Quick Value 8.8.22 ($ARCB)

Logistics provider trading below 4x EBITDA

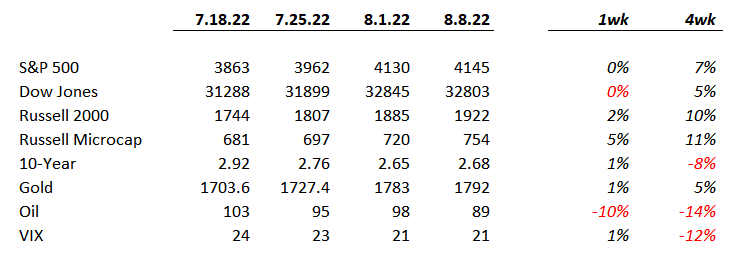

Market Performance

Market Stats

Global ad spending is starting to slow (even at major tech firms)…

Earnings season has lead to a number of positive EPS “surprises” with ~77% of companies matching or beating expectations so far in Q2 according to FactSet…

Quick Value

ArcBest Corp ($ARCB)

Continuing down the LTL path from last week’s post on XPO 0.00%↑. ArcBest has handily outperformed the S&P 500 over the past 5 years following a multi-year stretch of underperformance.

ArcBest provides both asset-based less-than-truckload (LTL) and asset-light freight brokerage services (much like XPO). LTL generally refers to smaller shipments that do not require a full truckload, these LTL providers pool together many small shipments and make shorter distance deliveries. ArcBest operates a fleet of 27k trucks and trailers making ~20,000 deliveries per day up to 1100 miles. They also have a growing “asset-light” business which refers to domestic and international freight brokerage and expedite services.

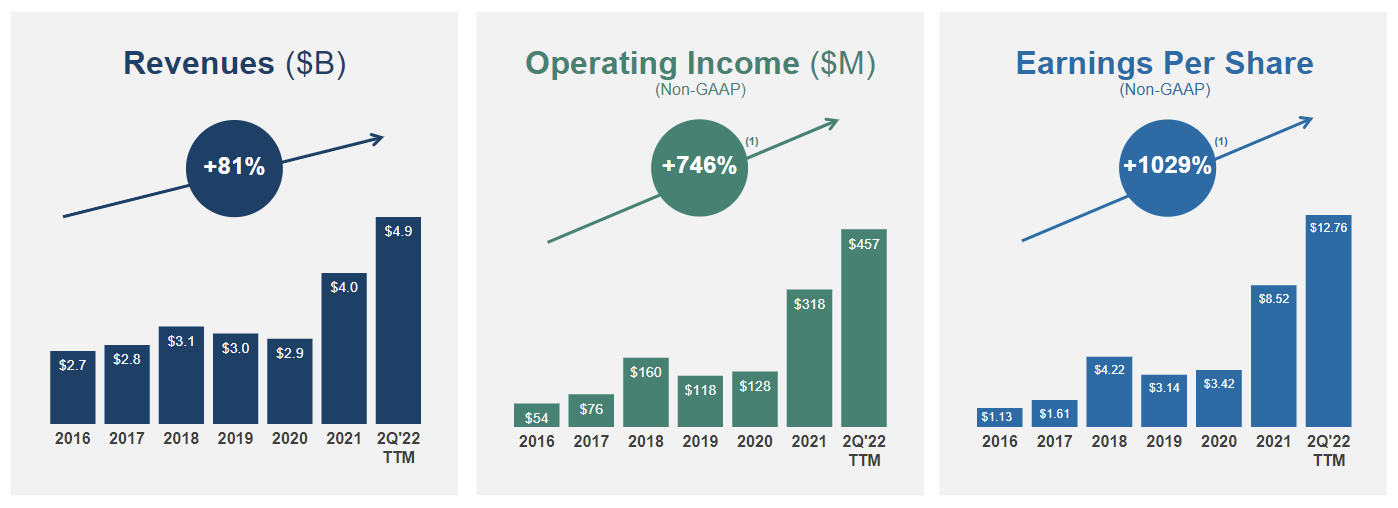

Both segments have seen strong growth in revenue and operating income over the past few years. Management is building on the asset-light business which made up ~40% of 2021 sales and 45% of 2Q22 sales compared to ~30% in 2016. This segment carries lower margins but requires much less capital to grow.

Increased prices helped fuel the margin performance. Asset-based prices are up >30% since early 2019.

From a capital allocation standpoint, ArcBest has had the benefit of increasing operating cash flow with mostly stable capex. A recent acquisition to expand in asset-light services was the first acquisition in years. Steady debt paydown has kept the balance sheet in good shape. And buybacks are starting to ramp with the added discretionary cash flow.

ArcBest is trading at ~4x EBITDA with less than 1x leverage. It’s a situation where the stock price has moved higher along with the outlook for increased EBITDA, yet the multiple of those fundamentals is unchanged or arguably lower.

A lot could happen to hamper both freight volume and pricing given the current state of the economy but this company has done well to improve fundamentals of late…