(Mistakenly sent to paid subscribers only; now shared with all subs.) Welcome back from a much-needed holiday weekend! Sign up for the weekly newsletter or consider the premium subscription:

Market Performance

Market Stats

Jobs gained 235k in August vs. 750k forecasted — big miss… Average hourly earnings grew 4.3% YoY… Unemployment fell to 5.2%

Purchasing Managers Index (PMI) for both manufacturing and services came in better than expected for the month of August and still signal growth (a reading over 50 signifies expansion)

Bonus unemployment benefits from COVID stimulus comes to an end as of Labor Day… In total, the US spent $680bn on additional unemployment benefits since March 2020 (compare with $835bn spent on PPP loans).

Quick Value

Liberty Global ($LBTYA)

Today’s post will be a bit different… I’ve written about Liberty (about 18 months ago) but much has changed recently that sparked my interest to dig in again. Consider this my initial set of research notes in revisiting the stock…

Liberty Global is a cable / broadband / mobile operator with a presence in a slew of European countries. They’ve made a ton of interesting (and confusing) moves lately and perhaps there’s some value to be found here…

Segment review…

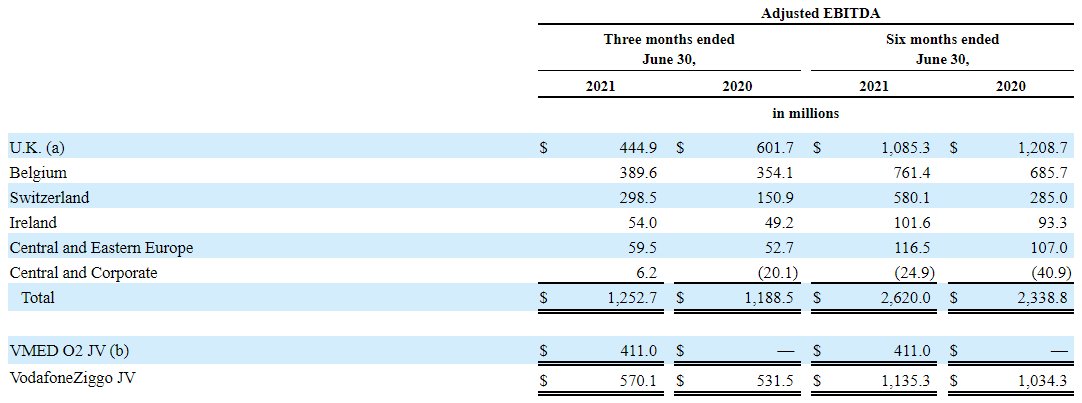

Segment results are broken out by country / region with a mix of consolidated and non-consolidated pieces:

Let’s walk through the segments…

UK — Starting June 1, 2021, the UK business has been dropped into a JV with Telefonica’s O2 mobile business — Liberty will own 50% and record this as an equity method investment

Belgium — The Belgium segment is a 60.7% ownership in publicly traded Telenet — results are consolidated on Liberty financials given the >50% ownership

Switzerland — This one is wholly owned (100% ownership)

Ireland — Wholly owned (100% ownership)

CEE — Poland and Slovakia divisions are about to get broken up as management signaled they are working on selling the Poland business for $1.9bn

What assets does Liberty Global own…

Following the JV contribution of the UK assets, Liberty technically only owns/controls their business in Switzerland, Ireland, Poland, and Slovakia. Remember the Poland business is on the block for $1.9bn / 9.3x EBITDA.

They just acquired Sunrise Communications for $5.4bn which substantially adds to the Swiss business.

Literally everything else is either an equity method investment, fair value investment (i.e. publicly traded minority investments like Lions Gate), or consolidated without control (i.e. Telenet).

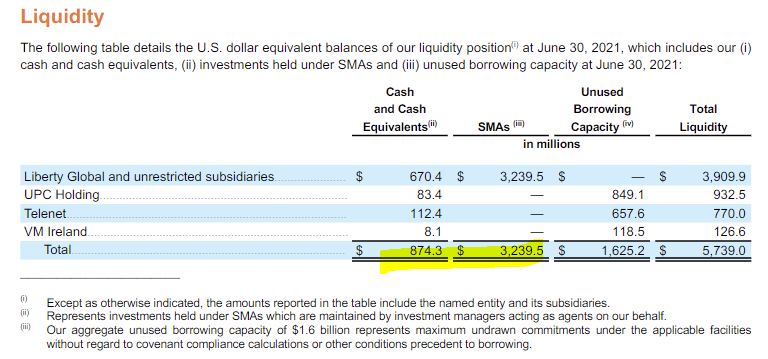

Cash and investments are $4.1bn consolidated at 6/30/21. Back out ~$100m from consolidated Telenet and Liberty Global has about $4bn on hand.

