Quick Value 8.30.21 ($AIG)

$AIG -- Making progress on the turnaround and split of Life Insurance business

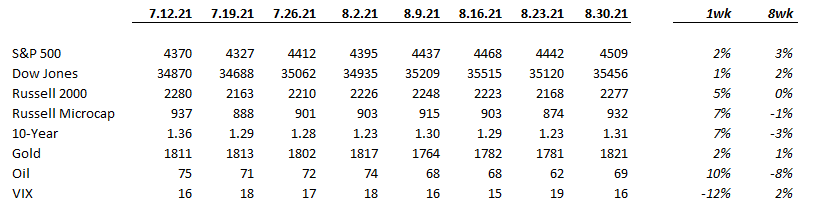

Market Performance

Market Stats

Personal income grew 2.7% year-over-year in July… wages continue to grow and unemployment benefits have been mostly flat as bonus payouts are easing…

S&P 500 is trading at 20.5x 2022 earnings estimates and those estimates for 2021 and 2022 have been creeping higher as Q2 earnings roll in…

Ocean freight and supply chain issues are still painful for plenty of public companies… There are plenty of stories about container rates going from $4k in 2019 to $10-12k in 2020, then $20k in early 2021, and now reaching $24-25k per container. Here’s some commentary by Dollar Tree:

Quick Value

American International Group ($AIG)

This one came onto my radar after an announcement by Blackstone to invest in AIG’s life insurance unit for $2.2bn and, separately, a sale of some real estate assets to Blackstone for $5.1bn — together, paving the way for a split of AIG’s life insurance business.

AIG survived the financial crisis and has since traded at a low multiple of book value (a 30%+ discount on average over the last 10 years) as they’ve struggled to grow per share book value.

Some quick overview notes:

AIG named Peter Zaffino as new CEO in March 2021 — he was formerly COO since 2017

There are essentially 2 segments — General Insurance and Life & Retirement — here’s the revenue mix as of fiscal 2020:

The Life & Retirement segment has been the consistent performer over the years…

Hence, why AIG is planning to separate the L&R segment via an IPO… The stronger business is likely to fare better in an offering, the cash proceeds will help improve the balance sheet and allow remaining AIG businesses to slim down and simplify…

There are 855m shares outstanding x $55/share = $47bn market cap

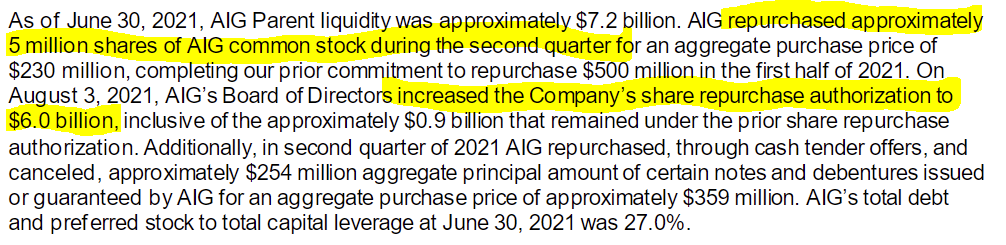

Management is starting to buyback plenty of shares — recently announced $6bn in total buyback authorization or ~13% of the current market cap.

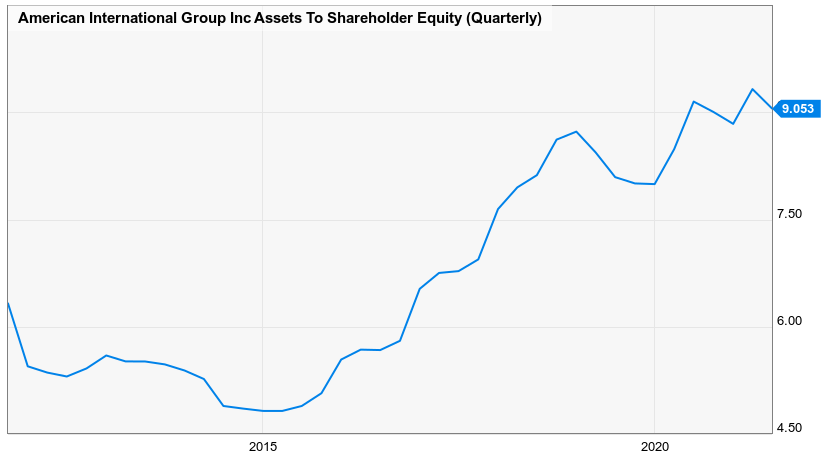

Leverage (defined by me as assets-to-equity for a financial services company) has been worsening over the years with impairment charges and run-off business — a 9x ratio indicates they have $1 of equity supporting $9 in assets

At the same time they are preparing to jettison the L&R business, General Insurance is starting to turn the corner with an underwriting profit in both Q1 and Q2 of 2021…

Life Insurance competitors and General Insurance competitors have very different valuations… Generals typically trade above book value while Life Insurance is at a 20% discount to book or so… Another contributing factor to the split as AIG trades at a hefty discount to book value with both businesses combined.

AIG has been a value trap for years coming out of the crisis but they finally seem to be making progress toward the turnaround… Profitability at both core businesses and nearing the finish line in an IPO of Life Insurance… Valuation off of book hasn’t changed much either… Could be a good setup!

Sign up for the weekly Quick Value newsletter and check out the monthly premium newsletter with deeper coverage of portfolio holdings…