Quick Value 9.12.22 ($ODFL)

ODFL - Premium LTL player at a premium valuation

Starting next week, Quick Value is moving partially into the premium posts… weekly ideas are a lot of work and I tend to hold back on some of the ideas that are more actionable. Those ones will be favored in the premium newsletter while other Quick Value ideas will be published for free 2x per month.

This means:

2x Quick Value per month FREE — tend to be larger caps

2-3x Quick Value per month PREMIUM — tend to be smaller caps / special situations

Here’s a promo to try it out:

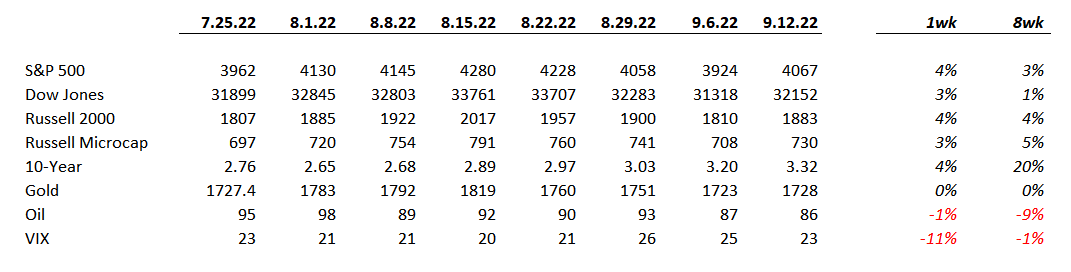

Market Performance

Market Stats

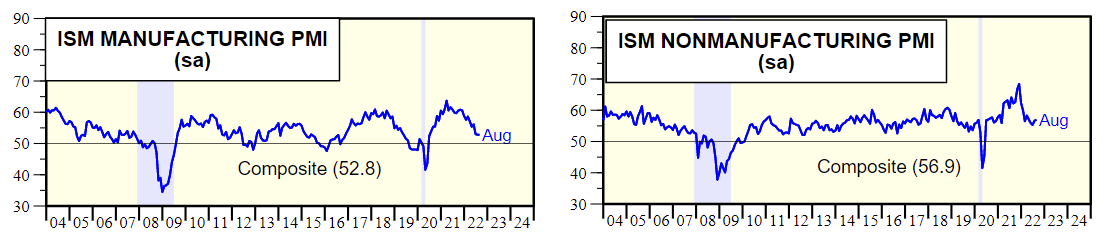

Purchasing indices for both manufacturing and services are still in expansion mode… Services has been rebounding slightly and manufacturing is declining…

Quick Value

Old Dominion Freight Lines ($ODFL)

Back on the freight theme!

What they do…

ODFL is another less-than-truckload (LTL) freight company. They pool together lots of small/medium sized packages (think palletized) and make route-based deliveries over short-haul distances of less than 1000 miles. They operate a fleet of 10k+ tractors and 42k+ trailers.

We’ve already covered some other competitors like ArcBest and XPO Logistics. They also compete with FedEx, UPS, Yellow Corp, and SAIA.

