Quick Value #206 - Berkshire Hathaway ($BRK)

Welcome to another edition of Quick Value — this week we’re covering the Berkshire Hathaway annual report and valuation of BRK.B shares.

Market Performance

Quick Value

Berkshire Hathaway ($BRK)

Same as in the past, let’s take a look at 2023 results with an updated valuation. (We’re focused on the annual report here as opposed to the shareholder letter.)

Note — BRK.B has an equivalent 2.16bn shares outstanding x $417/share = $900bn market cap.

Quick reminder on how Berkshire segments financial performance and where various businesses are grouped together:

For most companies, business segments are determined based on revenue which led to Pilot/McLane being separated. Since they have annual earnings lower than most of the businesses within Manufacturing/Service/Retail (MSR), I’ve lumped both of those there…

1) Overall operating earnings

Here’s the big picture look at earnings from 2017-2023:

Insurance businesses carried the weight in 2023 with a huge jump in earnings thanks to higher interest rates. Buffett called out the non-insurance operations would face a tough year and that held true. Interesting that the non-insurance businesses have underperformed S&P 500 earnings growth from 2017-2023 (though not entirely a fair comparison).

2) Non-insurance subsidiary performance

From the high level graphic above, we see the railroad and utilities businesses were a big drag on earnings in 2023, down 13% and down 40% YoY.

The remaining businesses in MSR held up fairly well (2% growth) considering the macro challenges since in other industries like consumer, retail, building, industrial, etc. [look at 2023 earnings growth/decline for companies like SWK, ATKR, ABG, and your pick of consumer brand to get a flavor for comp performance.]

These are the “smaller” businesses in the portfolio that I think of when Buffett describes Berkshire as a collection of companies a bit better than the average American corporation.

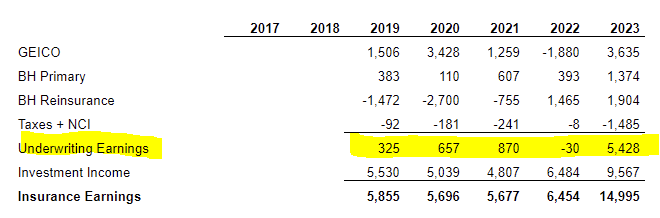

3) Insurance performance

This is where all the 2023 outperformance came. It’s a fascinating picture with 4 years of stable performance and close to breakeven underwriting income followed by a more-than-doubling of total earnings in 2023.

So what happened?

Investment income grew from higher interest rates kicking in (makes sense with fed funds rate) and the growing pile of treasuries.

Underwriting income went from ~breakeven to $5bn+ in 2023. How sustainable is that jump? Most insurers have been on fire lately with insurance prices hardening and fewer catastrophic events to cover. Translation: it would be prudent to normalize 2023 underwriting results instead of extrapolating them.

4) Cash & investments

Cash and treasuries hit a new high at $167bn as of 12/31/23. On a per share basis, BRK has ~$77/share of cash and treasuries; that’s about 18% of today’s share price ($417).

Book value (equity) grew 18% last year to $567.5bn or $261.50/share (translates to 1.6x P/B multiple).

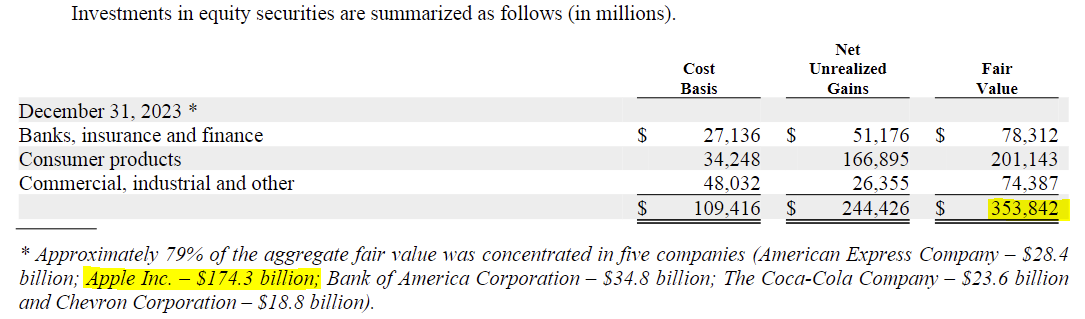

Equity investments were $353bn ($163/share) at yearend with Apple making up $174bn of that amount

Kraft Heinz (KHC) and Occidental Petroleum (OXY) are equity method holdings that add another $29bn to the investment portfolio ($13.40/share)

5) Cash flow & capital allocation

With the big jump in insurance earnings this year, cash flow naturally saw a boost to $49bn operating cash flow / $30bn FCF — both of those were +30% YoY. Capital allocation remains balanced across: adding to the investment portfolio, tuck-in acquisitions, and buying back stock. Generally, BRK lives within their annual FCF generation

The highlights:

$8.6bn spent on acquisitions — more than a normal year but still a small portion of overall cash flow

$9.2bn spent on buybacks — more than spent in 2022 but still light in relation to current market cap (1%)… maybe because shares had such a strong year?

$5.3bn added to investment portfolio

6) Valuation

Buffett’s 2-column method calls for valuing the operating businesses and the investment portfolio separately.

Cash and investments totaled $550bn or $254.60/share

Non-insurance operating businesses had net earnings of $21bn in 2023 (vs. $22bn in 2022)

Much of Berkshire’s valuation depends on how you capitalize the earnings of non-insurance businesses. The long-run S&P 500 earnings multiple is something like 16-18x (need a source for that)… using that range would value the operating businesses at $336-378bn on 2023 results. That works out to $155-175/share.

Add in the cash & investments of $255/share and we have $410-430/share fair value for BRK.B shares (my estimate).

It feels like BRK is running pretty close to fair value at the moment and investors at today’s price should expect something a “bit better” than the S&P 500. With one major caveat that BRK holders are over-indexed to Apple shares at something like 19% of today’s market cap.