Quick Value 8.16.21 ($MCK)

McKesson ($MCK) -- another cheap drug distributor at 7-8x cash flow with stellar balance sheet...

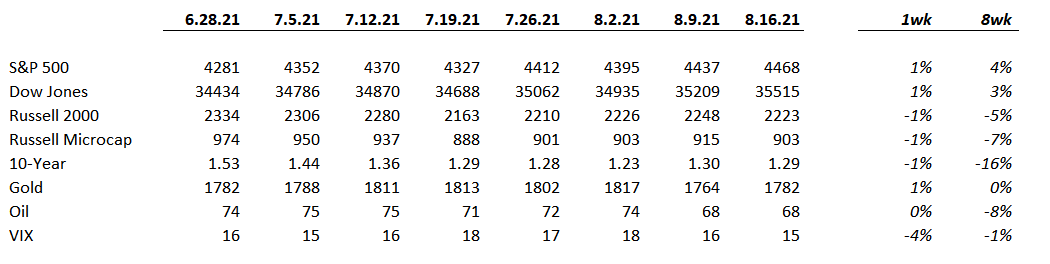

Market Performance

Small stocks continue underperformance relative to larger stocks and treasury yields continue to decline…

Market Stats

Job openings… are up to 10.1m unfilled positions, now larger than the total pool of unemployed people!

Inflation logged another month of 5%+ YoY increase

Quick Value

McKesson Corp ($MCK)

Continuing to look at distributors of pharmaceutical products this week with McKesson. They operate distribution centers, purchase various drugs and medicines (branded, generic, specialty, etc.) direct from manufacturers and sell to national and independent retail pharmacies, hospitals, etc. A pretty traditional distributor business model.

As a reminder of the industry / relative pecking order — the top 3 distributors control some 90% of the market. McKesson is top dog with ~$250bn in annual sales, Amerisource ($ABC) is next with $200bn+ annual sales, and Cardinal ($CAH) is the smallest with $160bn+ sales (covered last week).

Similar to Cardinal covered last week, McKesson shares some industry risks:

They have an increasingly concentrated customer base — 51% sales to top 10 customers and 21% to the largest (CVS)

Opioid settlement is on the table similar to Cardinal — a $21bn settlement spread out over 18 years for the top 3 players

Legislation on drug pricing

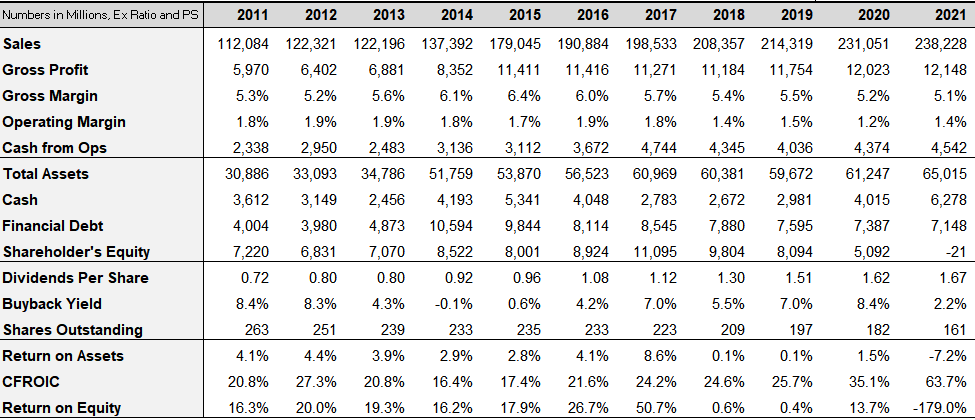

Let’s take a look at what McKesson has been doing financially…

Revenue has grown at a great clip — 7-8% per year from 2011-2021

Gross profit and margins have suffered since 2015-2016 — largely thanks to rapidly falling generic drug prices — a key piece to the drug distributor model

