Quick Value 8.9.21 ($CAH)

Cardinal Health -- Drug distributor trading below 10x earnings

A friendly reminder to subscribe to the free weekly newsletter (Quick Value) and to check out the premium subscription covering mostly small and micro cap stocks with ongoing coverage of my core holdings…

Market Performance

Smaller stocks have been slowing lately compared to larger stocks… Looking at Russell 2000 (small caps) compared to Russell 1000 (large caps) shows that smaller stocks were rocking through ~March 2021 but have since been fading…

Market Stats

Banking… Lots of small businesses that received PPP funds from the CARES Act used the extra boost to cash flow to repay lines of credit or other borrowings and are now sitting on huge amounts of borrowing capacity… Dry powder in the banking system

Consumers are going out more… Roku noted in their Q2 earnings release: “Streaming hours were 17.4 billion hours, a decrease of 1.0 billion hours from Q1 2021”

943,000 jobs were added in July… and the unemployment rate fell to 5.4%. The labor force is still 3m+ persons below pre-pandemic levels and employed persons is 5.7m people lower than February 2020… still a long way to go…

Quick Value

Cardinal Health ($CAH)

Cardinal is a distributor of drugs and medical devices mainly to retail pharmacies. It’s an oligopoly industry where Cardinal (the 3rd largest player) and competitors AmerisourceBergen ($ABC) and McKesson ($MCK) share something like 90% of the industry.

You can see from the chart that Cardinal has been a massive underperformer of the overall market for a very long time — in fact, all of the Big 3 distributors have underperformed over the past 1, 3, 5, and 10 year periods!

More recently, Cardinal shares have fallen ~15% following Q2 earnings… This caught my eye to take a quick peek…

Starting with the negatives (which apply to competitors as well):

Customers have been consolidating and gaining buying power — CVS and Walgreens have each doubled revenue from 2013-2020 and exert much more pressure on distributors

Opioid liabilities — distributors are working through a $26bn settlement for opioid-crisis mis-dealings — the current settlement proposal is for the 3 competitors to pay $21bn over 18 years

Political landscape — there have been talks of a drug-pricing overhaul for years and that conversation is still ongoing…

Plenty of external forces at play here!

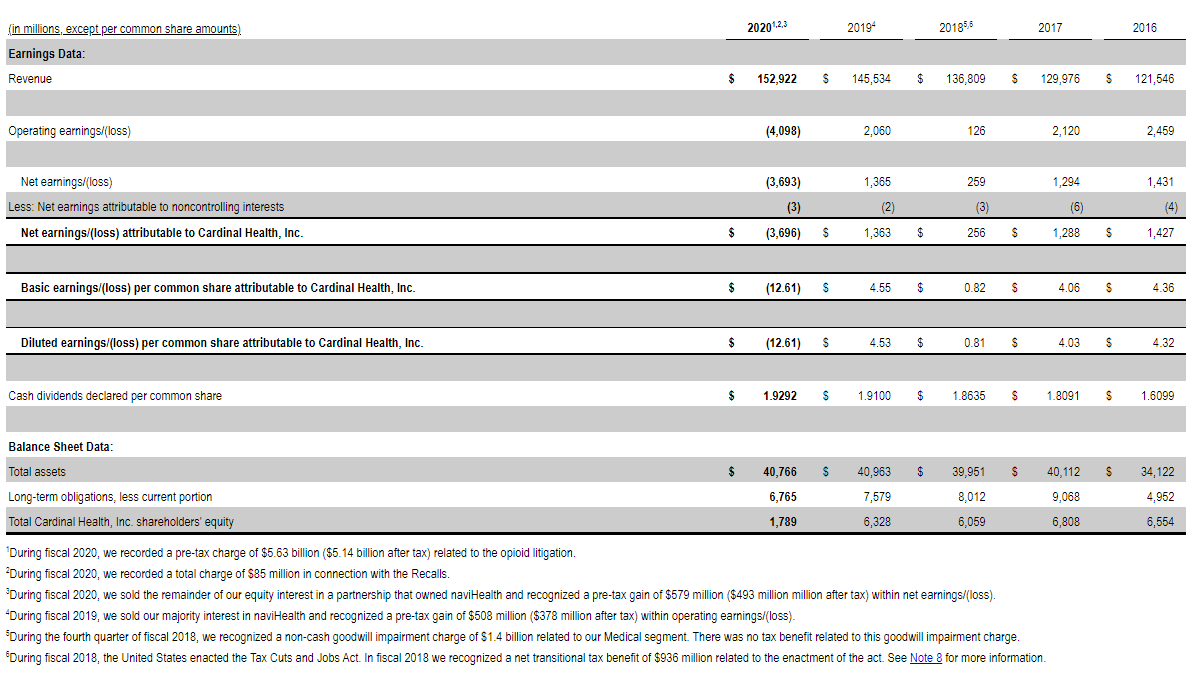

In August 2021, Cardinal announced fiscal Q4 results… In Q4, revenue grew but earnings declined by 26% and they took a big reserve on PPE inventory. Full year earnings grew only 2% to $5.57 per share and the outlook for FY22 called for modest earnings growth to $5.60-5.90 per share — a pretty weak earnings announcement but not disastrous.