What’s happening here…

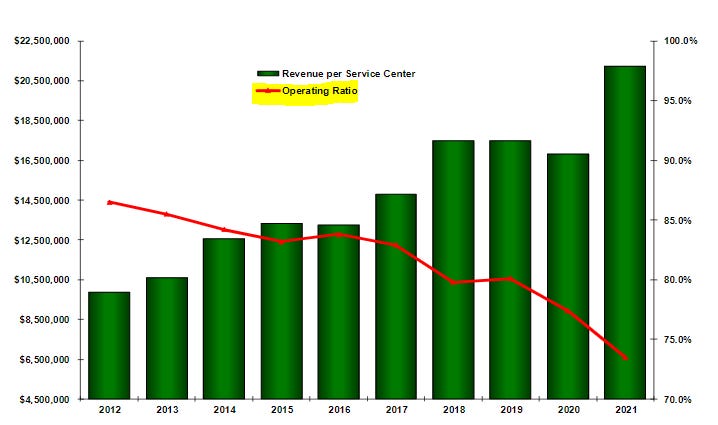

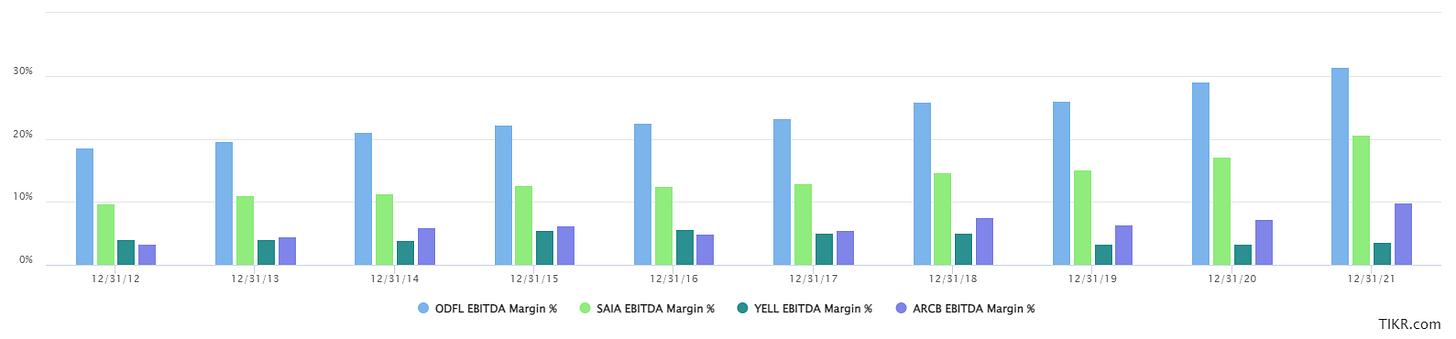

ODFL has gotten a reputation as a very high quality business over the past decade. Operating ratio (inverse of operating margin) has improved from 85% to <75% (this is good).

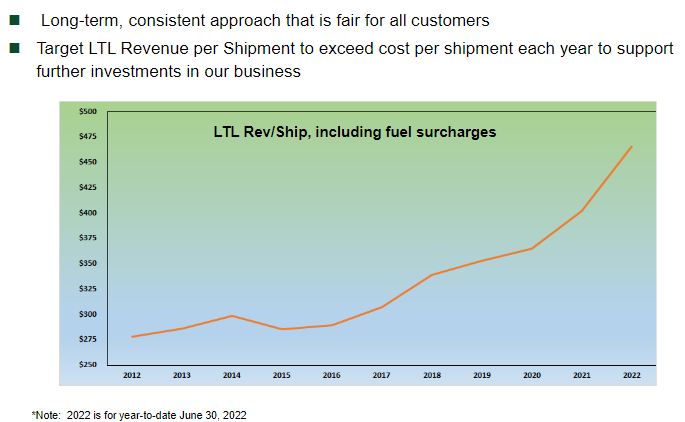

Revenue per shipment has been expanding (exponentially since the pandemic):

