Quick Value #253 - Canal+ (LSE:CAN)

European media business with large pending acquisition closing soon

Today’s idea:

Recently completed spin-off

Subscription TV & advertising in France, Africa, Europe

Post-acquisition shares trading at <7x earnings / 2.4x leverage

For newer subscribers, check out the VDL “home base” for background info, links to key resources, articles, trackers, etc. As always, leave a comment with thoughts or stocks you want to see covered and check out past posts here to get a flavor for recent write-ups.

Quick Value

Canal+ (LSE:CAN)

I’m finally getting around to reviewing the Vivendi pieces… this one is fascinating because it has both a spin-off and large M&A aspect to it.

Caution: My estimates are based only on a quick review of very complex filings so I could be way off when it comes to estimates (interest, capex, and I’ve completely ignored acquisition synergies). I have little confidence in accurately handicapping the currency risk here too. So take my analysis with a grain of salt!

What they do…

Canal+ is a French media business with heavy exposure in France, Europe, and Africa. Roughly 53% of revenue comes from France, 23% from Europe, 17% from Africa/Asia and the remainder from their content/studio business.

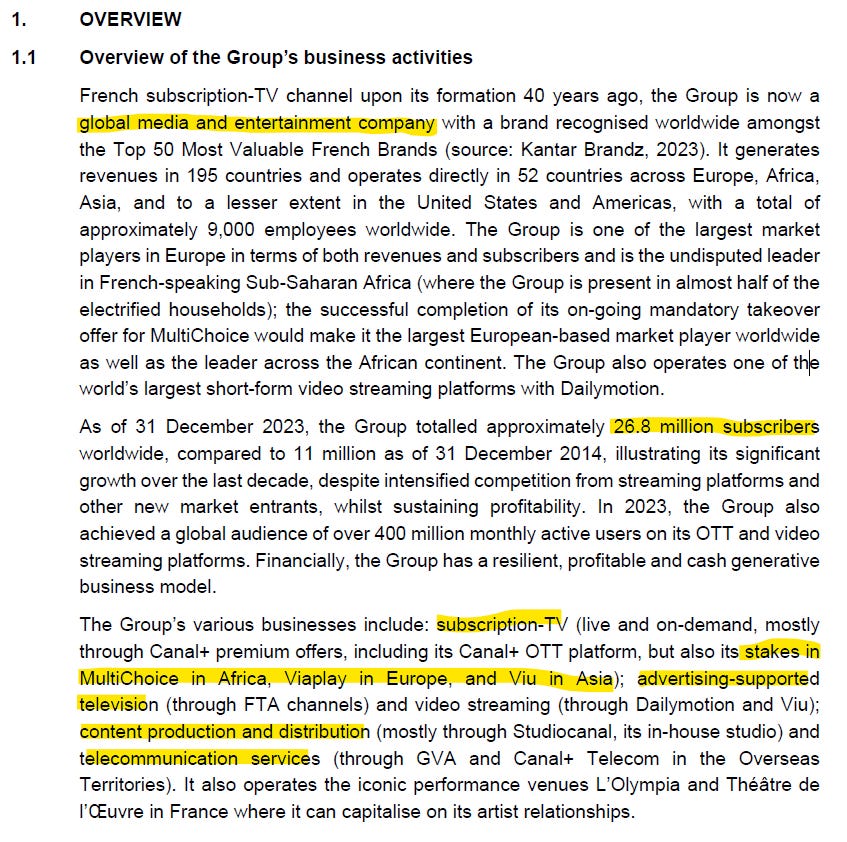

Here’s a description from the spin-off prospectus:

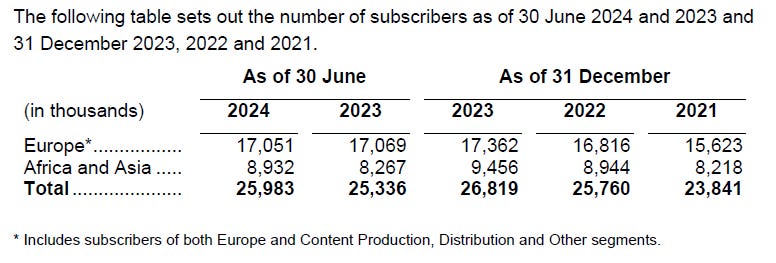

Total subscribers are growing but that growth has slowed in 2024:

Revenue comes from subscriptions (81% of 20923 sales) and advertising (19%). Like other media businesses, they face challenges in transitioning from linear TV to digital/OTT:

At present, advertising-supported traditional linear TV channels are facing challenging market conditions in mature markets, and certain of the Group’s advertising-supported channels (i.e., C8 and CNews) are loss-making. Traditional TV advertising market decline is being more offset by digital advertising growth in mature markets. In Africa and Asia both segments (traditional TV advertising and digital advertising) are growing.

