Quick Value 8.23.21 ($VIAC)

ViacomCBS - media conglomerate at 10x earnings

Market Performance

Market Stats

Retail sales (a huge portion of GDP) were down a 1% from June levels but grew double digits from last year… previously struggling categories like clothing, department stores, and food service are now coming back strong

Housing starts for July were 1.5m vs. 1.6m forecasted… Roughly on par with the 1.5m starts in July 2020 and well above the ~1.2m of July 2019

Business formation has grown spectacularly since COVID began… Not quite what you’d expect but with “work from home” taking over, perhaps this is the onset of a multi-gig standard with side hustles as commonplace?

Quick Value

ViacomCBS ($VIAC)

CBS and Viacom had a long history of marriage and divorce. More recently, they’ve gotten back together as of late 2019.

This is a media conglomerate with TV assets (the CBS network); cable TV channels like Comedy Central and Nickelodeon; the Paramount movie business; streaming services (Pluto TV and Paramount+); and some international assets too.

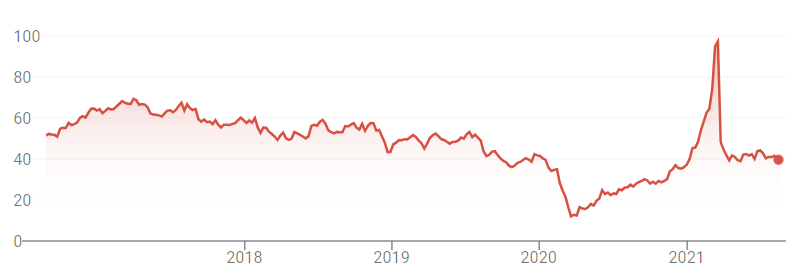

Viacom is another stock that got caught up in the Archegos Capital hedge fund debacle. Shares ran from below $30 to $100+ and since settled in around $40. A wild ride!

But even before 12-months ago, Viacom shares were on a solid downward trend from ~$60 to $30 for several years. COVID amplified that downward trend and now here we are.

Prior to the Archegos events, both Viacom and CBS were cheap and had struggling fundamentals…

Viacom standalone financials from 2015-2019 — revenue flat, operating income and earnings down:

CBS standalone financials — revenue up but operating income flat:

The big question is whether they can turn the corner to start seeing growth. First half 2021 results have revenue up >20% thanks to a rebound in advertising and new streaming subscribers but earnings down 30%+ so far this year.

As all of the media / content companies race to grab streaming subscribers, they are throwing every last penny (not earmarked for shareholders) at creating new content. Some are even sacrificing margin to do so. Competition is only heating up…

Below are some additional stats:

650m shares outstanding x $40/share = $26bn market cap

Debt (net of cash) at 2Q21 = ~$12.3bn / 2.4x leverage

Selling Simon & Schuster publishing business for $2bn+ in 2021

Trailing free cash flow was $2.4bn ~11x P/FCF

Pluto TV users were 43m MAU in 2020, 53m in 2Q21

Paid streaming subscriptions were 42m as of 2Q21

Streaming ads and subscriptions are growing fast but ~15% of total sales

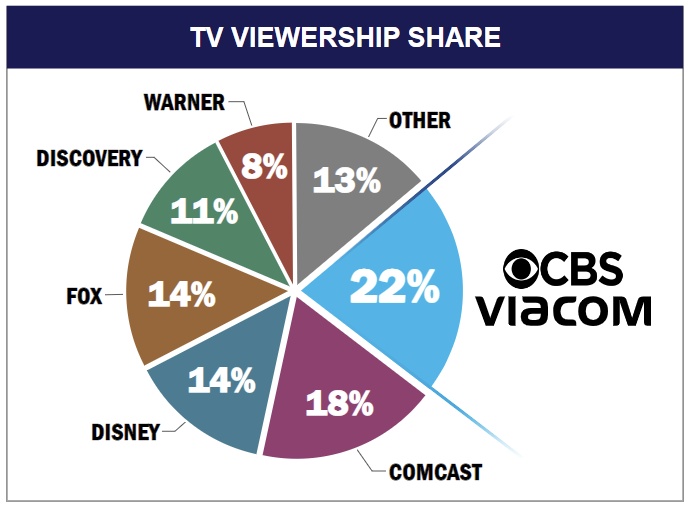

Combined, there is plenty of good content here with solid market share compared to media peers.

Capital allocation — There’s a small dividend (2.4% yield) but no buybacks. Management commented on a doubling of content budget from 2020 to 2021 and hinted at all / most capital going toward internal investment.

After several years of flat performance, ViacomCBS is going for growth in their streaming package. With a heftier content assortment they might be able to pull it off. The stock looks cheap but earnings may stay low as they reinvest profits back into new content.