Quick Value 9.20.21 ($MFIN)

Medallion Financial - Consumer specialty finance at <0.9x book and 6x earnings

Don’t forget to subscribe to the premium newsletter…

Market Performance

Market Stats

Inflation jumped 5.3% YoY and core inflation (ex energy and food) jumped 4% YoY… That’s now 6 consecutive months above the Fed’s 2% targeted inflation rate (though they base their target from a variant measure).

Retail sales had another robust month with mid-teens growth YoY… Retail sales growth went negative for a 3-month period from March-May 2020 but has grown rapidly since…

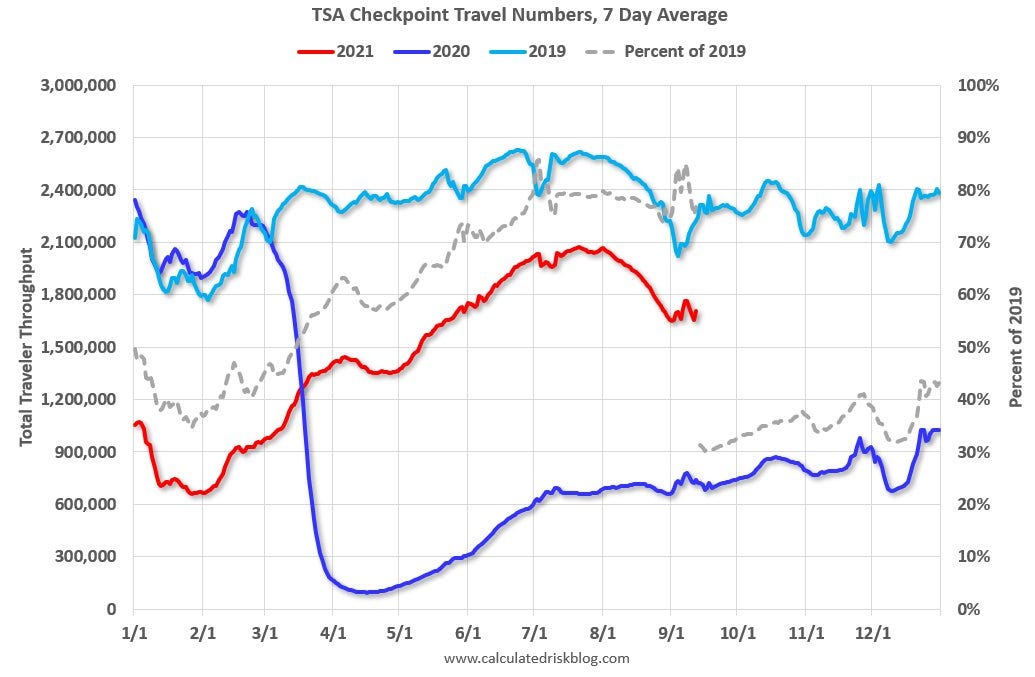

TSA travel levels have retreated a bit but are still in the range of 70-80% of 2019 level (courtesy of Calculated Risk blog)

Movie theater attendance has been steadily climbing in 2021 — red line below (again, thanks to Calculated Risk)

Quick Value

Medallion Financial ($MFIN)

This is a smaller stock than I typically cover here but it’s been on my list to review. I was surprised to see such little coverage on the name (and even a complete lack of discussion on Twitter) that I felt compelled to write about it…

Medallion has a long and complicated history. The stock has been a big underperformer for the last 10 years but it’s recovered significantly from 2017-2018 lows and then again off the pandemic lows of 2020….

Medallion is a specialty finance company with a few divisions. In a past life, they were a big lender for Taxi Medallions, mainly in NYC. Taxicab drivers often borrowed to finance the medallion and prices reached a speculative peak in 2013-2014… prices have since fallen some 80-90% making a loan portfolio consisting of taxicab medallions a pretty terrible place to be.

Today, MFIN consists of 3 parts:

Medallion Bank — Consumer lending for RVs, home improvements, boats, trailers, etc. (call it “recreational” lending)

Medallion Capital — Mezzanine loans to small and mid-size businesses (typically $2-5m loan size).

Medallion Funding — The legacy taxicab medallion portfolio.

