Quick Value 8.10.20 (BAC)

Bank of America (BAC)

Market Performance

[Index | % change WoW ]

S&P 500 | 3351 +2%

Dow Jones | 27433 +4%

Russell 2000 | 1569 +6%

Russell Microcap | 594 +7%

10-Year | 0.57% +3bps

Gold | 2046 +3%

Oil | 42 +5%

VIX | 22 -8%

As of mid-July, small stocks have been leading the charge… Though these indices are still down for the year, they are nearing closing the gap — R2K is down ~6% YTD and Microcap index down ~4.5%

Market Stats

Let’s run through the checklist of economic activity supporting the markets right now:

Money supply growth — we’re still at 20%+ YoY growth in money supply (although 3 consecutive readings of sequential declining growth rates) — the Fed is still hard at work!

Personal income & savings — as noted from last week’s post this is a check ++

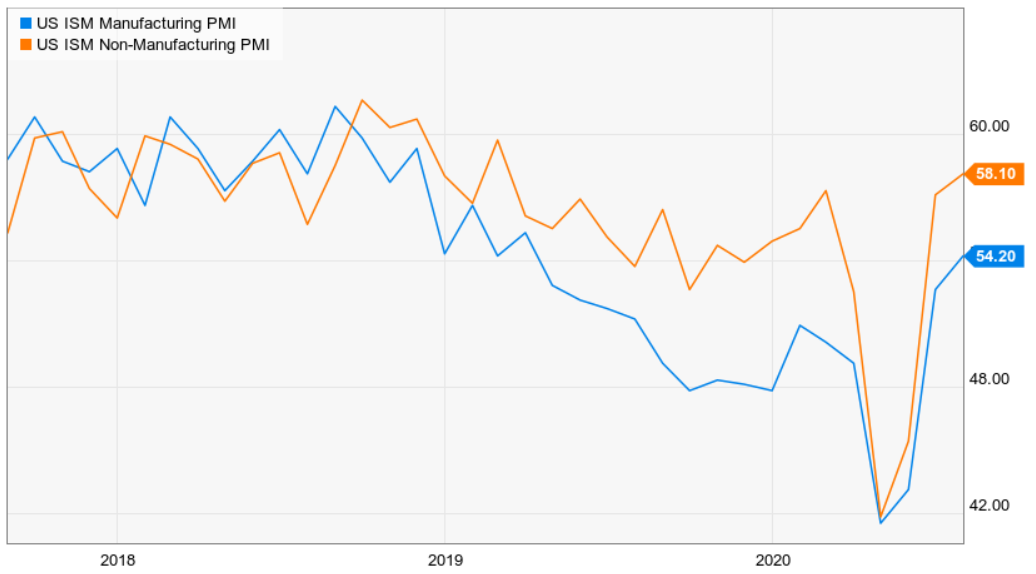

Business activity — as measured by PMI — both manufacturing and services indices continue to rise compared to previous months (a reading >50 is expansionary)

Jobs — July saw employment rise by 1.8m jobs though we’re still a net loss of 12.5m jobs in 2020…

Quick Value

Bank of America (BAC)

I figured I would cover Bank of America in honor of Buffett’s recent large purchases in the stock…

The stock is still down some 26% YTD from $35 to $26 as COVID and interest rates are impacting banks around the globe…

As one of the Big 4 banks, BAC is the 2nd largest bank behind JP Morgan (JPM) with $2.7tn in total assets.

Since CEO Brian Moynihan took the reins in 2010, performance has vastly improved coming out of the crisis. Over the past 5 years, they’ve doubled earnings, repurchased ~2bn shares, grew book value 20%+, and improved capital levels.

Today, about half the business comes from net interest income on loans and the other half from fees, commissions, services.

Consumer Banking is still the largest and most profitable business line for BAC…

The first half of 2020 has been impacted pretty severely by COVID and interest rates just like other banks. Some notable items:

BAC took $10bn in provisions for loan losses in 1H 2020 — the lowest of the Big 4… the other 3 banks averaged $15.7bn in reserves during 1H

1H pre-tax earnings were down ~7% when excluding the loan loss provisions

Book value grew ~6% YoY in 2Q20 to $27.96 per share

Net income was $6.8bn in 1H20 (including provisions) compared to $14bn in 1H19

Big banks are great at giving helpful information in their quarterly releases with 5-quarter running results for comparison.

At first glance, Bank of America is highly efficient with good ROEs… the heavy mix of noninterest income makes them somewhat insulated from declining interest rates (you can see the impact here in the net interest income line over the past 5 quarters).

There are 8.7bn shares outstanding

x $26 stock price

= $226bn market cap

Trailing earnings were $19bn / $2.07 per share (includes $10bn 1H provisions) — 12.5x PE

Book value is $242bn / $27.96 per share — 0.93x PB

Both of these metrics are just shy of historical averages and a decent amount below JPMorgan…

JPMorgan is deservedly the leader in bank valuations with an extremely efficient operation as measured by ROEs and Efficiency Ratio (essentially noninterest expenses to revenue).

Bank of America isn’t far off however — with efficiency ratios in the high-50% range while JPM sits in the mid-to-low 50’s… If BAC can close this gap then it’s possible the valuation gap could close as well…