A Guide to Beaten Down Shares

Investment themes Pt. 1 = beaten down shares

In his book One Up On Wall Street, Peter Lynch outlined six “story types” for stocks he followed: slow growers, stalwarts, fast growers, cyclicals, asset plays, and turnarounds. Using this basic pattern recognition framework would make a decent investing process by itself.

Depending on your style and how granular you want to get, there are easily 100’s of ways to categorize investment themes. Personally, I don’t want to track and manage 100 categories, but I need more than six.

Looking back on my past 10-15 years of activity, I’ve grouped my universe of potential investments into 15 “themes” that I’ll cover over the next 15 days.

15 Investment Themes (in no particular order):

Beaten down shares

Spin-offs

Post-reorg

Management changes

Insider buys

Activism

Inflections

Jockeys & compounders

GoodCo / BadCo

Public LBO / deleveraging

Share cannibals

M&A

Plain vanilla cheap

Turnarounds

Asset plays

Here’s how this will work…

Over the next 15 days, I’ll share my notes on each category, how I evaluate it, look at some historic examples, and share a few potentially actionable ideas. When we’re done, I’ll package it up into a nice pdf / e-book for the holidays.

Because it’s December (and despite the recent rally), I’m starting with the beaten down category so we can all do some bottom feeding going into the new year.

[Note: I haven’t decided how I’ll rotate these between free & paid subs, so you’ll want to upgrade to make sure you get them all + get the compilation… it’s only $200/year]

1) Beaten Down Shares

This is one of the most fruitful categories from an idea generation perspective. Virtually any stock can become “beaten down” at some point along its lifetime. So think of this bucket as more actionable from a research standpoint than a buying standpoint.

Typically, I consider a sharp move downward or a big event-driven price decline as a “beaten down” security. They can also be slow grinding moves lower over several months or years (though these might be less attractive as they turn into falling knives). Sometimes entire industries are beaten down which create pockets of opportunity. Some investors may describe these situations as “out of favor” stocks or industries. Beaten down is a pretty vague term though; in my view, it comes in a few different flavors:

Multiyear dogs

Coiled springs

Mean reversion

Falling knives

Big decliners

52 week lows

Fallen angels

Think of these as loosely related to each other, it’s possible for a stock to have several of these elements at any given time.

Multiyear dogs — Companies that have underperformed the overall market for an extended period of time. These situations are very distinct from a “falling knife” where a share price is cratering (potentially quickly). Multiyear underperformance creates an expectation reset for both buyside and sellside estimates. Picture a perennial disappointment, missing guidance and resetting the bar, eventually these can become good investments. If a stock is -10% over a 5 year period, you may not think of it as “beaten down,” but if the market is +50% during that time; you’ll definitely consider it a dog.

Bristow Group (VTOL) — Shares are +15% over 10 years while the market is +293%. It isn’t drifting lower or a falling knife, just steadily underperforming. (This is arguably a coiled spring too.)

