Quick Value 9.13.21 ($WLTW)

Willis Towers Watson looks interesting following Aon deal termination

Market Performance

Market Stats

Natural gas prices have rocketed to highs not seen in years, reaching $5/mmbtu… Stockpiles are at lows heading into winter which could lead to further gains in the commodity…

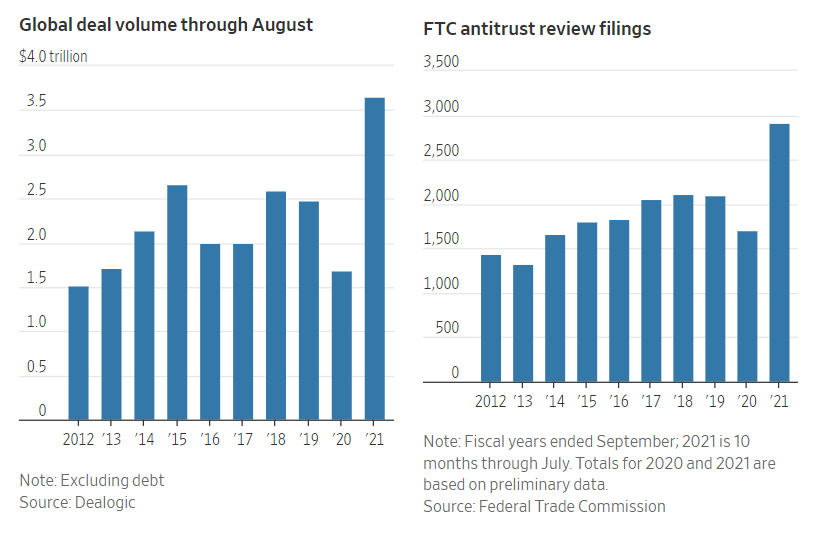

Global M&A volume is up a ton this year (on pace to surpass 2015 record levels) as companies look to reshape their businesses following the pandemic. Interestingly, this commentary is around larger public deals… there was an article a while back about business unused credit line availability reaching ~$1tn in total.

S&P 500 stocks are off their highs to the tune of 53%… as in, 53% of S&P 500 constituents are more than 10% off their all-time high and 31% are more than 20% off their all-time high…

Quick Value

Willis Towers Watson ($WLTW)

Willis is an insurance broker, benefits management, and retirement services provider. Here’s a breakdown of their business:

They were set to merge with Aon but that deal was canceled in July from antitrust issues. The deal break-up led me to take a closer look… Conveniently, they held a recent investor day to highlight the business in a world without the Aon combination…

Willis is the #3 player in the insurance broking industry and the combination with #2 Aon would have jumped them into the #1 spot over Marsh & McLennan. This is also the cheapest stock in the industry by a fairly wide margin.

With the breakup behind them, investors want to know what’s next for the company. They’ll receive a $1bn breakup fee from Aon and already have a fairly strong balance sheet so the focus is turning to buybacks. With that breakup fee, proceeds from a $3.25bn asset sale, and ongoing FCF generation, Willis plans to buyback some $7-9bn in stock over the next 3-4 years (25-30% of current market cap).

With buybacks as the driving force tacked onto some organic revenue growth. Management is targeting $18-21/share in earnings by FY2024 vs. $11.70 earned in 2020.

At last close, Willis trades at $236/share… Off its highs but up from the announcement of the Aon termination. Analyst estimates call for $13.60 in 2021 EPS for a 17.4x earnings multiple. A similar multiple on targeted 2024 earnings would offer some good upside from here… an industry multiple would be even better…