Revenue has grown from $121bn in 2016 to $162bn in 2021 — a 6% annual rate. Where the business has stalled however, is earnings growth — from $5.24 in 2016 to $5.57 in 2021 (and $5.60-5.90 in FY22) — a ~1-2% annual growth rate. AND they lowered the share count from ~327m to 290m during that ‘16-21 period!

So Cardinal has grown its top-line but done little with earnings and margins even while buying back plenty of shares…

Typically, that sort of performance leads to a lower valuation over time as expectations drift lower…

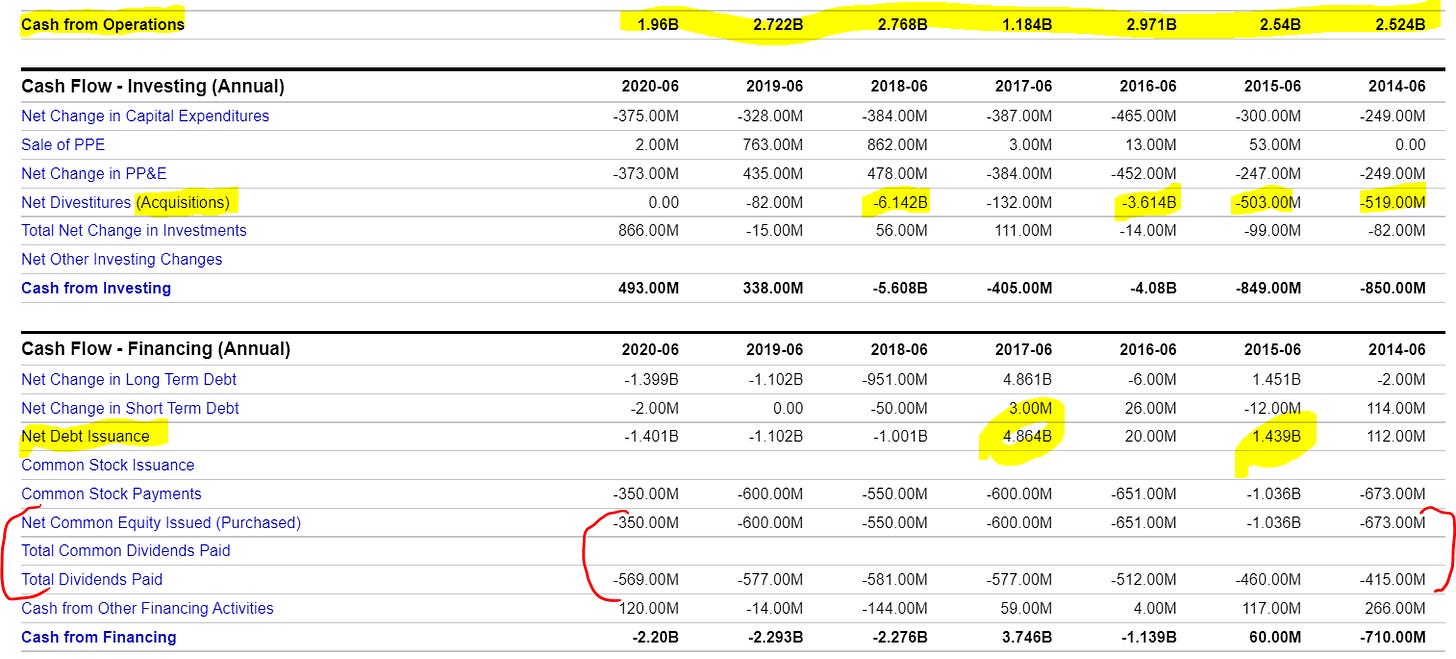

How has the company been using cash flow?

Taking a look at a long-term cash flow chart helps to get the best picture of what a company is actually doing. (Note: FY21 not shown here but figures included in comments below.)

$19.1bn cash generated from 2014-2021

Spent well over $10bn on acquisitions which means they were a net borrower during this period

Last few years were used to repay debt to the tune of ~$4.1bn

Big capital returns — total of $9bn in dividends and buybacks from 2014-2021 (vs. current market cap of ~$15bn

More of the same expected in FY22 — $850m in debt paydown and $500m to $1bn share repurchases

At $51/share, Cardinal is trading at 8.9x the mid-point ($5.75) of FY22 earnings guidance. Quite inexpensive relative to the market and other healthcare companies. Also the cheapest of the drug distributors…

If this company could get a handle on growing earnings and expanding margins (beyond just repurchasing stock), then this stock could have some major upside over time. There are external risks but some of these are starting to become clearer (opioid settlement and renegotiation with large customers).

Turning the corner on margin expansion and earnings growth generally leads to multiple expansion… Worth a closer look as to what it would take to get there.