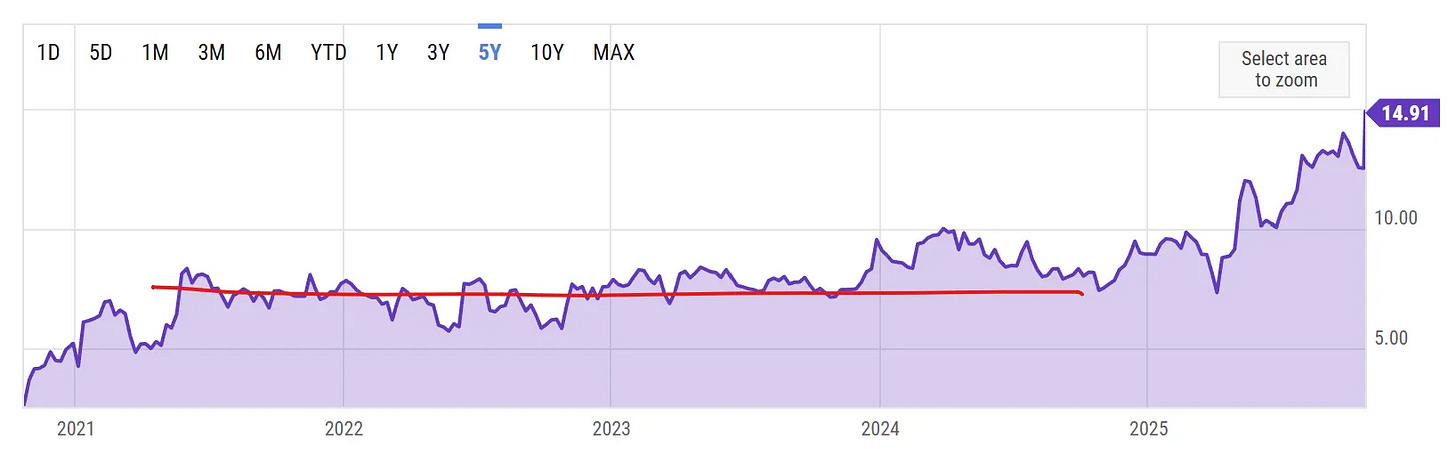

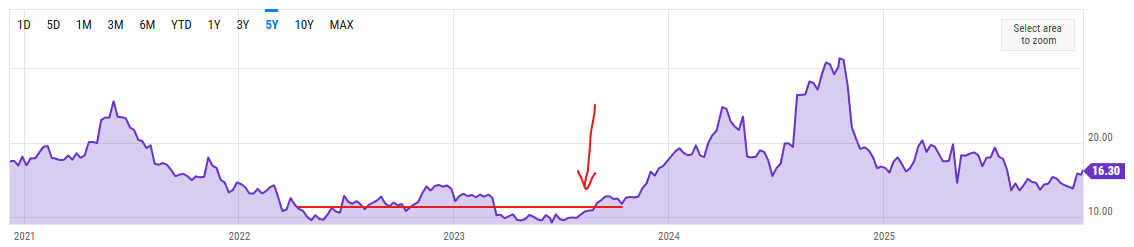

Coiled springs — This category is separate from a multiyear dog; although it’s possible (and likely) that these shares have also underperformed for several years. I define a coiled spring as a stock that maintains a fairly tight trading range for at least a full year but ideally 2-3 years or more. A “tight trading range” in my book means +/- 15% price volatility. That would mean a $10 stock trades between $8.50 and $11.50 over 2-3 years. This is the category I’m most interested in. Why? After several years of flatlining performance, investors and analysts set lower expectations for the future, plus it’s a much better chart setup than trying to catch a sentiment-driven falling knife. I take some comfort in having a strong base in the chart (bonus points for improving fundamentals during the 2-3 year period too).

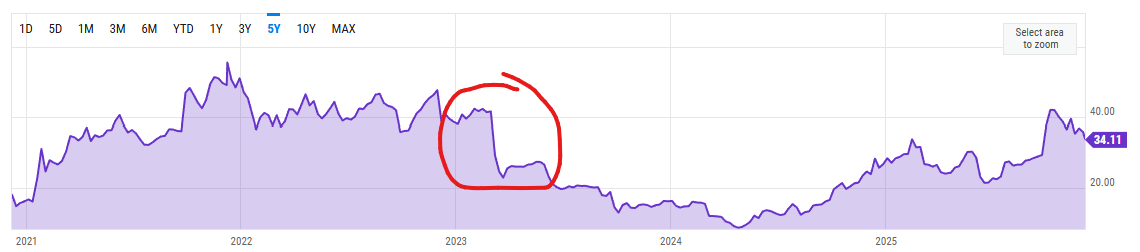

Garrett Motion (2021-2025)

Activision Blizzard (2010-2013)

Rubicon Technology (2017-2022)

Mean reversion — Every value investor is hoping for or expecting some level of mean reversion via multiple expansion in their investment thesis when buying a cheap stock. We’re hoping to buy a decent business trading at 8x earnings when it should be trading at 10x earnings. If earnings grow in addition to that multiple expansion then we get an added bonus.

