Quick Value #264 - 7 beaten down small caps

A list of 7 small caps I've been buying

Today’s post:

Group of 7 small caps down 20-30% in the past month

Average market cap of $1bn with 2x leverage

Collectively trading at 5x earnings/FCF

Consider this a “markets in turmoil” version of VDL. Today I’m highlighting a few names I’m buying or adding to. Some of these are special sits (activist, post-spin, recently completed large divestitures, etc.) and some are plain vanilla cheap stocks with capital allocation as their “catalyst.” A few have direct tariff exposure but most of these are indirectly impacted (i.e. economic activity, consumer spending, etc.) so I think this basket will do quite well over the next few years.

For newer subscribers, check out the VDL “home base” for background info, links to key resources, articles, trackers, etc.

As always, leave a comment with thoughts or stocks you want to see covered and check out past posts here to get a flavor for recent write-ups.

Quick Value

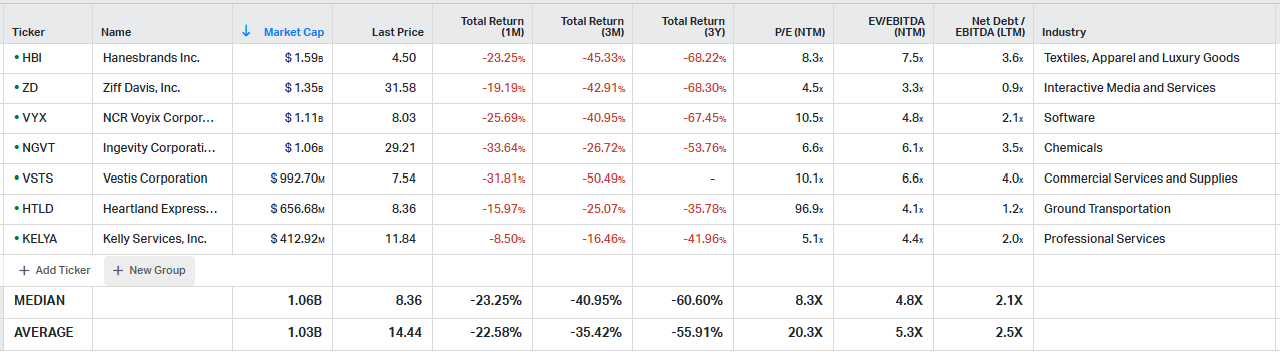

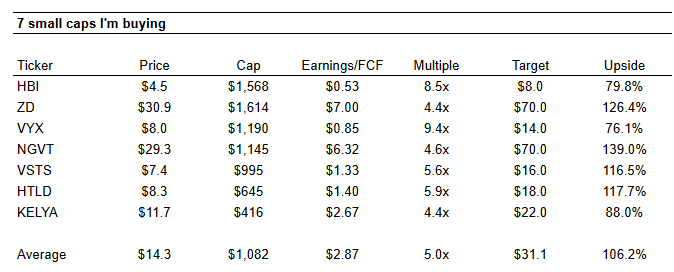

Here are 7 stocks I’ve been buying or adding to lately:

Working through this list in order by market cap:

1) Hanesbrands — HBI, $5 — Completed the sale of their Champion apparel brand and repaid $1bn in debt (leverage down by 2x). It’s not quite a full capital allocation inflection as they expect to repay more debt to hit their 3x leverage target by end of 2025.

HBI’s biggest international manufacturing exposure is El Salvador and Dominican Republic which are subject to the 10% baseline tariff, so perhaps less exposure than other apparel/consumer stocks.

It’s a simple wholesale apparel business (minimal DTC) of basics like socks, underwear, bras, etc. Management is guiding to $300m FCF ($0.83/share) for CY2025. Some of that is working capital benefit but I get somewhere between $0.50-0.60/share in normalized FCF before any new capital allocation priorities. At 12-14x, it’s a $6-8 stock. It isn’t a sexy growth business but these value-brand basics should hold up well in a downturn. I expect they can get EPS/FCF close to $1/share in a few years with more flexibility on cash flow.

2) Ziff Davis — ZD, $33 — Very recently wrote about this one (March 2025) at $40. Other than their exposure to general economic activity, consumer, and advertising; there shouldn’t be much tariff impact here.

The balance sheet is in excellent shape and management is going on offense lately with buybacks and M&A. I’m hopeful they are buying back shares at depressed prices right now or getting inbound calls on M&A.

My estimates are $6.75/share in 2025 FCF so you’re getting the stock at less than 5x. I believe it’s worth twice that.

3) NCR Voyix — VYX, $9 — This is the hospitality software and services side of the 2023 NCR spin-off. I like these “transformational divestiture” situations and Voyix recently completed a $2.5bn sale of their digital banking business at a huge premium. The balance sheet just got a ton better

At 1.6x leverage, the company is well below its 2x target. Capex, M&A, and buybacks are top of the list with very limited color. There’s a risk they do an expensive/bad deal and relever the company but I’m hopeful with a brand new CEO.

Guidance is $0.75-0.80/share in earnings and $170-190m “adjusted” FCF ($1.10/share). I’m using $0.85/share as my normalized FCF estimate. My guess is they’ll take out the messy preferred share structure before doing any common stock buybacks or M&A. That would be the equivalent of a 10% buyback.

As a kicker, they’re transitioning the entire POS and self-checkout hardware business to a third-party whereby Voyix will act as a sales agent earning a commission. Maybe some risk the partnership doesn’t close due to tariffs?

