Quick Value 8.28.23 ($DIS)

Turnaround at Disney - what's the upside?

What better stock to cover than Disney while my wife is in Orlando on a Disney trip and I’m here with the kids writing this article? This is one media company I haven’t looked closely at yet and with shares hitting lows, I wanted to find out for myself what was going on… (hint: it’s more than just streaming).

Subscribe to the full newsletter below for access to all weekly Quick Value posts, monthly write-ups, portfolio updates, and other content! (Note: still running the “lifetime membership” through the end of the month, just sign up for an annual subscription and I’ll convert your membership to lifetime comp!)

Market Performance

Market Stats

Home sales for July were good on the new homes front, weak on existing homes (impacted by mortgage rates), and building permits climbing back toward 5-year average levels

Quick Value

Walt Disney Co ($DIS)

I’ve covered plenty of other media companies in the past — Charter, Cable One, Comcast, Warner, Paramount, etc. — but have never dug into Disney… just assumed it was too much of a perceived high quality (see: expensive) big-cap stock for my taste. Then I come to find it’s actually a 10 year dog and trading at 2014 levels. Reminds me of a Dave Dreman investment strategy…

What they do…

Disney is a well known (I hope) media conglomerate with several lines of business from the ABC TV network, ESPN cable channel, streaming service Disney+, movie studios like Marvel, Pixar, and Lucasfilm, theme parks like Disneyworld and some other stuff too.

How do those assets breakdown?

Everything rolls up into just 2 business segments:

Disney Media and Entertainment Distribution (DMED) — Includes Linear Networks like broadcast TV network ABC, 8 TV stations, and various cable channels, Direct-to-Consumer (DTC) which is mainly the streaming services, Licensing and Content Sales (like DVDs or on-demand viewing), and the movie Studios.

Disney Parks, Experiences and Products (DPEP) — Theme parks, cruises and all consumer products (which are typically licensed) including video games, toys, books, etc.

In March 2019, they overpaid in a bidding war to acquire parts of Twenty-First Century Fox. In total they spent $71bn through a cash and stock deal. It added leverage, diluted shareholders, and promised $2bn in synergies on top of $6.7bn in expected EBITDA contribution. Then COVID hit…

Why it’s interesting…

There’s a ton of discussion around the losses at streaming and the bad acquisition of FOX but for me there’s really one thing that makes this interesting…

Disney was generating excellent EBIT levels (and growing) from 2014-2018; then the FOX acquisition + COVID took a bite out of that and they’ve yet to recover. Can they get it back and grow from there? That’s the key in my opinion.

Where did those earnings go? Let’s find out…

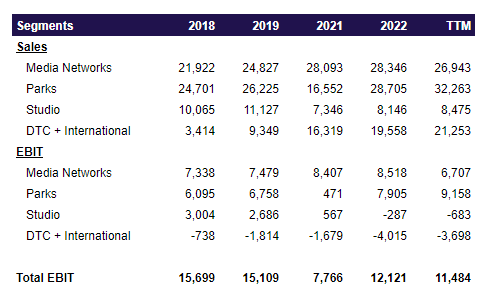

Here’s a comparison of segment performance from the 2018-2019 period (note the FOX deal closed in March 2019) vs. the 2021-2022 and TTM periods:

Yikes… despite a $71bn acquisition we don’t see much of an uplift… And nearly all of the EBIT decline came from the studios and streaming segments.

The networks business saw a jump in revenue but not much addition to operating income and in 2023 that business is facing cost headwinds (both in programming and SG&A).

Theme parks were largely unimpacted by the FOX deal but hit by the pandemic and have since recovered well above pre-pandemic levels of revenue/EBIT.