The challenge here is finding stocks where the mean reversion is justified. A stock which was historically trading at 10x earnings and now trades at 5x probably got there for good reason (crummy results). So what gets it back to a 10x multiple? Therein lies your bet. In my view, you need to answer that “what” for mean reversion to work. So these ideas usually become part of another theme like a turnaround or GoodCo / BadCo situation.

Example

Hamilton Beach Brands (HBB) — This conservatively-run maker of household appliances had a beaten down share price after COVID. But management was guiding to another year of consistent earnings performance. As the year progressed and guidance achieved, shares quickly re-rated to historic multiples. (See Aug 2023 write-up.)

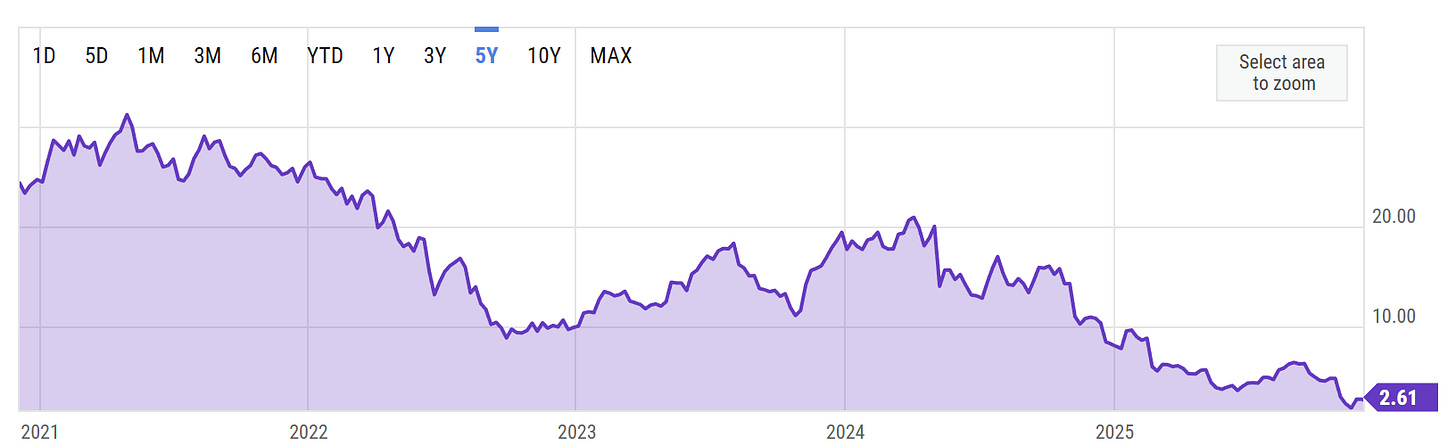

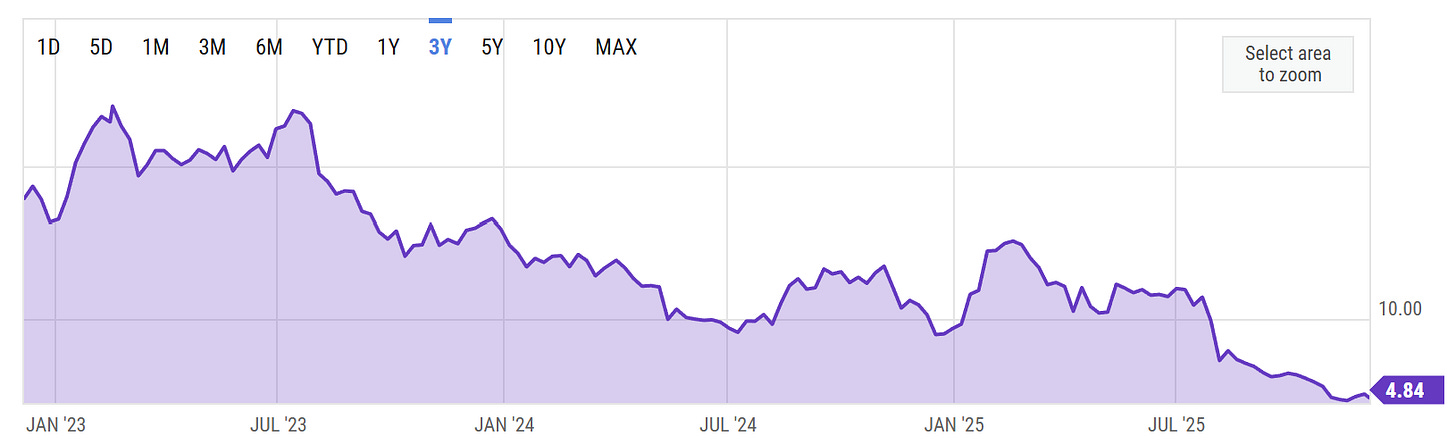

Falling knife — A rapid and sustained share price decline is often called a “falling knife.” The share price itself doesn’t matter when defining these, but I typically see them resulting in a low single digit share price ($1-5).

The term is commonly used in phrases like, “don’t try to catch a falling knife,” which can be translated to mean, “wait for the price to bottom out before buying it.”

Falling knives generally come with a negative connotation, but there can occasionally be opportunities here (usually when fundamentals start to inflect).

Examples:

Portillo’s (PTLO) from 2023-2025

Big decliners — Separate from a falling knife, I categorize “big decliners” as stocks that have or recently had a major 1-2 day sell-off around an event, earnings, or news flow. Consider this theme as fishing for stocks that are down 20-40% in a single day. It can be for any number of reasons (or no reason at all) and that’s usually