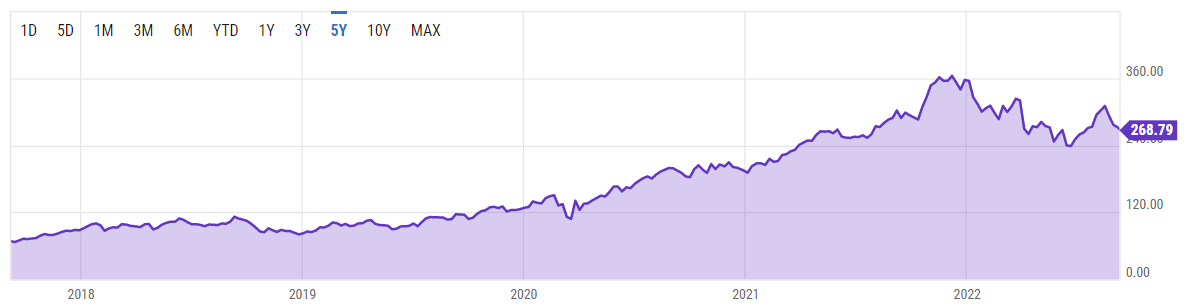

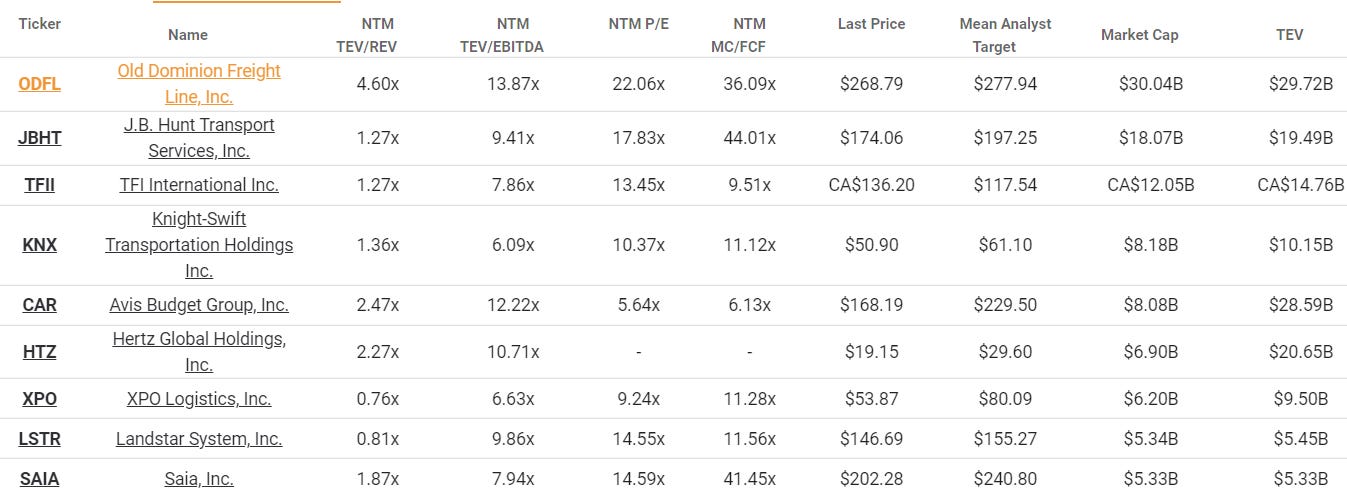

Valuation metrics are expanding too… Pre-pandemic, ODFL was trading at an average ~9x EBITDA which then became an average of ~18x EBITDA since March 2020. EBITDA grew from $500m to $1bn during 2012-2020 and then jumped from $1bn to $2bn during 2020-2022.

