Quick Value 8.14.23 ($LEE)

Pivot to digital turnaround at 5.8x EBITDA / 2x FCF

Today’s Quick Value looks at a super cheap (5.8x EBITDA / ~2x FCF) newspaper-to-digital turnaround story in Lee Enterprises (LEE). If you like ideas with tons of upside optionality then this one’s for you!

Subscribe to the full newsletter for full access to all ideas!

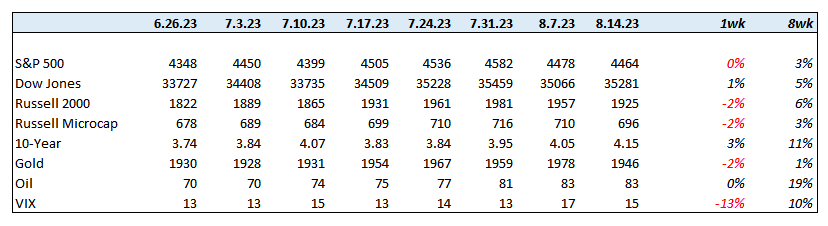

Market Performance

Market Stats

Inflation is easing as YoY growth fell to 3.3%… ex food & energy, things are still a bit more inflationary at 4.7% YoY and have eased much less.

Quick Value

Lee Enterprises Inc ($LEE)

This stock was written up by Kuppy back in October 2022 at $17/share. Shares have drifted down to $11-12/share since then. I have no idea if he’s still long this stock but I’m finally getting around to looking at it so let’s see what’s going on…

What they do…

LEE is a newspaper publisher which notably acquired Berkshire Hathaway’s newspaper assets back in 2020 for $140m which included some valuable financing from Berkshire at attractive rates. That deal added quite a bit:

Serving communities in 10 states, BHMG owns the print and digital operations of 30 daily newspapers, as well as more than 49 paid weekly publications with digital sites and 32 other print products. BHMG had 2019 revenues of $373.4 million and adjusted EBITDA1 of $47.4 million.

Today, LEE has 606,000 digital subscribers, serves 75 mid-sized cities, and operates in 26 states. Competitor Gannett (GCI) had 2m paying digital-only subscribers at 12/31/22.

Everything gets reported under a single business segment so unfortunately we can’t tease out margin differences between digital and print without making estimates.

Why it’s interesting…

1) Digital transformation

Like other newspaper publishers, LEE is working on a business model transition from print publishing to a digital subscriber base with digital ads and digital marketing services to go with it.

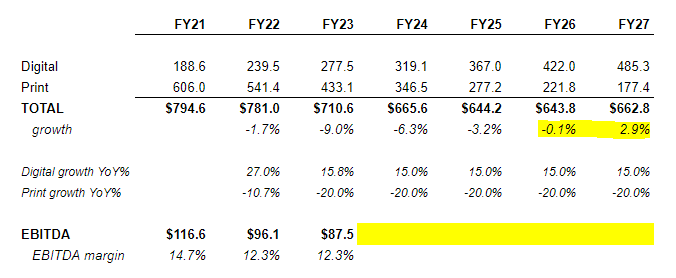

Digital offerings are 41% of sales and expected to be more than 50% by 2026. At that time, digital is likely $450m+ in total revenue and (hopefully) pushes the company into overall revenue growth. Print revenue is down 20% YTD (through Q3) and fell 10.6% in FY22. Subscribers have grown 37% annually from 2020-2023E though that rate is slowing to 19% in 2023.

Digital revenue is likely going to be much more profitable than print revenue given the lack of printing facilities, labor, supplies, paper, ink, etc. (this is a key difference from the media industry’s transition to streaming services).

On the back of this transition, LEE is selling assets related to the print business along the way. Asset sales brought in close to $50m since FY2020 and management has another $30m in their back pocket. I’d expect this to continue for the foreseeable future with NBV of assets at ~$67m and equipment alone having gross asset values north of $216m.

2) Attractive funding with Berkshire debt

In 2020, LEE “paid” $140m for Berkshire’s newspaper business and the Buffalo News but it was financed with a new $576m term loan provided by Berkshire which LEE also used to refinance existing debt at the time.

In a rising rate environment it’s pretty valuable to have both fixed rate debt (9%) and a long-term maturity (2045). While that’s great and gives LEE a lot of flexibility to execute the digital transition, it has some drawbacks… asset sale proceeds generally need to go toward the debt, excess cash flow over $20m must be swept to principal payments, and there are restrictions on buybacks, dividends, and acquisitions.

Translation = this is a debt paydown story until or unless earnings start to grow meaningfully.

The upside to this long-term fixed rate debt held by Berkshire is that bankruptcy is likely a very very low probably event. With point #3 below, having this level of funding flexibility is crucial!

3) Option-like payoff potential

By now you’re probably realizing that LEE has a tiny equity value squashed under a big pile of debt. That’s right! There are 6.1m shares outstanding at a $12 price = $73m market cap. Net debt is $443m for a $516m enterprise value. On 2023 EBITDA guide of $88m that works out to a 5.8x multiple and 5x leverage. That leverage isn’t quite the same as your typical 5x levered company for reasons outlined above.

Cash flow is normally pretty great but they were hit hard by working capital in both 2021-2022 and that’s starting to ease up a little in 2023. They also generate plenty of cash from asset sales as mentioned earlier.

Let’s think about pro-forma FCF for this business. Take the current EBITDA guide of $88m less $42m in interest ($460m x 9%) less $5m capex, less $8.5m cash taxes = $32.5m before working capital. That’s $5.30 per share on a $12 stock! There’s big upside potential. The challenge is whether that $88m will hold before they hit overall company growth… hmm…

Sticking with that last thought for a moment…

If we extrapolate the digital and print growth rates through FY27 then we start to hit combined growth by FY27 when digital would represent 73% of sales. That’s how hard it is to overcome a rapidly declining business. Note that if print declines at a 10% rate, then LEE achieves overall growth in FY25.

A more important question might be when the inflection in EBITDA/FCF would happen. If digital is substantially more profitable than print, then I’d expect earnings to inflect before revenue growth. So far, EBITDA is still falling significantly.

We can’t just slap a 10x multiple on $5.30/share of FCF and call this thing a potential 5-bagger but that does highlight the optionality here.

Summing it up…

As I reviewed this one and reflected on the general thesis — pivoting from print-to-digital while preserving cash flow — I’m also thinking about how that exact same model is working for streaming companies… and it’s not great. This has a slightly better makeup in that digital should eventually be more profitable than print so they’ll have expenses to shed along the way.

There’s a ton of upside here if management is successful pivoting this business. But it’s also possible/likely that results will stink for a few more quarters/years. It’s hard to own a business with declining EBITDA that you think will start to grow someday.

At best this looks like a call option today.

Here’s a crazy simple FCF bridge from today to FY27 using some existing trends/extrapolation. It shows FCF bottoming in FY25 before starting to grow in FY26 with still pretty high leverage. What do you pay for this today? That’s hard to answer… I think I’d rather own this at 2-3x the current price knowing that FY25-27 earnings trends are in-place… thoughts?

Hi,

Thank you very much for this analysis.

Do you have any idea why Berkshire agreed to such a long maturity? 25 years seems unusual to me, especially for a pivoting business.

Always scary to invest when cash flow from operations keep falling... the stock reminds me of NZME, which is similarly cheap and also trying to engineer a shift to digital