the starting point in looking at these situations. Was it a major contract loss? A bad merger or acquisition that spooked investors? Or maybe it’s a microcap selling off on no major news… What we’re looking for are overreactions which caused the sell-off. It may not warrant an immediate investment, but the big decline is usually a good catalyst to do some homework.

United Natural Foods (UNFI) in 2023 — Shares fell from $40 to $26 in 2023 from a big earnings miss and lowered outlook. In this case, things got worse before they started getting better, but it would have been a good time to begin research and add to the watchlist.

52 week lows — This almost isn’t worthy of a category by itself because any number of falling knives, beaten down stocks, or big decliners could be making new lows. A list of 52 week lows is widely available (I like to review the Wall Street Journal daily lows). Sometimes I’ll just skim the list and look for notable or high profile businesses that might otherwise be good companies hitting lows for non-fundamental reasons. I’m also looking for companies I’ve previously owned or researched. Again, this is top of funnel idea sourcing.

Fallen angels — These are former high flyers, once popular stocks that have “hit the skids” and are no longer adored. The usual reason is they aren’t growing anymore. Imagine a GARP stock trading at 15-20x earnings with a cult-like following; if growth falls to zero (or negative), investors bail and shares get orphaned. Sally Beauty (SBH) and Monro Muffler (MNRO) both fit this bill.

Again, this category is plentiful with new ideas since stocks are constantly getting clobbered or rotating between their 52 week high and low. It’s a better top of funnel research category than a definitive “invest now” category.

