The best ideas hit you in 30 minutes or less

An investment idea in a few simple charts...

I tweeted that my favorite investments are the ones that take only 30 minutes of review to realize it’s a good one.

Here’s that idea in a (very brief) nutshell…

(For those that use or bookmarked my digital stock database, this write-up can be found there.)

Hamilton Beach Brands…

Don’t knock it ‘til you hear it. Yes this is a cyclical and consumer-driven business facing many of the same retail + inventory headwinds plagued by so many others. Hear me out first…

This looks like a pretty easy short-term bet at today’s price around $11/share. Here’s the pitch in just a few simple charts.

FIRST — shares have massively underperformed the overall market since the 2017 spin-off and though I’m not a big technical person, the stock has found a floor and isn’t a falling knife with shares stable between $10-12. Expectations are low and the stock is sufficiently beaten to a pulp.

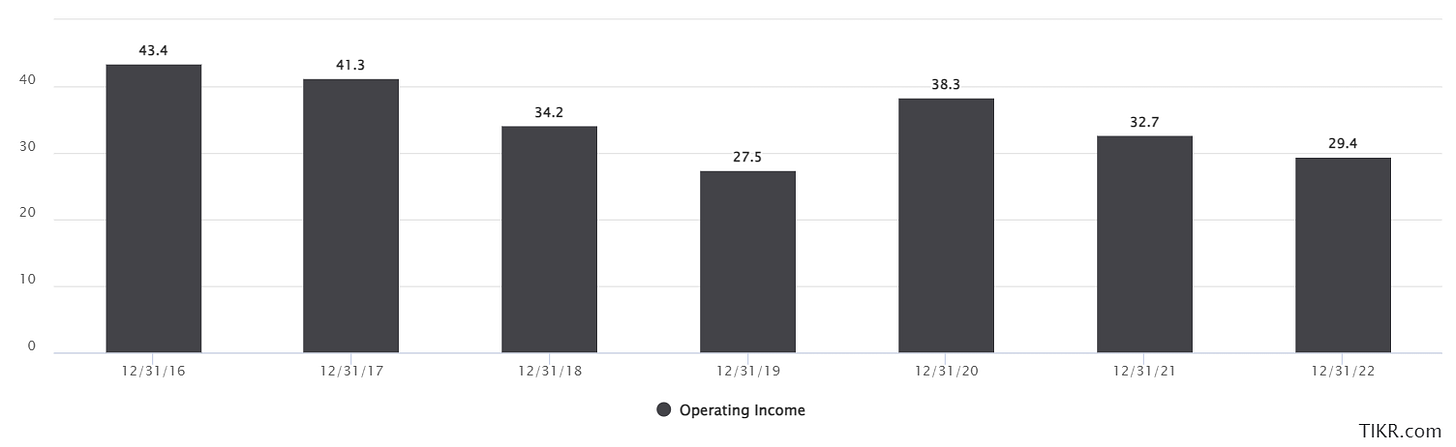

SECOND — EBIT has been relatively stable from $27m in 2019 (pre-COVID) to $29m in 2022. As of August 2023 (2Q23), trailing 12-month EBIT dipped to $17m as they burn through bloated high cost inventory. In fact, 2Q23 EBIT was down 87% YoY from $5.4m to $0.7m!

2023 guidance is calling for EBIT to increase from 2022 levels despite the weakness in Q1/Q2 of 2023… that means we’re looking at $30m or better in full year 2023 EBIT.

THIRD — Valuation… there are 14.1m shares outstanding x $11/share = $155m market cap. Net debt is $58m at 2Q23 for an EV of $215m (rounded up a bit). Trailing EBIT is $17m so that’s a 12.6x EV/EBIT multiple but by yearend HBB should be back to $30m in EBIT. Since the spin-off, the stock has averaged a 9.5x EBIT multiple. At that multiple on $30m, shares would be worth $16 for 45% upside. And that assumes no additional cash generation from working capital improvement.

LAST — Insiders are starting to buy… in August 2023, the CEO and CFO bought ~$140k worth of shares around $11. Shares are basically unchanged since mid-2022 and don’t look like a falling knife.

This is a plain vanilla company and the thesis isn’t complicated… I think shares will recover as earnings recover in Q3 and Q4. Maybe we’ll get a little bonus as the balance sheet improves from further working capital reduction.