A Guide To Insider Buys

Investment themes Pt. 5 = insider buying

As a recap for new readers, I’m expanding on Peter Lynch’s six “story types” when it comes to evaluating stocks.

My categories total 15, from spin-offs, to beaten down stocks, to post-reorg equities. Today we’re covering insider buying.

Here are the previous articles for those who missed them:

Part 1 — beaten down shares (my favorite source of idea gen)

Part 2 — spin-offs (my favorite source for actionable investments)

Part 3 — post-reorg equities (infrequent but actionable)

Part 4 — management changes (good ones are uncommon but actionable)

5) Insider Buying

Insider buying isn’t a standalone “buy” signal (usually).

But it is a good way to spot stocks worth researching (i.e. as a screener or idea generation), identify a good entry point in a name you’re already researching (buy signal), or add conviction to an existing holding.

What I’m paying close attention to are frequency (how often and how many insiders are buying) and magnitude (dollar amount, size relative to salary/worth, and size relative to existing position).

[Note: We’re focused on insider buying activity only here; i.e. identifying signals for good investment opportunities.]

Here’s what I look for when it comes to insider buying:

Big one-time buys > lots of small buys — I consider a steady drip of small insider purchases as a weaker signal than a big one-off purchase (especially if the purchaser does so infrequently).

Big purchase = meaningful to that person — “Big” can be measured 3 ways: 1) relative to the insider’s salary (bigger = better); 2) relative to their net worth (much harder to identify); and 3) relative to their existing holdings in the company.

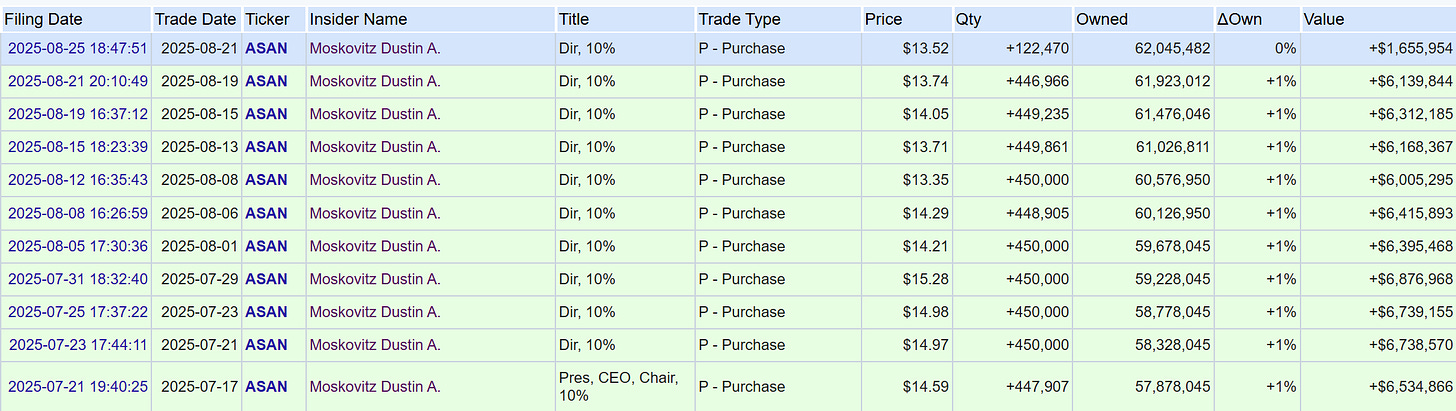

Who’s buying matters — Are folks lower on the org chart buying? Role seniority matters as a signal. I’d much rather see a mid-level employee closer to the trenches buying. A chief accounting officer, VP of sales, or director level employee might be a better signal than a CEO/CFO buy. And a CEO/CFO buy is a better signal than a 10%+ owner buying. And so on.

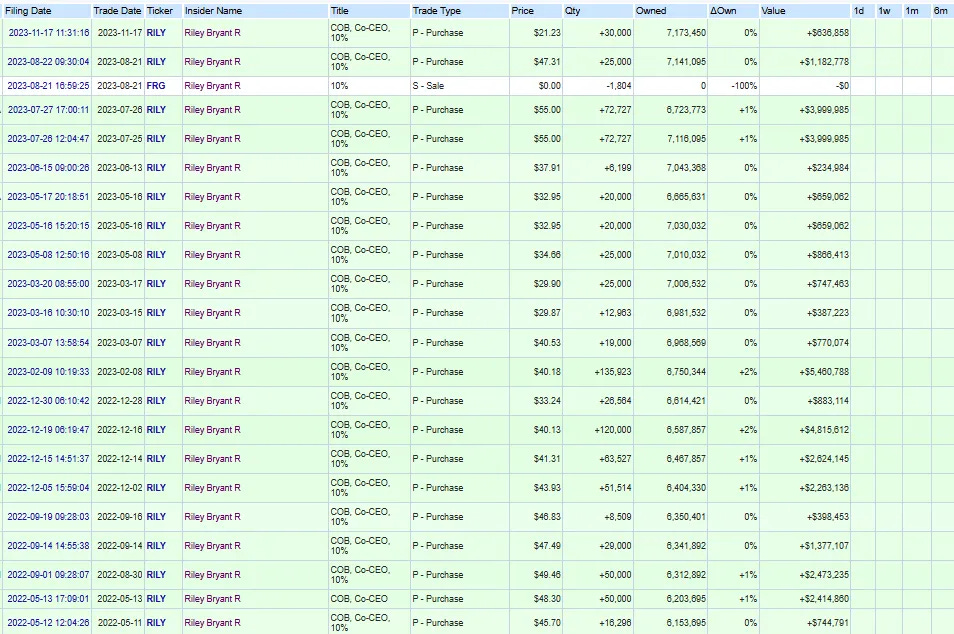

More frequent = weaker signal over time — If a CEO is consistently purchasing a bunch of stock over an entire year (or years), that signal gets weaker as it goes (see B. Riley and Asana below).