Current ideas that are beaten down:

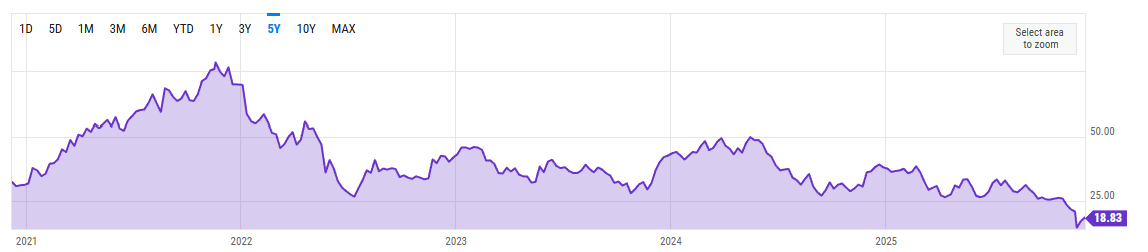

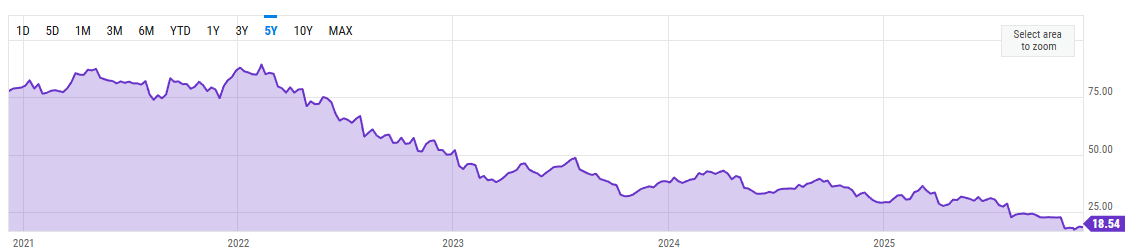

Bath & Body Works (BBWI, $19) — Falling knife. Modestly levered retailer with mostly declining revenue trading at 7x earnings. Median P/E over last 10 years is ~12x which could mean >80% upside on a re-rate. But investors are worried about a big reset in guidance (FY25 EPS guide went from $3.35-3.60 to $2.87 on Nov 2025 earnings call).

Gibraltar Industries (ROCK, $50) — Big decliner. Shares fell 22% the day they announced a levered acquisition. Now trading at 11.8x earnings before including the acquired earnings. Divesting some assets too which makes it look even more like an overreaction. Housing markets are weak in 4Q25, and this is a “top of pile” idea on that list as I could see the acquisition adding $2/share to EPS in 2-3 years. (See write-up here.)

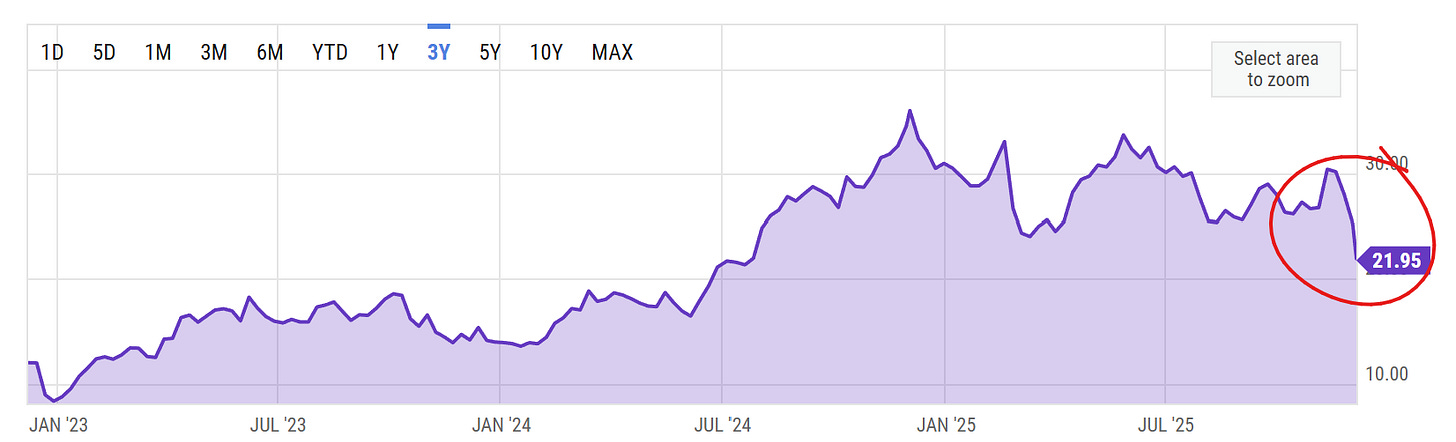

Cinemark (CNK, $22) — Big decliner. Shares are down from $27-30 to $22 along with the Netflix acquisition of Warner Bros. It’s a good cash flow business (movie theaters) with high fixed costs, the concerns are whether Netflix will start pulling back on theatrical releases in the future. This name is literally sitting on top of my research pile right now.