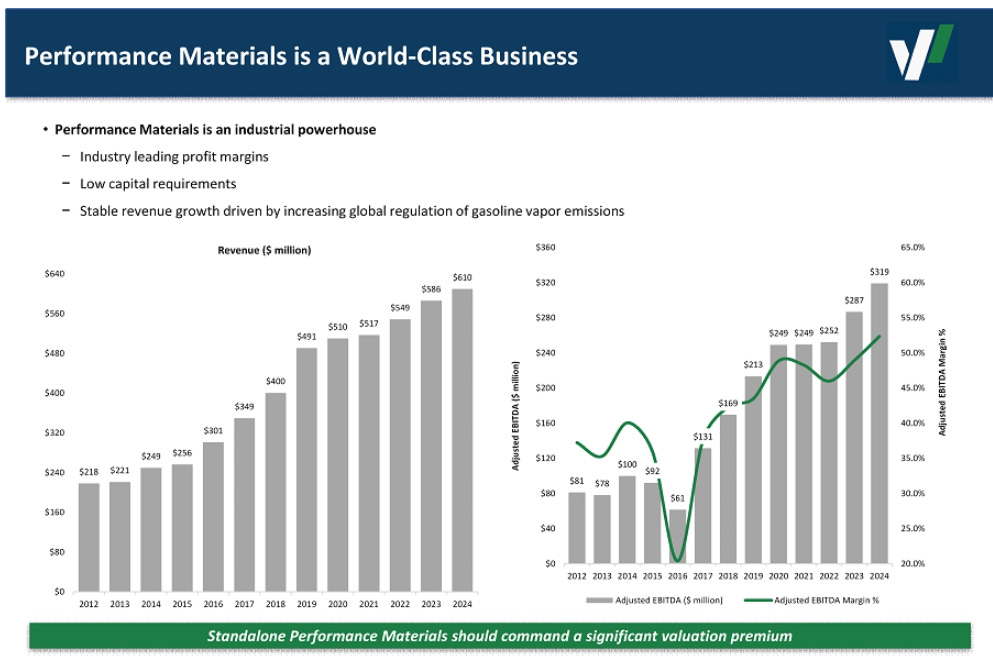

4) Ingevity — NGVT, $31 — Another recent write-up (reviewed at $47 in March 2025)… This specialty chemical maker has significant international exposure (42% of sales are international going to 70 countries) so a portion of earnings are very much at-risk here.

But I love the trifecta of: intensifying activist situation with proxies being filed, management is running a strategic review process (in part to placate activists), and they have an insanely valuable vehicle emissions business (very few companies have >50% EBITDA margins).

I have shares valued at $70 by 2026 vs. $31 today and the activist situation should act as a nice catalyst for value realization whether they’re successful in obtaining board seats or not.

5) Vestis — VSTS, $8 — I typically monitor spin-offs for a few years post-spin even if I don’t wind up buying at time of spin. Vestis separated from Aramark in 2023 at $20, fell to $9-10 in early 2024 on lowered guidance (poor expectation setting at time of spin), rallied to $16 in early 2025 on buyout rumors, and now sits at $8. What a ride…

Vestis hasn’t executed as well as uniform rental peers Cintas or UniFirst; and they have significantly higher debt (3.6x leverage). But shares are cheap and they still generate plenty of FCF. In a stable industry, it’s like an LBO while waiting to see if the buyout rumors materialize.

There are ~132m shares x $8 = $1.06bn market cap. Net debt should finish 2025 at $1.1bn with EBITDA and FCF at $350m and $175m each. That’s 6.2x EBITDA and 6.1x FCF with peers at >20x earnings.

6) Heartland Express — HTLD, $8 — Wrote about this name in Feb 2025 at $11. Again, this business is more tied to overall economic activity and therefore indirectly exposed to tariff impact. Management is ultra conservative and navigating to a net cash balance sheet (probably a few quarters away). Trucking is coming off a pandemic surge in pricing and finally stabilizing, so I feel comfortable extrapolating 2024 results with slight improvement from debt paydown.

My estimates call for $1.40/share in run-rate owner earnings (net income + D&A - net capex) by end of 2025. At 13x = $18 per share.

7) Kelly Services — KELYA, $12 — Wrote up Kelly Services in Feb 2025 at $13. The stock isn’t tanking as hard as others on this list (or elsewhere on my watchlist) perhaps because this industry is already so beaten down.

This temp staffing agency has exposure to overall economic weakness but there are a few positives here… first, peers are guiding to continued revenue declines in 2025 while Kelly sees organic revenue and earnings growth; next, results are not reflecting the massive portfolio change from business sales + acquisitions; last, management is going on offense with buybacks while peers are retrenching.

Adjusted EPS was >$2.30/share in 2024 but there are some questionable restructuring/M&A add-backs in there. I’m using an owner earnings figure here and I get to $2.67/share in 2024. Assuming no improvement in 2025 and an 8.5x multiple = $22 per share.

Most of these stocks are getting cheaper by the minute as I’m publishing this during another market downdraft:

I’ve got this group trading at a collective ~5x earnings or FCF on my estimates as opposed to adjusted or management figures. Some of these are normalized for divestitures or balance sheet transformations.

Virtually every company on this last has “all options on the table” when it comes to capital allocation except for VSTS and NGVT which still are in debt paydown mode. Leverage is low or manageable for every company here too (~2x median leverage). And the combined tariff impact is mostly indirect.

I think this basket of companies should do quite well over the next few years. Leave a comment if you’ve done work on any of these names or reply with what you’re buying today.

Cheers,

Colin