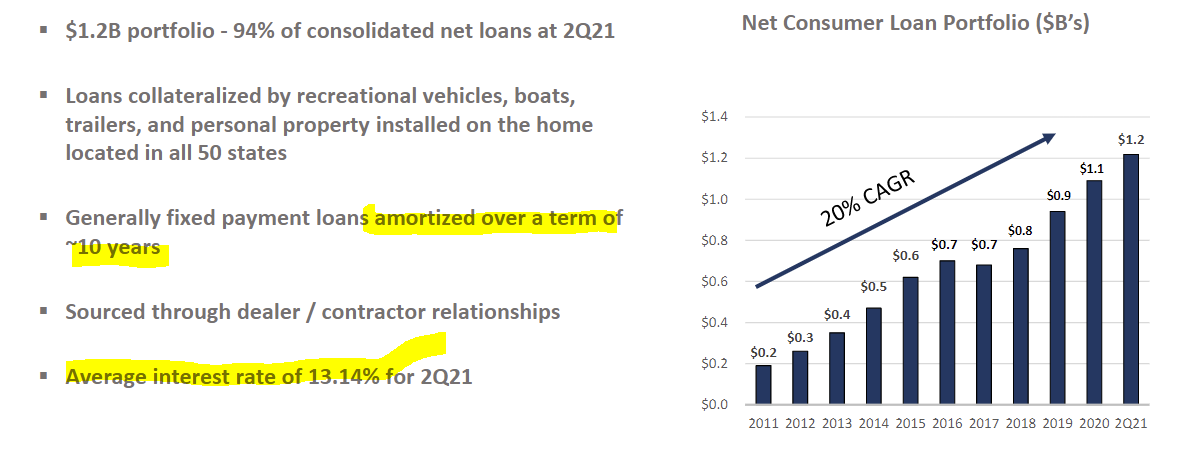

And here’s the loan book at 6/30/21 — the Medallion Bank segment makes up ~94% of gross loans outstanding.

Medallion Bank is now the focal point of this business, consumer loans on RVs and such. These are generally very high-interest loans (13-14%), with terms of 10-years on average, FICO scores in the high 600s to mid-700s, and a typical loan balance of ~$16,000. Pretty phenomenal growth in the past decade.

Surprisingly, charge-offs have been fairly low around +/- 2% with an exception during the 2008-2010 period which saw 4-6% charge-offs annually (nearly 17% in total).

The consumer lending side of the business is certainly a profitable one. To the tune of $30m in 2019, $40m in 2020, and close to $60m over the past 12 months. Whereas the business as a whole generated a profit of $2m in 2019, a net loss of $26m in 2020, and a profit of $20m through 6 months of 2021.

First glance would make you think it’s a volatile business with sketchy fundamentals... Back to the taxicab medallion loans… This portfolio generated losses of $23m in 2019, $58m in 2020, and a measly $3.5m through 6 months of 2021 — Outside the continued growth in the consumer segment, these headwinds fading are a big contributing factor to the turnaround in performance so far in 2021. These loans went from $155m (net of reserves) outstanding as of 12/31/18 to $5.7m at 6/30/21; almost a negligible headwind at this point.

With those headwinds fading, the business is starting to hit stride… From Q2 results release — solid loan growth, improved profitability, normal levels of charge-offs, etc.

Back to the stock and the investment setup…

There are 25m shares outstanding and an $8.40 share price makes it a $210m market cap. Book value at 2Q21 was $250m or $10 per share = ~0.85x price/book. GAAP earnings through 6 months are $0.73/share so close to $1.50 annualized… That’d make it less than 6x earnings at today’s price. Even looking at 2019 and 2020 performance, if we were to erase the losses from the medallion portfolio, we’d have earnings of $26m and $31m, respectively.

It seems like an interesting value. I’m not in love with the high-yield loan portfolio and the past mistakes in the medallion business. On top of that, it doesn’t take much to blow through $250m in equity with this business, on $1.3bn in net loans that’s a 19% equity cushion; from 2008-2010, the consumer business alone experienced nearly 17% in cumulative charge-offs. It only takes one bad stretch of loan losses to severely harm a lender…