Quick Value 2.27.23 ($BRK)

Berkshire - no opinions, just some facts and figures and an updated valuation attempt

Subscribe to the full newsletter below for full access to the weekly Quick Value and other posts!

Market Performance

Market Stats

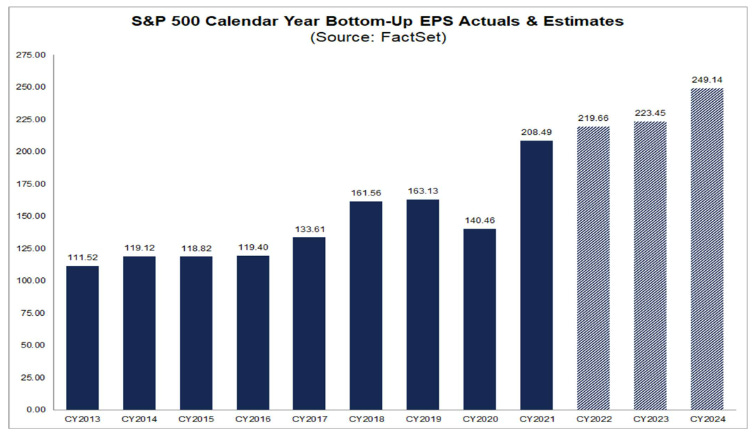

S&P 500 earnings are looking like ~$220 per “share” in 2022, good for an 18x multiple at today’s 3970 index level. Little growth is expected in 2023.

Quick Value

Berkshire Hathaway ($BRK)

I’ll take a similar approach to last year’s post and focus only on some facts, stats, and an attempt at an updated valuation. I won’t touch on the shareholder letter as that seems to be well covered elsewhere. We’re looking mainly at the annual report here.

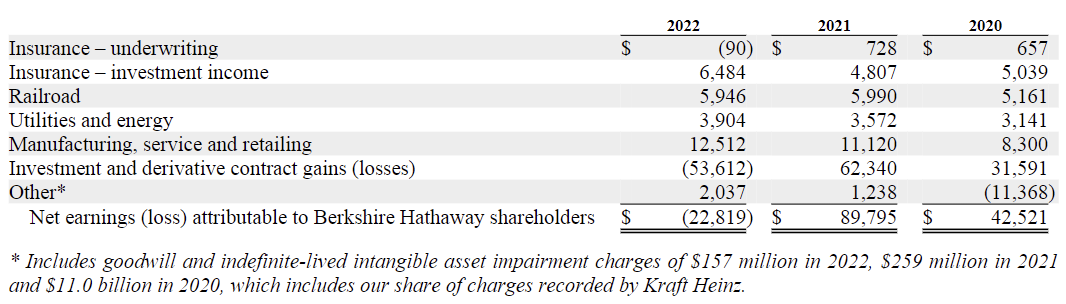

Starting with operating earnings, I see $28.8bn in 2022 vs. $26bn in 2021 and $22bn in 2020. I’m excluding investment gains/losses and the “Other” section which includes equity method earnings, impairments, FX gains/losses, etc.

The non-insurance portion of earnings was $22.4bn after tax in 2022 ($27bn pre-tax). Those earnings should outpace S&P 500 earnings growth by a decent amount based on current estimates. Here’s a breakdown of pre-tax earnings by each major segment:

If we further breakdown the various manufacturing, service, and retailing segment we can see that consumer and retail really struggled in 2022 (no surprise based on comments from competitors in those spaces). The building products segment performed really well in both 2021 and 2022. Those 3 pieces (consumer, retail, building) were ~30% of 2022 pre-tax earnings and will likely decline a decent amount in 2023.

The investment portfolio totaled $309bn at 12/31/22 vs. $351bn last year. Most of the stocks in the Berkshire portfolio have rolled over by a decent amount since last year. Buffett and team added more to the stock portfolio during 2022 with cost basis up $27bn.

If you’re wondering about the Occidental Petroleum (OXY) shares, those went to the equity method investments line on the balance sheet and were worth ~$12bn at yearend. Equity method investments total $28bn at yearend and are mostly Kraft Heinz / Occidental.

How about an updated look at cash flow and capital allocation…

Notable acquisitions were the $11.5bn purchase of Alleghany Corporation, itself a mini version of BRK. Aside from that, acquisitions have been negligible since 2017.

Investments were a big focus in 2022… we saw equity investments jump by $28bn in cost basis during the year plus the ~$12bn investment in Occidental (equity method).

Buybacks took a big step down during 2022 but still continued.

Operating cash flow hasn’t budged in 6 years despite the growth in operating earnings.

Thinking about the 2 column method for valuing Berkshire…

Cash and investments total ~$490bn at yearend vs. $530bn at the end of last year. That works out to approximately $224 per B share. Apple and Amex are both up >10% YTD so it’s likely the portfolio is worth >$500bn today. The Apple stake alone was ~$54 per B share at yearend.

Non insurance earnings were $27bn pre-tax / $22.4bn after tax during 2022. Back in 2012, Buffett argued for buying good businesses at 9-10x pre-tax earnings. Using 10x pre-tax earnings would value the operating business at $270bn or $123 per B share. However, Buffett made that statement in the midst of a multi-decade run of 35% corporate income taxes. That rate implies ~15.4x after tax earnings. If you wanted to take a more aggressive stance, you could argue that 15.4x after tax multiple equates to ~12.2x pre-tax earnings under the current system. That would value the operating businesses at $330bn or $150 per B share.

Depending on your interpretation of 10x pre-tax or 12x pre-tax earnings, Berkshire’s intrinsic value could be somewhere between $350-375 per B share.

Alternatively, shares are trading just shy of 1.5x book value today vs. a long-run average of 1.34x.