Quick Value 7.6.20 (ROCK)

Gibraltar Industries Inc (ROCK)

Market Performance

[Index | % change WoW ]

S&P 500 | 3130 +4%

Dow Jones | 25827 +3%

Russell 2000 | 1432 +4%

Russell Microcap | 544 +3%

10-Year | 0.67% +2bps

Gold | 1787 unch

Oil | 40 +5%

VIX | 28 -20%

Market Stats

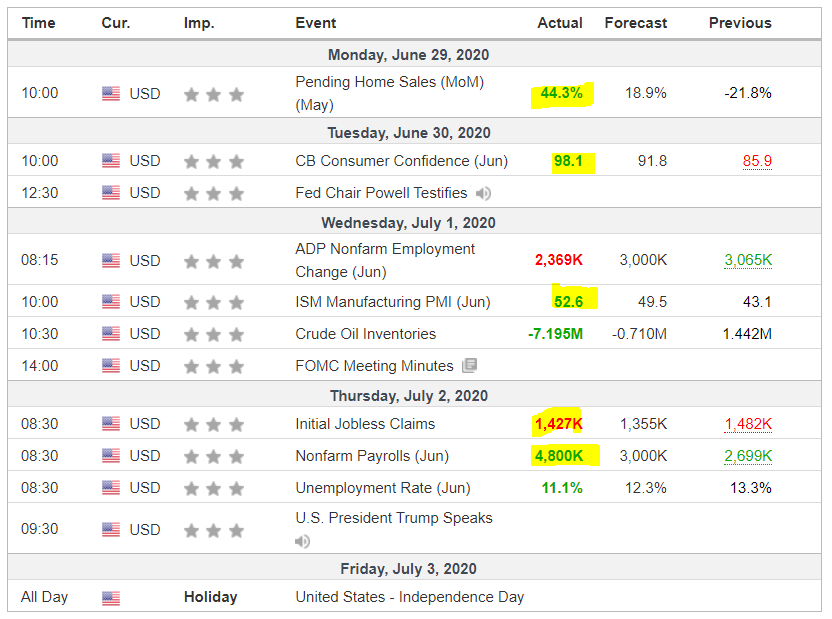

A few releases last week had some positive economic results tied to them…

Home sales rebounding

Consumer confidence continues to rise

Manufacturing activity expanding

Employment increasing (on a net basis)

Employment

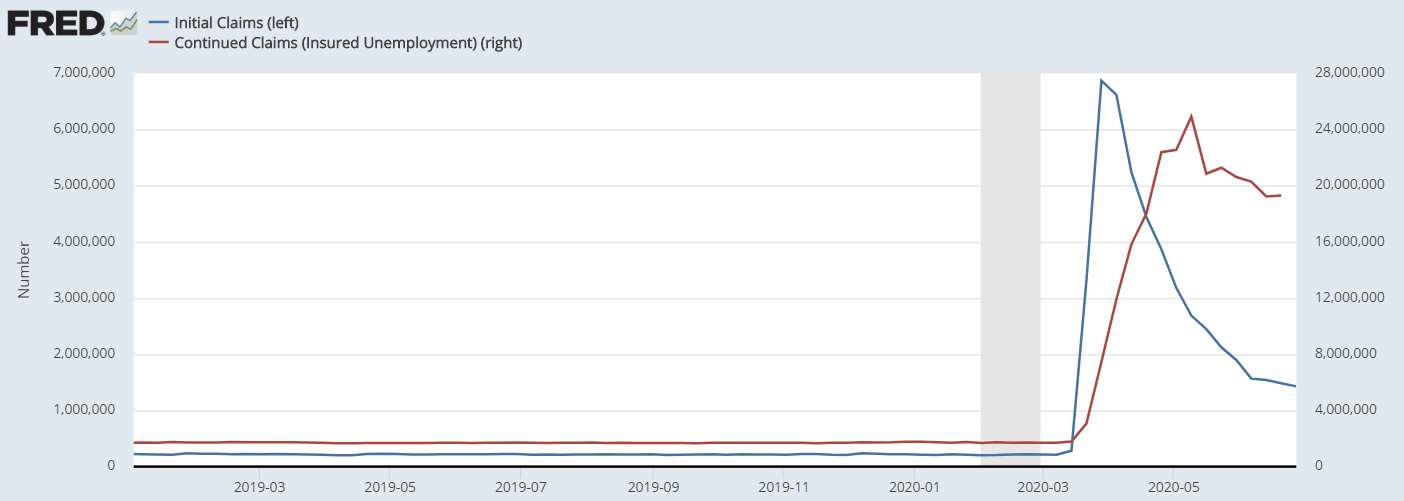

Continuing unemployment claims remain elevated near the 20m mark while initial unemployment claims are receding (albeit still elevated at >1.5m per week)…

As a reminder, the “bonus” unemployment benefits (additional $600 per week + allowance for independent contractors) is set to expire on July 31, 2020 — this will have serious ramifications to those unemployed earners.