Studio performance fell significantly and was hit hard by the pandemic. Box office receipts are still low… 2022 was ~65% of the 2019 level but it’s slowly recovering:

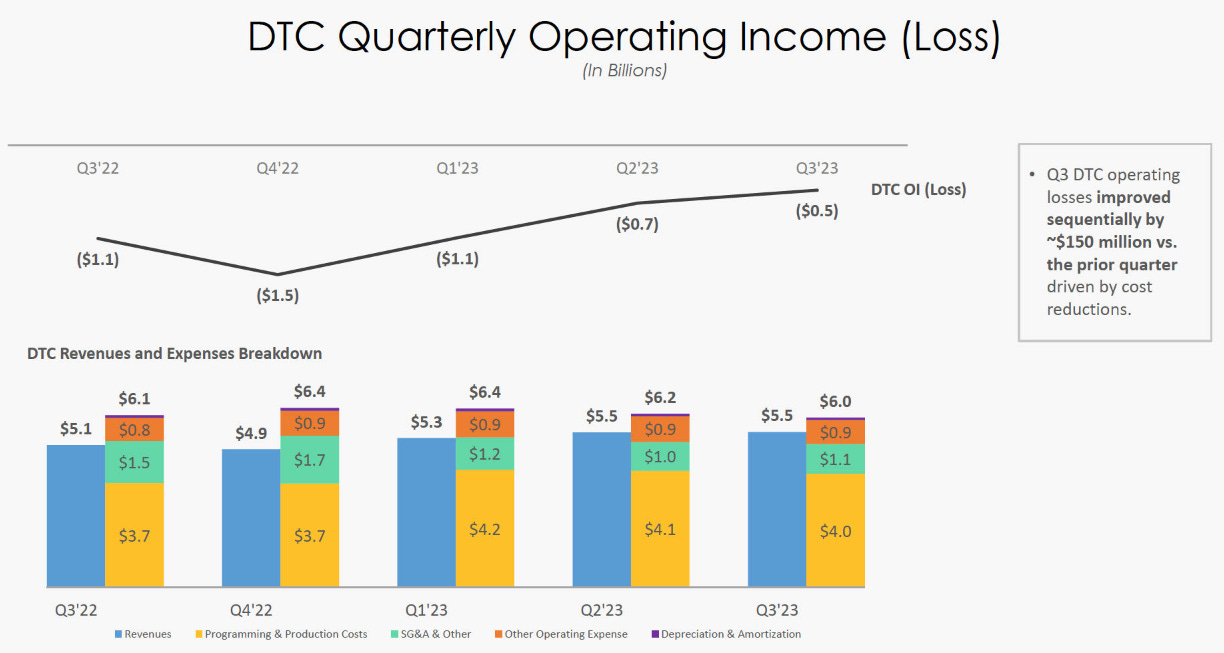

Last is the DTC business where every media company went hog wild investing in content and now find themselves pulling back hard on costs while also raising prices. Streaming wasn’t profitable before any of that started but at least it was closer to breakeven and less impactful on the combined company.

So how does Disney get back on track?

CEO Bog Iger laid out a path to $5bn+ in cost savings and a breakeven DTC business by end of 2024. Cost cutting efforts will come from both programming and overhead buckets. Those objectives would get Disney back to or above 2019 operating income levels, an important milestone.

Beyond the cost control efforts, Disney is also tackling major changes at 2 important assets:

ESPN — Given how poorly the DTC transition has gone for the industry and the overall importance of ESPN to operating income; Disney would prefer this transition to go a lot smoother (i.e. profitably)… they’ve talked about finding a strategic partner to help with that process whether that’s distribution, technology, or financial.

Hulu — Disney owns 2/3rds of Hulu and will likely buy the remaining stake from rival Comcast next year. The price tag has been rumored around ~$10bn and Hulu has been a money loser so this will add both debt and at least an initial step backward in operating income… long-term it’s probably(?) the best scaled competitor to Netflix and would have some bundling benefit with ESPN and Disney+

What about growth?

The combined business should continue to see decent revenue growth for years… The overall dependence on the parks business is pretty high right now and that’s probably the most cyclical business. It’s possible that revenue losses in the linear networks business (traditional cable) should transition to digital streaming so Disney needs to figure out how to port the bottom line economics from linear to streaming. Studios is in recovery mode from the pandemic and it looks like overall box office receipts are slowly climbing, maybe that business is the biggest incremental earnings contributor over the next few years? ESPN and Hulu add some revenue optionality too.