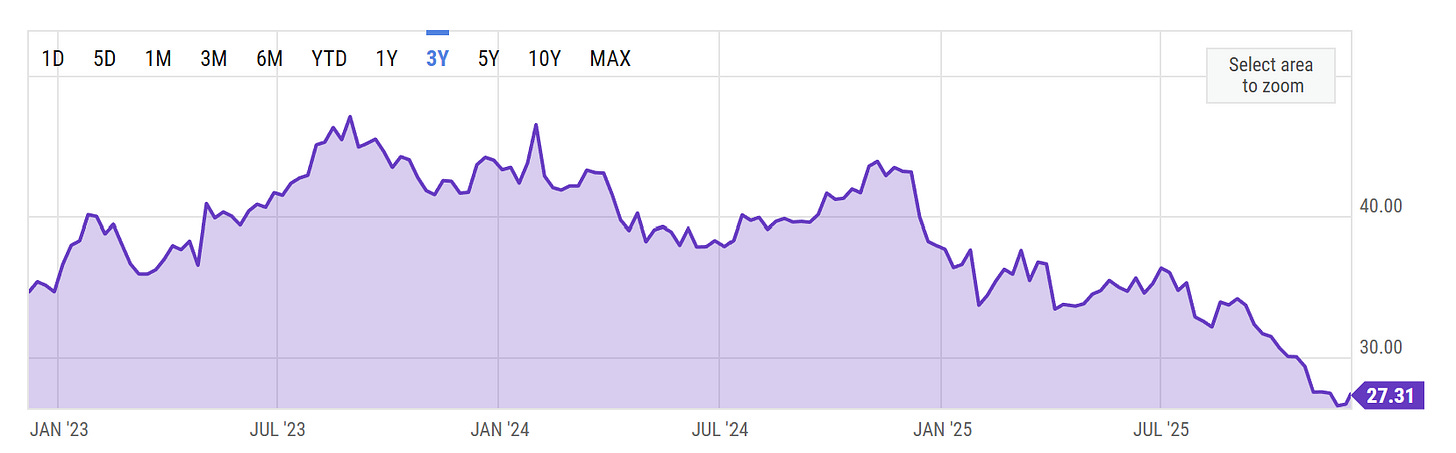

Comcast (CMCSA, $27) — Falling knife. Pretty fascinating to see such a large company falling so hard. It too is caught in the Netflix/Warner aftermath. But shares have never been cheaper (6.8x NTM earnings estimates vs. 3-5yr median at 10x). Leverage is reasonable. They’re spinning off the secular declining cable networks business. Pays a 4.8% dividend. Buybacks are consistently 1.5-2% of market cap per quarter. Lots of reasons to like this here.