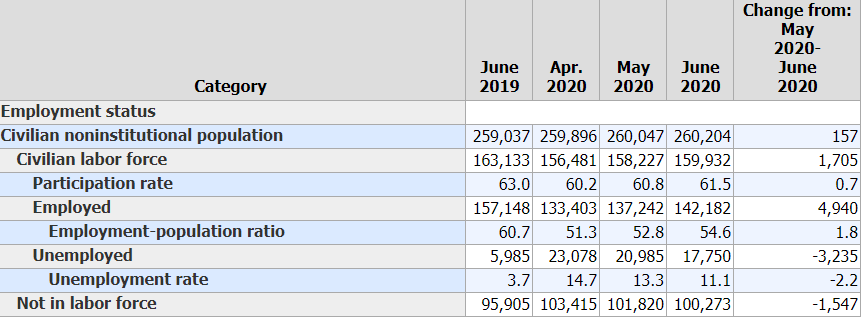

In June, 4.8m jobs were added to the workforce, a good jump from the revised 2.7m jobs added in May.

Unemployment remains high at 11.1% (from < 4% last year)… We will see how businesses and unemployed persons start to react after the CARES Act unemployment provisions expire starting in August…

Money

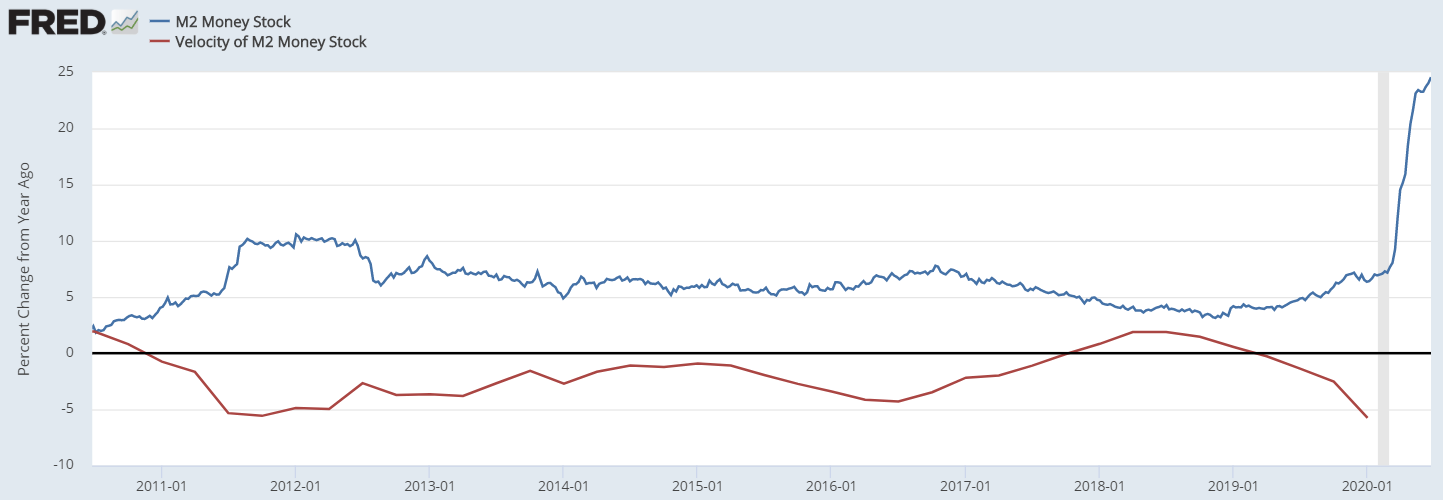

For those of you waiting for the Fed to take their foot off the gas to start getting bearish on the market; you’ll have a while longer to wait…

Money supply still growing at a >20% rate year-over-year while velocity (i.e. propensity to spend) continues to decline around 5% YoY.

Quick Value

Gibraltar Industries Inc (ROCK)

This is a small cap industrial/infrastructure company.

