Quick Value 8.22.22 ($ALLY)

Ally Financial - 1.1x book value and <5x earnings

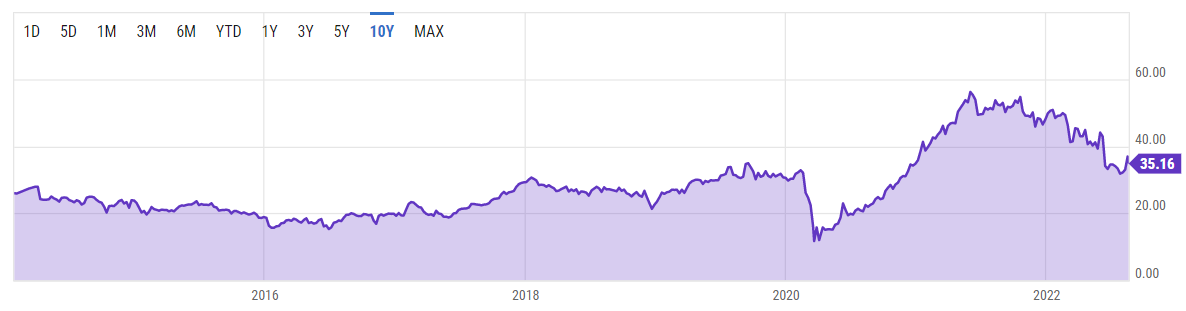

Market Performance

Market Stats

Retail inventories have been exploding (h/t Liz Ann Sonders) as supply chain pressures ease… this will likely eat away at cash flows for the next few quarters.

Quick Value

Ally Financial ($ALLY)

What they do…

Ally is a financial services company offering auto loans (67% of 2021 revenue), auto insurance (17%), mortgages (3%), and business loans and other (13%). The auto and insurance products are mainly sold through car dealers. Ally was formerly a part of General Motors and was initially created to help customers finance their purchases. Later expanding into mortgages and real estate, the company was bailed out in 2009 and eventually came public via IPO in 2014.

Since coming public, Ally has grown book value at a good rate — 8% annual growth in tangible book value from 2015-2021. Earnings have expanded from $2/share in 2015 to >$8/share in 2021.

There are 308m shares outstanding and the stock currently trades at $35/share for a $10.8bn market cap. Trailing 12-month GAAP earnings were ~$2.4bn or $7.80/share (4.5x PE) and tangible book value as of Q2 was $32/share (1.1x P/B).

What’s interesting here?

Shareholder returns — Ally has been steadily increasing capital returns to shareholders over the past few years. Share repurchases are close to $2.5bn over the last 12 months.

The share count has dropped from 484m in 2016 to 308m as of Q2. That’s ~8% per year. And it looks like management isn’t done yet. Under the current $2bn repurchase authorization, they’ve bought back $1.2bn through June 30 and plan to finish the full $2bn by yearend. So likely another ~7% drop in share count at current prices.

The quarterly dividend has steadily grown from $0.08/share to $0.30/share for a 3.4% yield at today’s price.

Cheap — Ally has certainly benefitted from auto market dynamics leading to a more than doubling of EPS in 2021 from 2020. The market seems to think this is unsustainable. In the meantime, Ally has plowed those extra earnings into share repurchases while simultaneously padding book value.

The stock is current currently trading around 5x 2022 EPS estimates vs. a 5-year average of 8x.

Warren Buffett a buyer — Berkshire Hathaway owns close to 10% of Ally with most of that stake purchased in Q2. This is unlikely to be a takeover candidate for Berkshire but it’s a newish position and the stake will likely be growing as Ally continues to repurchase shares.

Earnings are likely going to be lower than the $8.60/share earned in 2021. The auto market was (and still is) experiencing some strange action with supply/demand/pricing and this played to Ally’s benefit. Estimates call for $7.31 in 2022 EPS and $6.92 in 2023.

A fascinating area of the market are companies that have been (or are still) earning supernormal profits due to COVID impacts and putting those added profits to good use — maybe that’s cleaning up a bad balance sheet, making a smart acquisition, or giving it all back to shareholders. Ally seems to fall into the latter category. Even if GAAP net income were to return to the ~$1.4bn pre-pandemic level from 2018-2019; it will be a meaningfully higher per share level.