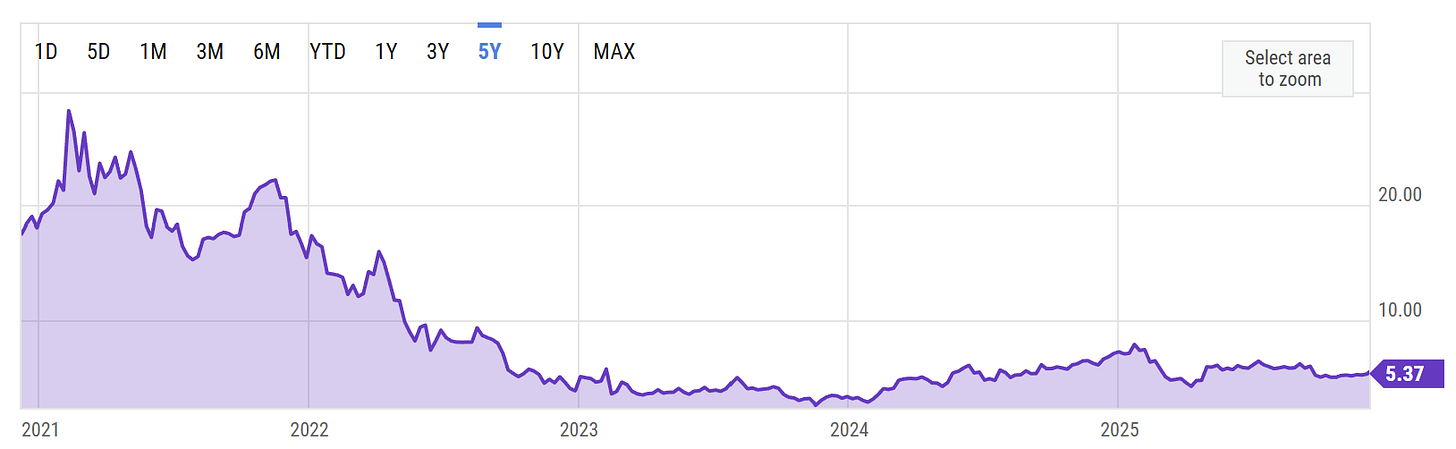

Sangoma Technologies (SANG, $5) — Coiled spring. Another name I’ve written about in the past. It’s not a perfect coiled spring chart, but shares are steady around $5 despite meaningful fundamental progress (FCF improving, debt repaid, capital allocation opening up). The stock currently trades at 7x FCF (NTM estimate) with an almost unlevered balance sheet.

Stanley Black & Decker (SWK, $72) — Coiled spring. Another recent write-up. It’s a turnaround story too. Earnings went from $10/share (2021) to near zero (2023) with 2025 guidance set for $4.55 (call it a 16x P/E). With a combination of self-help and modest industry recovery (i.e. resi construction + consumer), earnings could be >$10/share in a few years. What caught my attention was a return to growth in Q3 and another quarter of expected growth in Q4. I’m still trying to underwrite those outer year earnings and the recent +15% move from my write-up isn’t helping.

Baxter (BAX, $19) — Falling knife. Baxter is both a turnaround and management change story (themes I’ll cover in the future). To simplify a long story, Baxter overpaid for medical products company Hillrom in 2021 which led to excessive debt. They’ve sold a few businesses at good prices, but they’re still left with too much debt and a healthcare conglomerate structure. New management plans to host an inaugural investor day to layout plans.

These are names that are of high interest to me right now, several I’m actively considering investing in. This list could be infinitely longer as virtually everything I’m reviewing started with some kind of busted chart setup or news. Not always, but more often than not.

Summing it up…

This is the most technical analysis you’ll see out of my process.

Really, I’m not using these tools to try and catch an entry point, I’m using them to identify the “start research” point. When combined with another theme (like a turnaround, management change, spin, etc.), then I may find certain charts make a situation more intriguing (i.e. coiled spring or a big 1-day decline).

Thanks for reading and see you tomorrow.

Cheers,

Colin

P.S. drop a comment with an idea fitting one of these buckets and I’ll add it to my research list.

FMC would fit. Would love to see an analysis on it.

Excellent taxonomy of beaten-down categories here. The distinction between coiled springs and falling knives is particulary useful since most investors lump them together when they actually represent very diferent risk profiles. BBWI is interesting at 7x with that historical 12x median, but the guidance reset is tough because it shows management might not have clear visibility yet. The SANG idea catches my attention more, since unlevered balance sheets with improving FCF dynamics tend to offer cleaner setups when sentiment shifts.