On the liability side of the balance sheet…

Liberty has just shy of $15bn in debt outstanding (no major maturities until 2026 or beyond). The debt can be further grouped into: Switzerland/Poland/Slovakia (UPC), Ireland, Telenet, and corporate/other.

UPC totals ~$7.3bn at 2Q21, Telenet is $5.25bn, Ireland at $1.06bn, and corporate/other at $1.2bn. Again as a reminder, Telenet is consolidated for accounting purposes but Liberty owns only 60.7% of outstanding shares; it is a separate public company.

How on earth do you value this thing?

Liberty Global is likely to trade at a discount given the messy investment-vehicle nature of the business. It’s not really a single operating business which means investors need to do some extra math to price this thing. Not unusual for Liberty entities but generally leads to an NAV discount.

Fortunately, we have some comps to work with — Telenet is publicly traded at ~6.5x EBITDA, Liberty just acquired Sunrise Communications at 10x EBITDA, and they’re slated to sell UPC Poland for 9.3x EBITDA.

Couple of key assumptions for the wholly owned businesses:

For the Swiss division, I’m taking 2020 results (~$690m EBITDA) and tacking on the last guidance provided by Sunrise for FY20 (CHF690m = $760m) — combined, I get $1.4-1.5bn EBITDA from the Swiss segment

I’m treating Ireland and corporate expenses as a wash — through 6 months, Ireland generated ~$100m in EBITDA and corporate lost $25m so maybe this is overly punitive

I’m assuming Poland is sold for the $1.9bn in cash with minimal cash taxes / leakage

That leaves just the $1.4-1.5bn EBITDA from Swiss for wholly owned segments (as Ireland/Slovakia wash out with corporate). At 7-10x EBITDA = $10-15bn valuation for 100% owned businesses.

Telenet is publicly traded with a $4.35bn (USD) market cap and Liberty owns 60.7% = $2.64bn valuation for Telenet.

Corporate balance sheet consists of $9.55bn gross debt, $1.9bn proceeds from the Poland sale (potentially), and $4bn in cash / investments — these figures exclude the consolidated Telenet balances. This equals $3.65bn net debt.

That leaves the rest of the fair value minority investments and equity method investments… These were valued at $23bn as of 2Q21. The short-term investments included in net debt are in this ($3bn) so we have $20bn net investments at 6/30 if taken at face value.

All of these pieces together (Operating businesses, Telenet, net debt, investments) = $31.5bn or $56.60 per share — this is way higher than the current $29 share price.

I wish it were this simple in calling out the upside at Liberty Global… The truth is that the situation is messy, I’m sure I’ve missed at least one component to the valuation picture. Another key ingredient is the leverage at each operating business and invested businesses — these things are running at 4-5x+ debt/EBITDA and management is comfortable leaving them there. The cash flows may be stable enough to support high debt levels but optically in a downturn, this should get punished (and it has in those scenarios). Another key consideration is the actual cash flow coming into Liberty Global… Liberty only receives cash from non-wholly-owned investments like Telenet, UK JV, and the Netherlands JV when they make a distribution/dividend to shareholders. If none of the investments were paying out, Liberty would be collecting cash flow from wholly-owned businesses like Switzerland and Ireland while paying corporate costs.

Management has also publicly committed to repurchasing 10% of the market cap annually over the next 3 years.

Normally, this could be seen as a pretty strong endorsement for your stock but they’ve already been doing this for the past 5 years without successfully influencing the share price:

There are 556m shares outstanding and a $29 share price makes it a ~$16bn market cap. A 10% repurchase would be ~$1.6bn per year over 3 years at the current rate. With the Poland sale they’d have enough cash / capital on hand today to make that happen.

I find this situation incredibly interesting given the dramatic change in asset base over the past few years. I’m not sure it’s any less complicated an investment today given it’s more a holding company / investment vehicle rather than an operating business. This one is still in the research phase for me.