Quick Value 9.27.21 ($PRAA)

PRA Group - Another specialty finance company at 10x earnings and 1.3x book value

Market Performance

Market Stats

Housing starts were 1.615m units (seasonally adjusted) at August 2021… +17% YoY from August 2020 and +4% MoM from July

Lumber prices have had a strange trip starting 2020 at ~$400, running up to ~$1700 in early 2021, and since leveling off to ~$600

Sales of existing homes saw a big spike in activity since the start of the pandemic… Interestingly, the 2020-2021 peak in existing home sales very briefly touched 90-95% of 2004-2006 peak levels… activity is high

Housing inventory is coming off lows from early 2021 with around 2.5 months of supply on hand — turnover is high

Quick Value

PRA Group ($PRAA)

PRA Group (formerly known as Portfolio Recovery Associates) is in the business of buying nonperforming loans from banks/lenders and then attempting to collect on those loans. Obviously they buy these nonperforming loans at a pretty hefty discount to face value for their non-payment status. The goal is to recover 2-3x their purchase price.

Competitor Encore Capital has a good slide explaining the business…

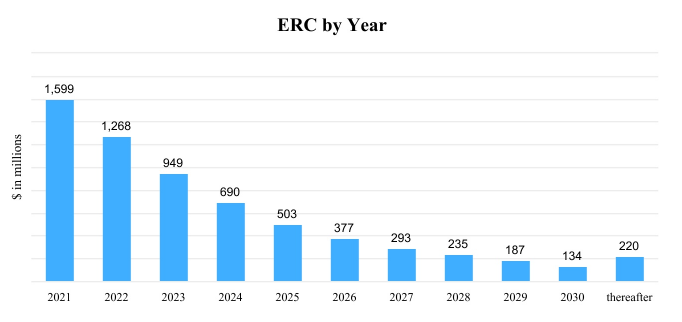

PRA has about $6bn in Estimated Remaining Collections (ERC) in its portfolio (vs. current market cap of $1.9bn). As you’d imagine, there’s a decline curve as receivables are collected and the balance draws down.

In order to replenish these balances, PRA is constantly buying new portfolios of delinquent loans. In 2016 they spent $890m, in 2019 it was $1.2bn and another $900m in 2020. This creates a problem to generate cash above-and-beyond what’s required to replenish and grow the receivable portfolio…

Until recently, it seems the company hasn’t generated much free cash flow (including net receivable purchases) over the past few years. This means they haven’t been able to direct much of anything toward share buybacks or dividends.

Lately, management is trying to turn that corner by announcing a $150m share repurchase plan (just shy of 10% of the market cap).

Looking at the valuation of PRA and their main competitor Encore — book value has been growing and price-to-book ratios have been falling (a fairly attractive setup).

Earnings were $1.89 per share in 2019, $3.26 in 2020, and $4.06 over the last 12 months. With the stock at $41/share, that’s right around 10x earnings (on unadjusted GAAP figures).

Like other specialty finance companies there are plenty of moving parts and unfortunately this one doesn’t come at a big discount to book value. Though it does seem cheap on earnings and relative to its historic valuation. On top of that, it seems like a business unaffected by supply chain and other macro issues right now (perhaps the labor shortage is hurting them?). And with the huge spikes in retail sales / consumer spending over the past 18 months, there is sure to be plenty of receivable portfolios available for years to come as those loans season…

Don’t forget to subscribe if you haven’t already signed up!