Competitors are trading at way lower multiples…

…But ODFL has best-in-class EBITDA margins and by a mile

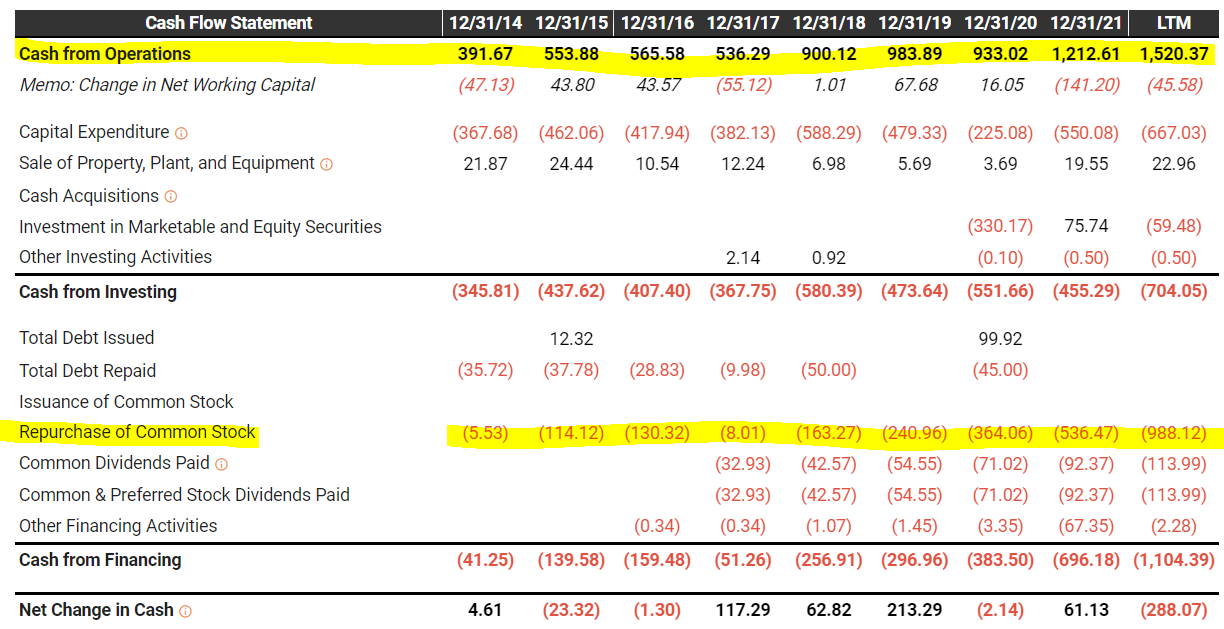

Capital allocation has been vastly in favor stock buybacks… Share count is down ~14% since 2014. They haven’t spent a single dollar on an acquisition since 2008! Dividends have grown almost 3.5x since initiated in 2017 but still represents a pretty meaningless 0.5% dividend yield.

There are 112m shares outstanding x $268 share price = $30bn market cap. Net cash is >$300m. Estimates call for $2.1bn in 2023 EBITDA and $1bn in FCF so the stock is currently trading at 14.3x EBITDA and 30x FCF.

To answer the question of “where they go from here” — you’d need a crystal ball into the future for freight pricing.

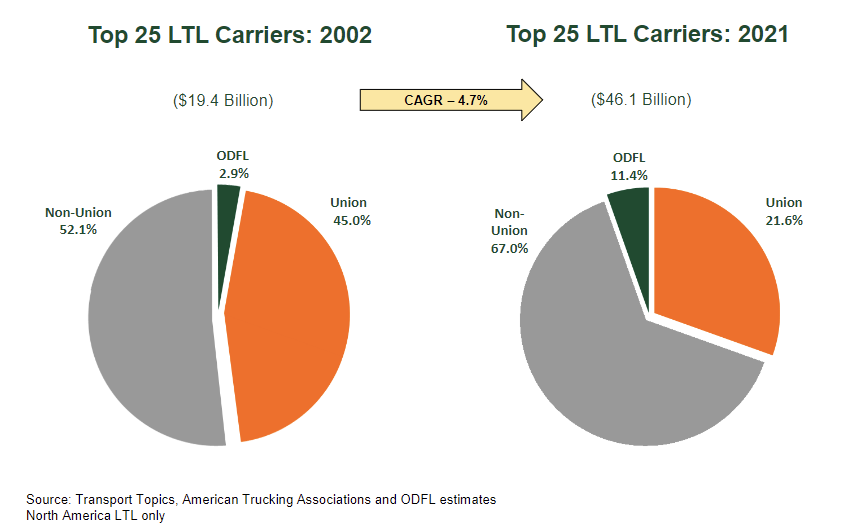

One could make the argument that LTL is a large and growing market with plenty of room to run long-term and ODFL is best-in-class; OR, you could argue that the valuation premium has gotten out of hand especially with the risk of falling industry pricing.

Either way, the accomplishments are admirable and ODFL will likely continue to take share.