Quick Value 8.15.22 ($OXY)

Occidental Petroleum - Buffett buying this energy company trading at 6x FCF

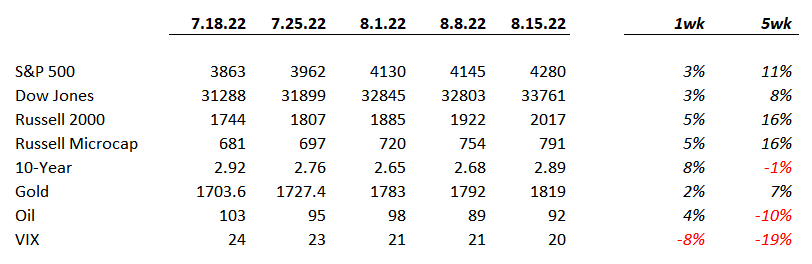

Market Performance

Market Stats

S&P 500 earnings estimates are coming down slightly but still project 8%+ growth in 2023 with the index trading at 17.5x 2023 earnings.

Large cap price-to-sales valuations have come down significantly while small and midcaps are stable/below recent valuation levels.

Quick Value

Occidental Petroleum ($OXY)

What do they do?

OXY is an energy company with 3 segments — oil & gas exploration and production, chemicals, and midstream. The lion’s share of sales and earnings come from oil and gas production.

The oil and gas segment sits on 8+ year’s worth of proved services based on 2021 production levels.

The chemical segment has been a slightly less volatile business and consistent earnings generator.

Warren Buffett involvement…

Dating back to the $55bn 2019 acquisition of Anadarko Petroleum, Buffett helped to finance that deal with a $10bn 8% convertible preferred stock investment to OXY.

More recently, Berkshire Hathaway has been buying significant amounts of OXY stock in the open market. At prices ranging from $50-60+ per share. The 188m OXY shares held by Berkshire are worth $12bn+ and makes up ~3.7% of their $328bn equity portfolio at 2Q22.

There’s been plenty of speculation on Berkshire/Buffett’s intention to acquire all of Occidental.

Capital allocation…

After taking on a lot of debt for the Anadarko deal, OXY has spent most of its cash flow repaying debt.

More recently, the increased oil prices have significantly boosted cash flow. Cash generation is now surpassing levels last seen before the 2015 oil price collapse. On top of that pickup, capital expenditures are low and stable meaning OXY is producing huge amounts of free cash flow (so long as oil prices remain high).

Whether the current oil price environment can remain stable is a huge factor in the go-forward cash generation of the business. At current rates, management intends to earmark cash for buybacks and rapid debt paydown as opposed to growing production levels.