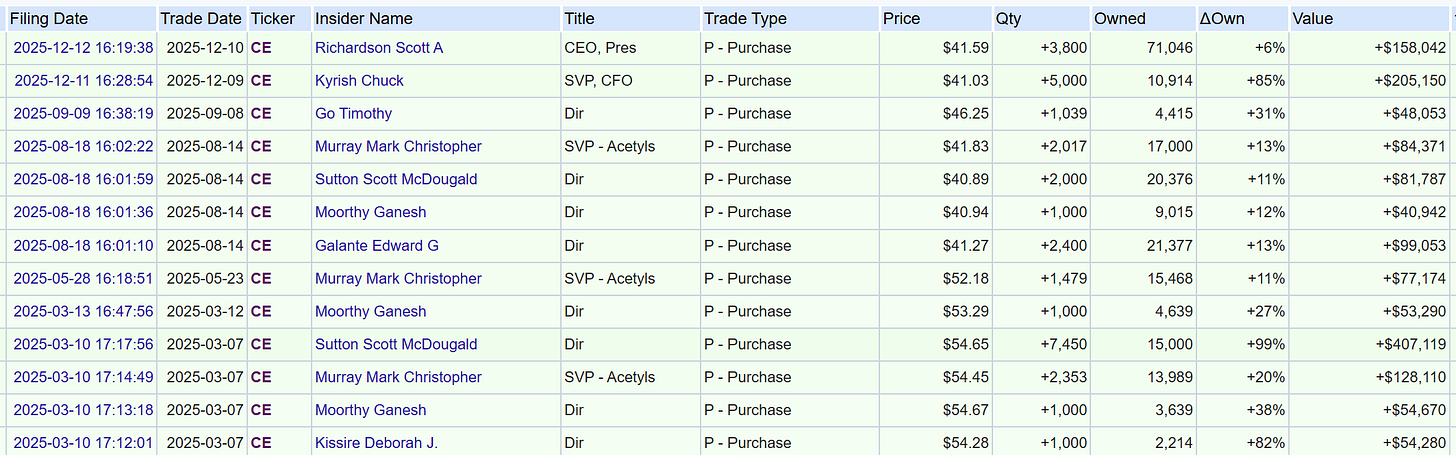

Clustered around major event — A group of insiders buying in size around a major event (stock price sell-off, guidance cut, controversial news, etc.) is typically a good contrarian indicator.

Pair with another theme — Typically, insider buy ideas accompany some other investment theme (spin, turnaround, etc.). I’ll rarely buy a stock solely because an insider is purchasing.

Where to find these — I use openinsider.com to scan recent insider purchases. It’s free and works well, but it has limited historic data available.

Examples and ideas

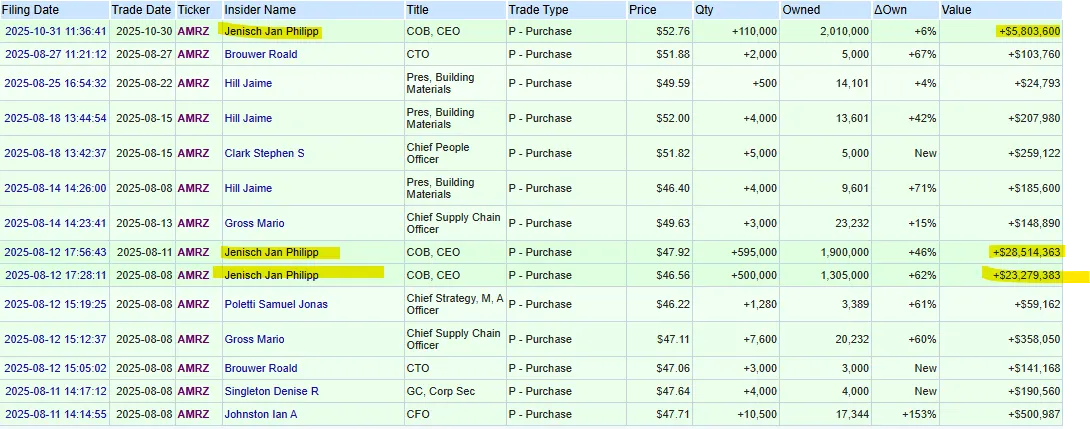

Amrize (AMRZ, $56) — The CEO of this June 2025 spin-off dropped $57.7m from August-October. This is >20x his 2024 base salary before the split from Holcim. Amrize trades at ~21x earnings and 11.8x EBITDA on 2025 guidance which might be reasonable for this cement + building products supplier.

B Riley (RILY, $4) — Large and consistent insider buys are not an “automatic” buy signal. We still need to look at the fundamentals + outlook to make sure things are going well at the business. CEO Bryant Riley was consistently buying his own stock in large amounts for years. In hindsight, this should have lessened the “signal” over time.

Asana (ASAN, $14) — Founder Dustin Moskowitz has been buying shares in large dollar amounts for years despite the stock continuing to drift lower. Each purchase is nominal to his existing position and he’s already a 10%+ owner (higher potential for bias). It’s a good example of a weak insider buy signal.

Celanese (CE, $44) — Celanese levered up to buy DuPont’s mobility & materials business in 2022 for $11bn. Shares fell from >$150 to $44 as they subsequently wrote off ~$3bn of the purchase. Analysts are expecting a return to growth in 2026 and shares are cheap (8x forward EPS) but highly levered (>5x leverage). Based on the buying activity below, maybe results are starting to bottom?

Thanks for reading!

If you’re enjoying these write-ups, give it a quick “share” to spread the word.