Quick Value 8.29.22 ($MGM)

MGM Resorts - selling real estate, buying back stock, trading at 5x EBITDA / 10x FCF

Market Performance

Market Stats

Personal income continues to expand as wages increase. Savings levels have flattened a bit around $930bn and 5% of income… spending continues to grow with income levels…

Quick Value

MGM Resorts International ($MGM)

How this one got on my watchlist…

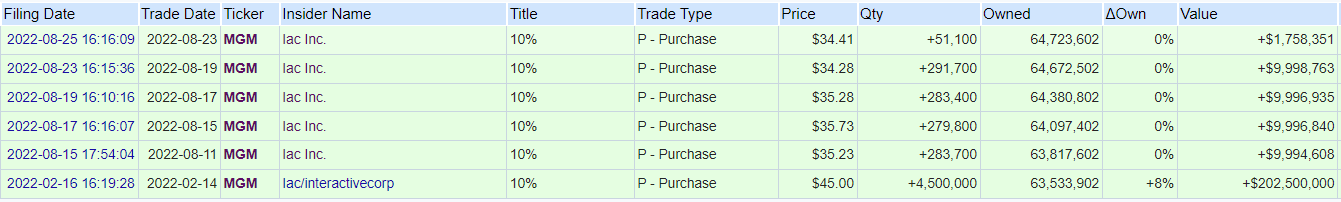

In August 2020, IAC invested $1bn for a 12% stake in MGM (~$17/share at the time). Then they purchased another $203m in February 2022 at $45/share. Again over the past few weeks, IAC has been buying more shares at ~$35/share totaling ~$42m:

What they do…

MGM owns and operates casinos with a concentration in Las Vegas, NV but also through several properties in regional markets (Midwest, South, Eastern US), and China.

Since 2016, MGM has been selling off real estate assets in sale-leaseback transactions to move toward an “asset light” operating model — MGM handles all operations for the resorts and makes rental payments to landlords instead of owning the casino properties.

Why it’s interesting…

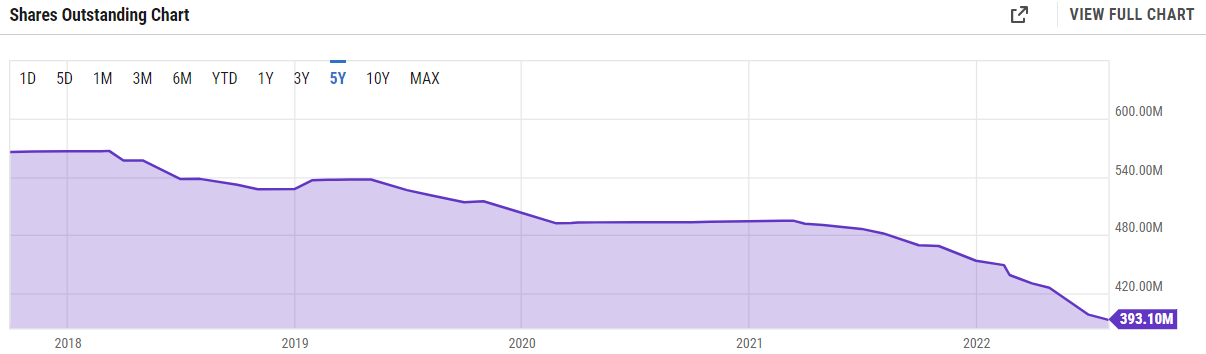

Recycling capital into share repurchases — Since 2018, MGM has bought back a little over 30% of outstanding shares

Since 2019, MGM has raked in close to $15bn in proceeds from real estate sales, repaid $3.5bn in debt, and repurchased $5bn worth of stock.

IAC ownership — After the latest string of open market purchases, IAC now owns close to 65m shares or 16.5% of MGM. This is a huge $2.2bn stake for IAC which itself is only a $5.8bn market value company.

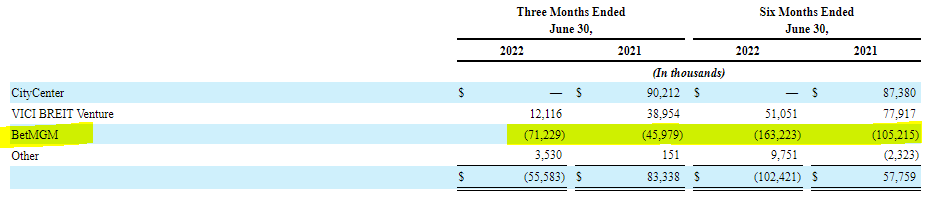

BetMGM — This is the online gaming and sports betting segment within MGM. They own 50% in a JV with Entain Plc. Losses are growing into 2022 as they chase market share. Revenue is expected to be $1.3bn+ for BetMGM in 2022

There are 393m shares outstanding x $33.50 price = ~$13.2bn market cap. I can’t sum it up any better than MGM’s CFO did on the latest earnings call:

IAC’s shareholder letter covering the MGM situation is worth a read. They like the offline to online transition happening industrywide and feel that MGM is positioned (and priced) to benefit from that. Here’s an excerpt:

MGM also has a $2.5 billion EBITDAR (a gaming industry metric designed to reflect profitability before taxes, capital expenses, and real estate expenses and simplify comparisons between those operators that own real estate and those that do not) operation domestically that comes alongside the opportunity in digital sports betting and table games, at a normalized free cash flow yield over 10%. This combination doesn’t exist in any growing internet opportunity.

As we looked further into MGM, we recognized a familiar sum-of-the-parts story with publicly-traded subsidiaries. MGM’s implied “stub” – the domestic business without the real estate – trades at an implied value of nearly zero. That’s not unlike IAC’s “stub” – which is perennially valued at zero (or less). When we saw the collection of well-run businesses (check), a sturdy balance sheet (check), and the undervalued “stub” after accounting for cash and publicly-traded securities (check), we realized that the MGM situation is remarkably similar to that of IAC.

Some of the concerns (and reason for the valuation disconnect) could center around recession, consumer spending pullback / inflation, the continued challenges in China, and the growing pile of leases that MGM is racking up…