Net debt has been falling and close to zero as of latest fiscal year

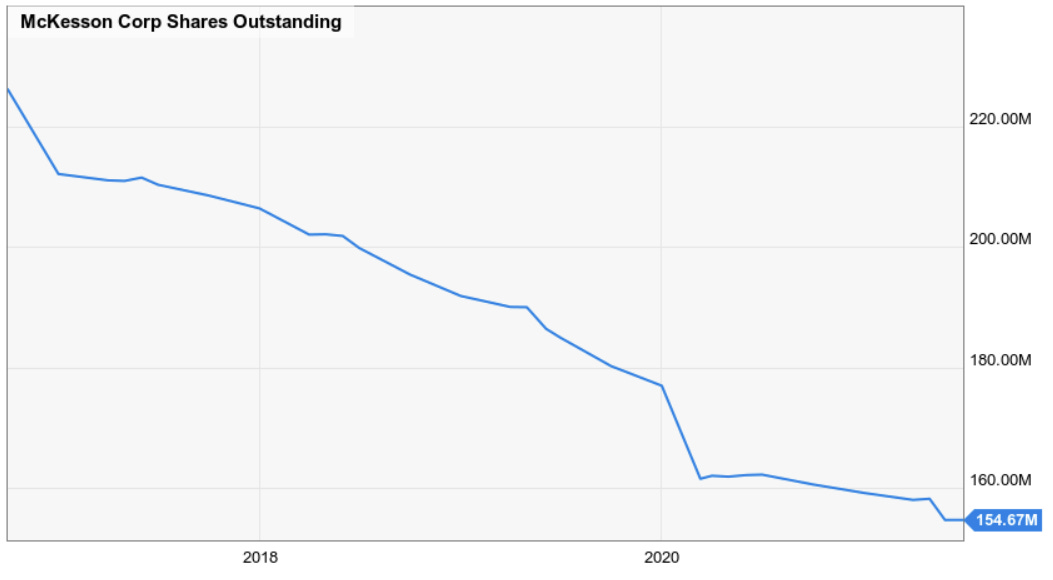

Buybacks (and thus share count) have been falling at an increasing pace as management picks up the buyback pace since 2016/2017

Along with gross profit (absolute dollars), cash flow has been stable

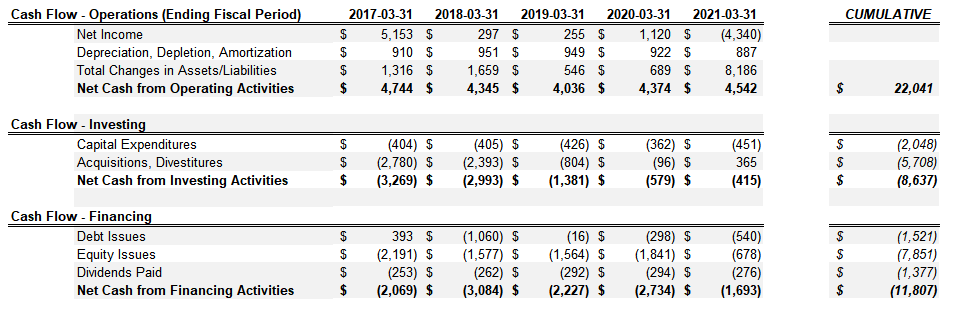

Capital allocation…

Operating cash flow has been stuck in neutral around $4-4.5bn per year from 2017-2021.

They racked up $22bn in cash from 2017-2021. Most of that cash went to share buybacks — close to $1.6bn per year on average and $7.9bn in total. And the share count has fallen by a third since 2017

And it looks like shareholders should expect more of the same in Fiscal 2022…

What’s coming next…

Another $4-4.5bn in operating cash flow and roughly $2bn in share repurchases coming this year. That should also improve the balance sheet a bit more; leaving McKesson in great shape to handle any potential opioid settlement.

With 155m shares outstanding and a $198 share price = $30.7bn market cap. Net debt is virtually zero despite the seasonal outflows in fiscal first quarter each year.

Despite the dollar amount of cash flow staying relatively flat over the years, McKesson has been able to boost per share cash flow through its buyback program. Guidance for FY22 would equate to $25-29/share in cash flow — giving the stock a 7-8x multiple — in FY17/18 they produced $21/share in cash flow.

At a quick glance…

It seems McKesson has managed the same set of problems in slightly better fashion than Cardinal ($CAH) has done… They also seem well positioned to stomach any legal settlements without missing a beat… Frankly, the company seems to have plenty of capacity for additional net leverage — whether M&A (if available in this concentrated industry) or an even greater pace of buybacks or dividends… Lastly, seems like shares are underpriced relative to historical averages…