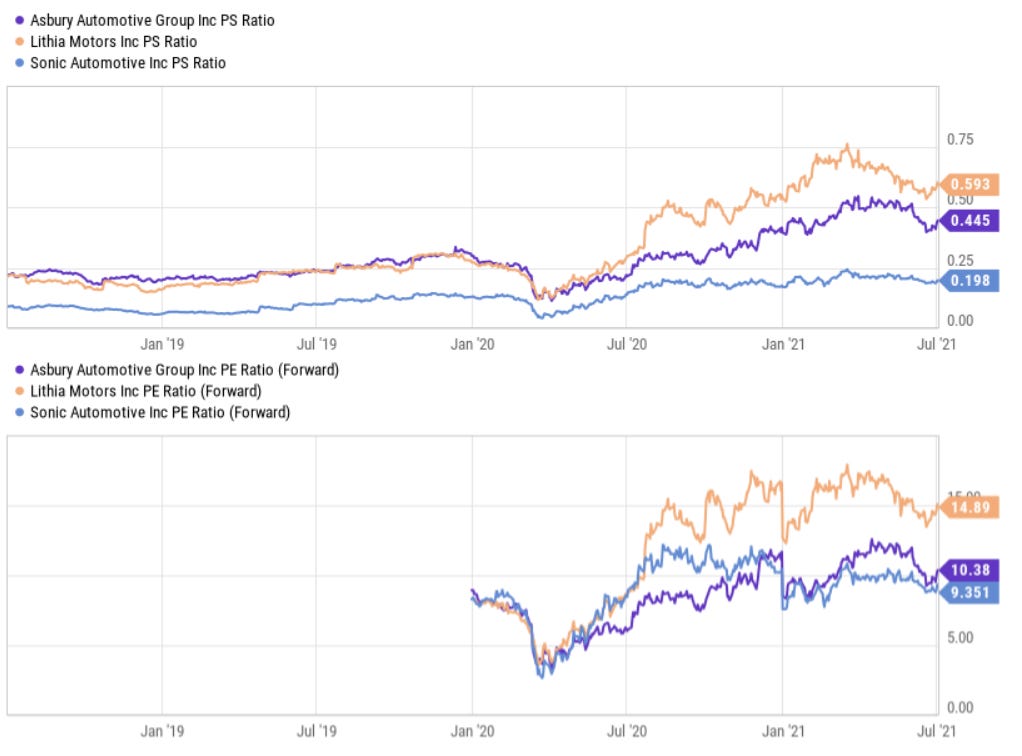

Despite this, Lithia trades at ~14x forward earnings, Asbury at 10x earnings, and (less optimized peer) Sonic Automotive ($SAH) at 9x earnings. All reasonable earnings multiples.

This looks like an interesting group worth closer investigation. Consider this a running list of notes on the space. Some open questions that remain:

Can all participants pursue the same strategy simultaneously?

If pushing online sales of new/used autos to geographically distant customers, how can they capture any high margin parts and service revenue?

Speaking of distant customers — this is a product line that would seem to have significant shipping costs, does the customer pay for this or are margins impacted?

More online sales means greater price discovery from market to market — how does that impact margins long-term? (i.e. the stereotypical negotiation / user car salesman motto getting lost in the equation)

How will autonomous / electric vehicles impact these 5 year plans? Would seem the market for new and used cars could change dramatically…

These outlooks are reliant on share-taking it seems… Unlikely that any of these offerings increase the “size of the pie” for automobiles…