Summing it up…

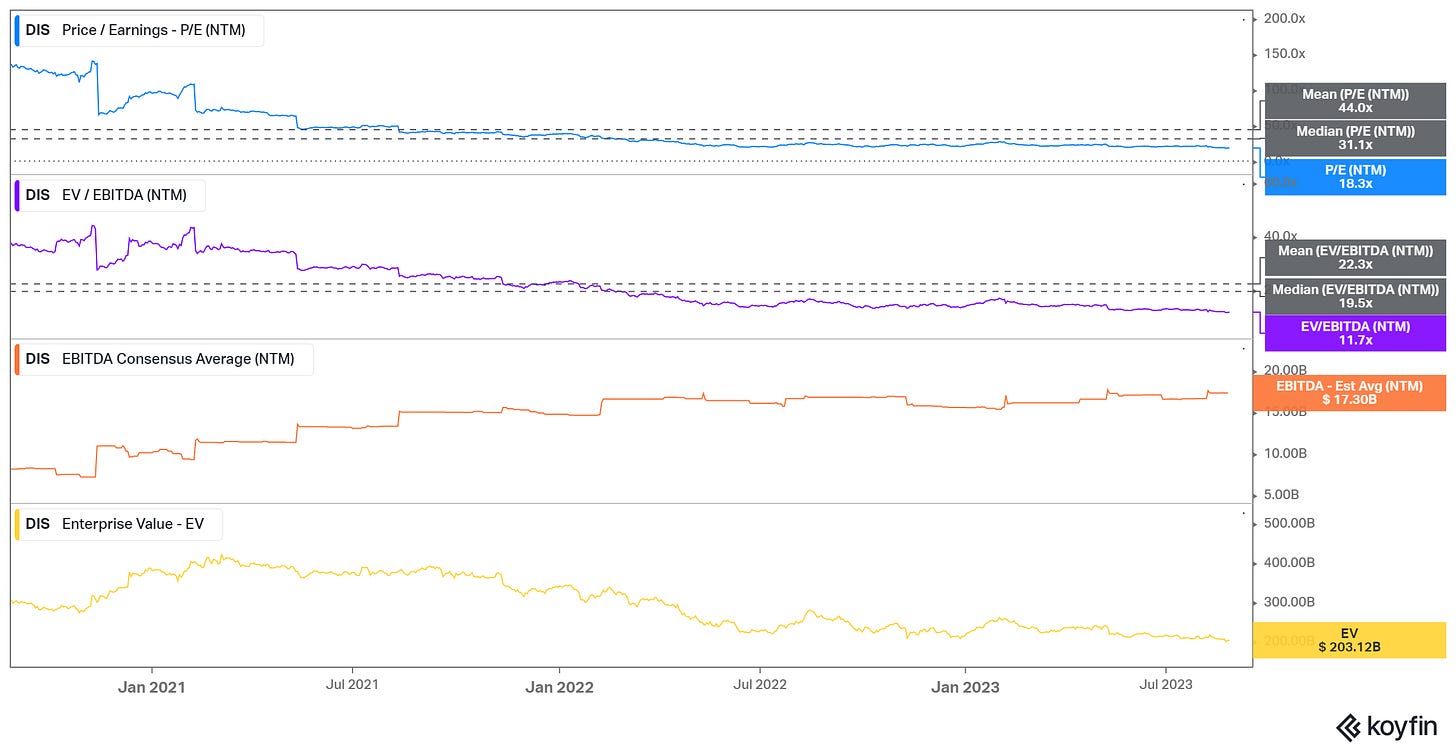

Up until the FOX acquisition, Disney was trading at 17.5x earnings and 10.5x EBITDA… they’re getting closer to those levels with EBITDA slowing climbing back up and the enterprise value down a bunch (partially from debt paydown and partially from share price declines).

Analyst estimates have EPS growing from $3.53 in FY2022 to $5 in 2024 and $8+ in 2027. I’m sure it won’t be quite that linear but assume that’s how it plays out… a stupid simple approach would be 17.5x that $8/share in 2027 earnings or a $140 price target in 2027… vs. an $85 price today = 18% IRR. Not bad if you can underwrite the probability of success.

Last point on this name… they haven’t been able to deploy capital toward anything other than organic capex in years… no share repurchases since 2018 and the dividend was eliminated in 2020… it all went to paying down debt. That will open up opportunities at some point in the 2024-2027 period when leverage gets to a reasonable level and cash can be used elsewhere. And it isn’t 100% dependent on debt paydown to get to a good leverage target since operating income is growing…

I think you are missing the main issue with Disney. Its the infamous "go woke go broke" meme. Sounds funny, but that IS the main issue. You do realize that, right ?