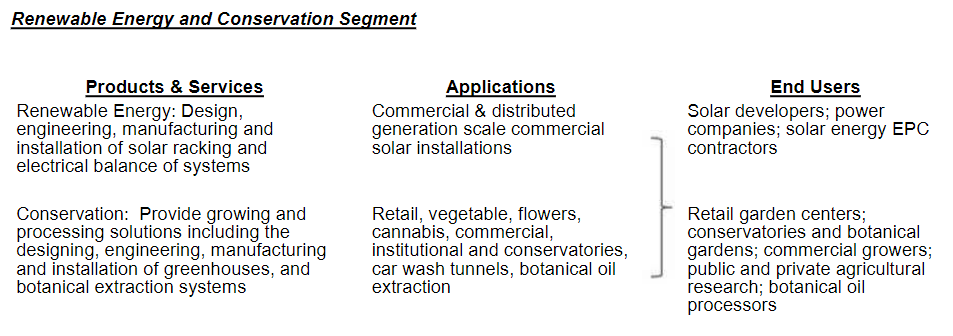

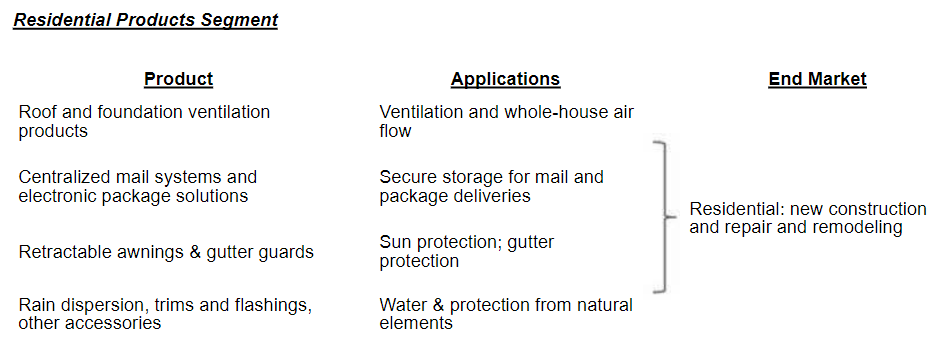

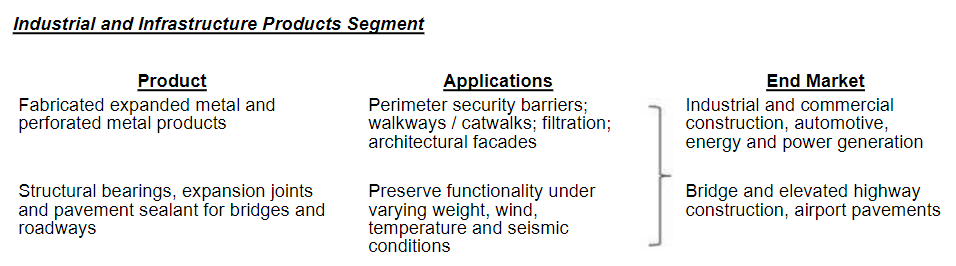

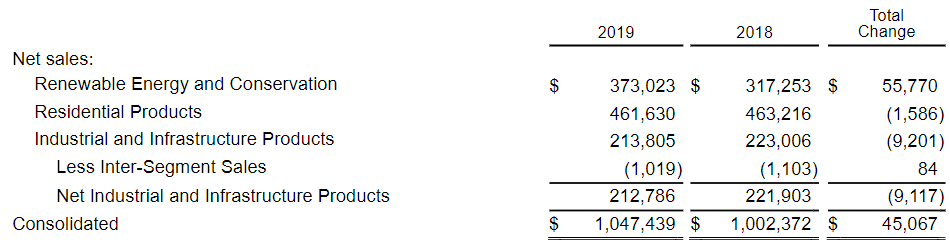

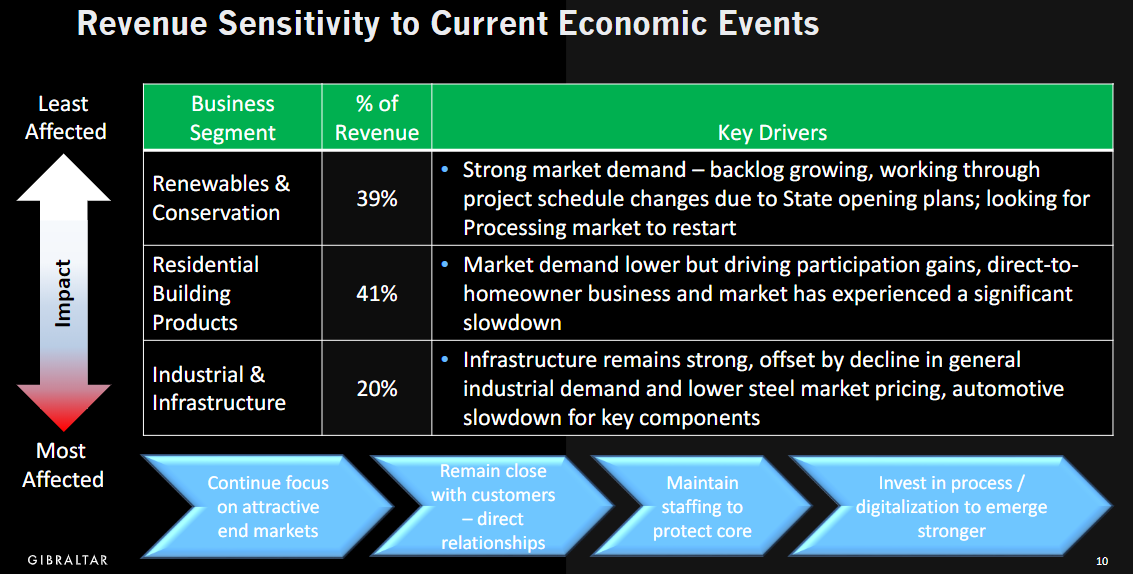

Gibraltar operates under 3 segments with exposure to various end markets including solar utilities, residential and commercial construction, and industrials…

Residential products represent the largest segment but the renewables business seems to be growing quickly and set to overtake residential products in the near future…

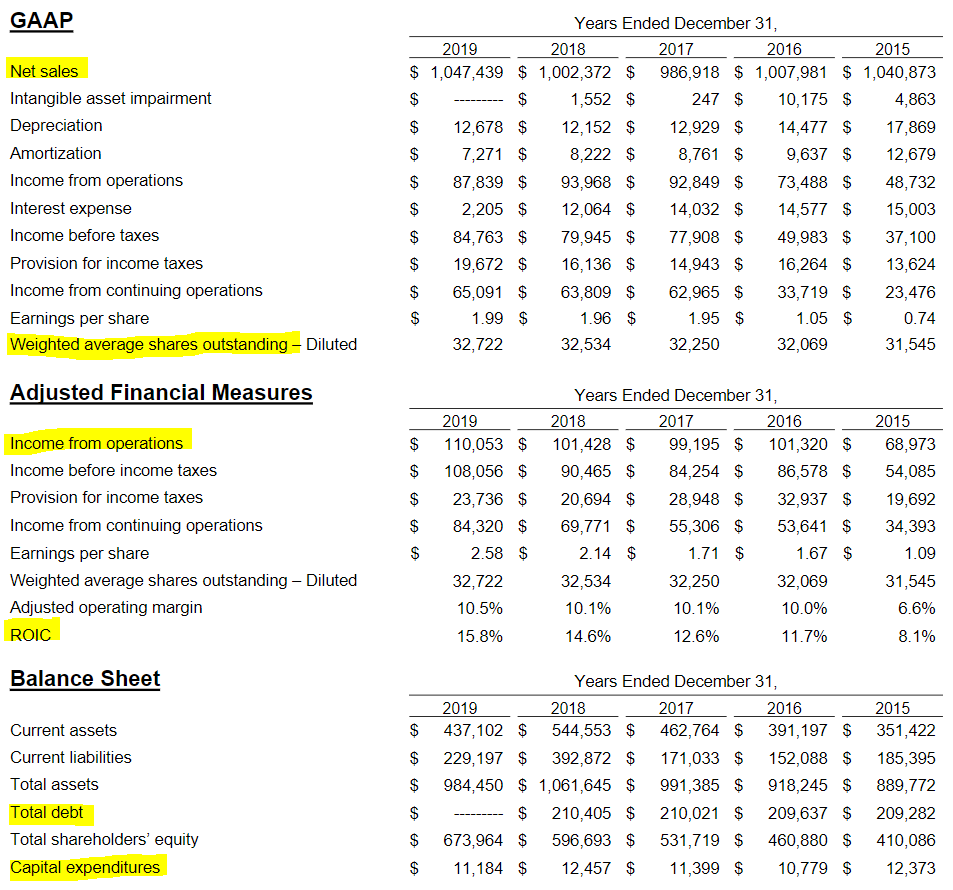

There are 33m shares outstanding x $47 stock price = $1.55bn market cap. Net debt is zero with $85m in cash on hand for a $1.47bn enterprise value.

Free cash flow was $118m in 2019 and averaged $87.5m over the past 3 years = 13x P/FCF

Performance over the past 5 years has been fairly good with flattish sales but improving margins and ROIC. No change in share count and debt fully repaid. It also seems to require very little capex at $10-12m on $1bn of sales.

Q1 results looked good as well with sales and backlog up by a decent amount. COVID may have a minimal impact on the overall business too…

Seems like a good starting point for a potentially quality business…