Midyear Picks Update

An update on VDL open/closed recommendations, general commentary, and a few actionable ideas.

The roadmap for this post will follow: 1) a snapshot of current recommendations; 2) overview of open/closed ideas; 3) quick highlight of each recommendation; 4) random commentary I feel like going deeper into.

For newcomers, I’d suggest skimming the following:

My bucket approach to investing

Core — cheap, undiscovered, or underappreciated compounders (low quantity, big weightings, longer hold periods)

Generals — mix of plain vanilla cheap stocks and special sits

Option — net-nets, levered turnarounds, balance sheet plays, call spreads, asymmetric bets (basket approach with lower weightings)

My investing philosophy & process notes

All-cap value investor with small/mid-cap emphasis

Special situation focus

Cash flow

For folks that aren’t subscribers yet… here’s a 20% off promo to give it a try. I promise you’ll find at least one good idea in the lot (heck, these are my best ideas that I’m personally invested in!).

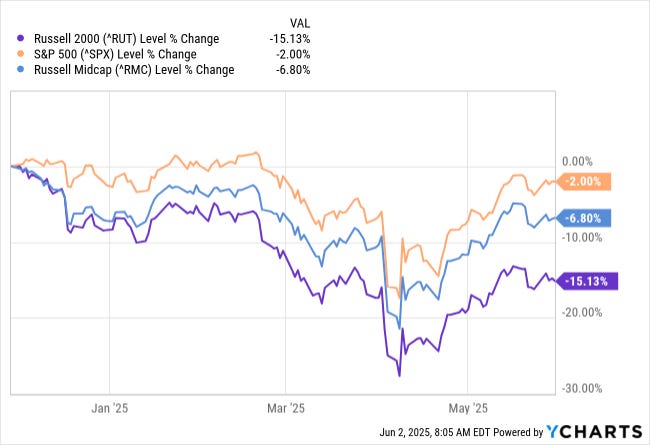

Small and mid cap stocks have been in a “bear market” for years now (relative to the S&P 500 at least). YTD 2025 has seen a widening of this trend. Translation? There are still plenty of opportunities in small and mid caps with the S&P 400/600 hanging around 14-16x earnings (vs. 20-22x for the S&P 500).

Notable VDL activity this year includes: 1) buying 7 beaten down small caps (all still attractively priced) during the April tariff selloff; and 2) closed out a handful of recommendations to double down on my Starz bet (more on that later).

As always, feel free to leave comments or request updates.