Quick Value 9.6.22 ($ELAN)

Elanco Animal Health - 14x earnings, shares down 46% YTD

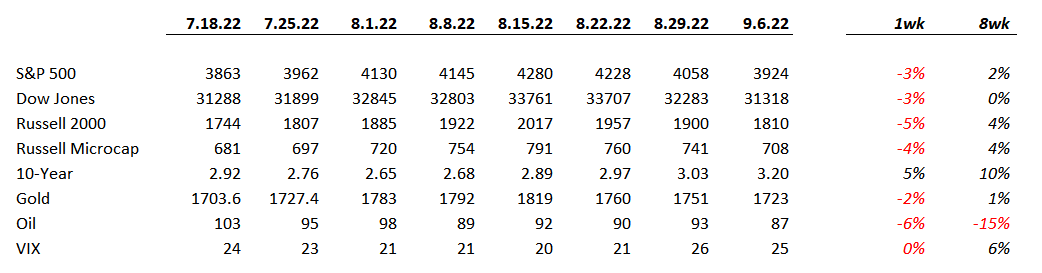

Market Performance

Market Stats

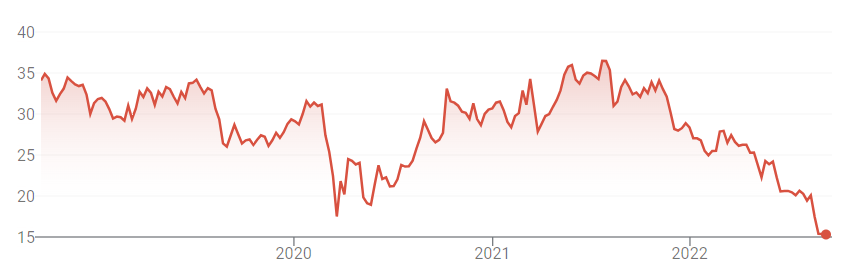

The “S&P 490” is an interesting way to break down the top 10 S&P 500 stocks vs. the remaining 490… under this view, it looks like the 490 bucket never traded to “unreasonable” valuations over the past few years…

Quick Value

Elanco Animal Health ($ELAN)

How this made it onto the list…

Elanco is a name I’m familiar with from a distance, it was a 2018 IPO/spin-off from Eli Lilly which was too expensive for my taste at the time of spin. Recently, it popped on my radar from a screen of larger cap stocks down big this year. Shares are down ~46% YTD and close to 60% off of highs. For a perceived “quality” business, that’s a big move.

What they do…

Elanco is a pharmaceutical company operating in the animal health industry. They develop and make products for pets and farm animals. These products do everything from treating for fleas and ticks, to vaccinations, to heartworm medicine.

Zoetis is the market leader with $7.8bn sales in 2021 and Elanco is #2 with ~$4.8bn. The industry is large and growing as the overall pet population continues to climb and pet owners are spending more to care for their pets.

Why it’s interesting…

From the 2020 investor day, Elanco laid out a case for the attractive industry dynamics and financial profile for the company — 3-4% revenue growth and 10%+ EBITDA and earnings growth while paying down debt.

Aside from the rapid price decline, valuation is the most compelling reason to dig in. Competitor Zoetis ($ZTS) hasn’t traded below 20x earnings in the past 5 years and Elanco was looking to follow suit. Both stocks are down significantly YTD but Elanco’s valuation gap has widened a ton since January 2021 when they traded at the same multiple.

Coming out of the spin-off, Elanco made a large acquisition of Bayer’s animal health business for $5.2bn in cash and issuing 73m shares to Bayer. They were already carrying a decent amount of debt going into the acquisition and the result was a heavily leveraged company that would need to pay down debt for a few years.

The acquisition isn’t panning out the way they thought it would and leverage is catching up to them:

In 2Q22 they lowered guidance and pushed out the timeline to achieve EBITDA margin and leverage targets (into 2023-2024).

There are 474m shares outstanding and a $15.50 share price = $7.4bn market cap. Net debt is $5.6bn for a $13bn enterprise value. FY2022 guidance calls for $4.5bn in sales, $1.1bn EBITDA, and $1.10 EPS.

That indicates sales will decline 5.5% in 2022. The stock trades at 11.8x EBITDA and 14.1x earnings compared to a long run average of >27x.

If the headwinds are truly temporary and the company can get sales and margins back on track, then the stock could be a good value compared to Zoetis and to Elanco’s own historic multiples…

Just time will tell. Thank you Value.