Why I'm Not Buying Crocs ($CROX)

Crocs (CROX) is in my On Deck list and I’ve written about it before but even after a good pitch from the Yet Another Value Blog podcast, I still can’t bring myself to buy it…

There are 2 key factors that will drive the stock from here (in my opinion). And these are the main reasons I'm not buying...

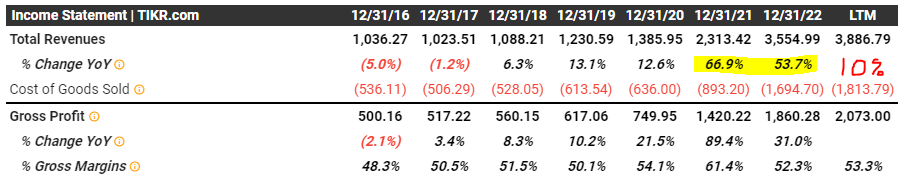

1) Revenue growth sustainability

Sales jumped 67% and 54% in 2021 and 2022. So far in 2023 they're still growing. But most retailers are struggling this year (that's not totally true, there are still some that are doing well like ANF). It's still pretty early to say they are out of the woods and will continue to grow from that 2021-2022 base. And yes, the Hey Dude acquisition added a bunch of revenue so I'm not saying that sales could fall all the way back to 2019 levels.

But plenty of retailers (including footwear competitors) are seeing revenue declines and CROX is coming off the hottest performance over the past 2 years. Most of the arguments in favor of CROX assume (both explicitly and implicitly) they’ll continue to grow off that higher base.

2) Capital allocation should go to 100% debt paydown

This sounds crazy because if revenue does indeed continue to grow, then yes they should be buying back tons of stock. I think the more defensive move here is to chip away at the Hey Dude acquisition debt (maybe entirely) and hunker down.

CROX was fortunate to outpace much larger competitors in cash generation during COVID…

Bank it to bolster the balance sheet and be ready in case a bigger consumer slowdown comes in 2H23 or 2024. Skechers (which is very highly regarded in the footwear space) has <0.8x debt to 2019 cash flow vs. CROX at ~3.3x last year’s cash flow… there’s no margin for error in a consumer downturn (or even if footwear as an individual category slows). Maybe there’s room for a slightly balanced approach between debt and buybacks but I’d rather see them keep the pedal down on the debt.

In the long-run, it’s a well run business and they’ve navigated the past few years really well. In the short-run, acknowledge that you’re making an implicit bet on continued growth and market share gains in this category…