It’s hard to tell how meaningful broadband/data offerings are, so I’m considering this purely a content and advertising business for now (correct me if I’m wrong or point me to the data from filings).

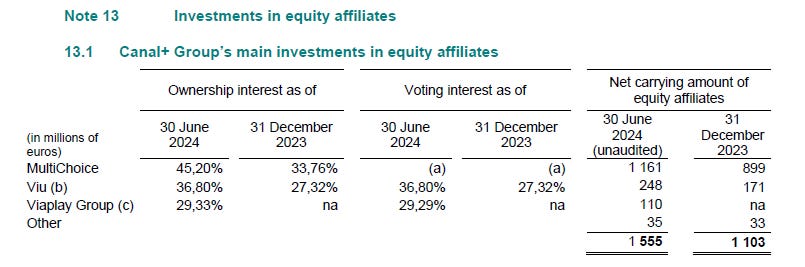

At the time of spin, Canal owns a few equity investments in publicly traded media businesses (MultiChoice, Viu, and ViaPlay). Those investments are carried on the balance sheet (equity method) at €1.55bn as of 6/30/24:

To sum up this business — France/Africa/Europe-based cable and broadcast TV provider with relatively low debt, a few equity investments on the balance sheet, and a large pending acquisition (MultiChoice).

Why it’s interesting…

Vivendi completed a 4-way break-up on 12/16/24. Canal trades on the London exchange (in GBP) but presents financial information in Euros; and adding to the confusion, they are closing an acquisition reporting in South African Rand (ZAR).

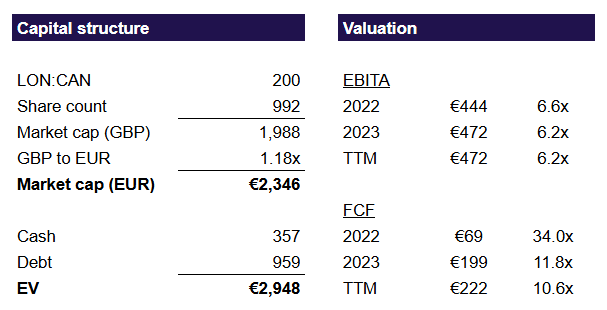

First, a quick look at the capital structure:

Canal is slated to close the full acquisition of its MultiChoice equity investment in a few months and this deal substantially changes the look of the business.

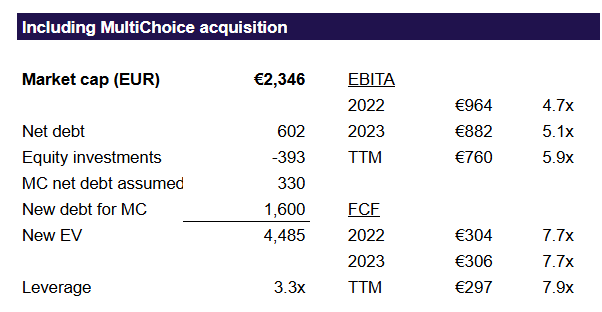

First, it adds a significant chunk of African revenue moving exposure in that region up to ~45% of total sales with France at ~33%. Then, it adds a good amount of debt as they’ll need probably €1.6bn to repurchase the ~240m remaining shares at ZAR125/share; plus they’ll assume net debt from MC’s balance sheet.

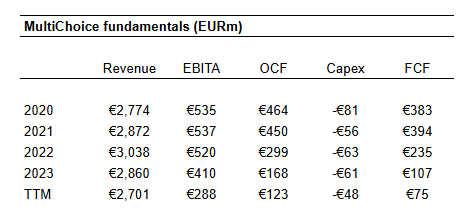

MultiChoice fundamentals don’t look that great right now… assuming 0.052 ZAR-EUR exchange rate, here’s an overview of 2020-1H24 financials:

So the ZAR125/share purchase price implies €2.9bn market cap + €330m net debt = €3.2bn EV or 6-10x EBITA depending on which year you’re using. I haven’t gone deep enough to understand the drivers of MC performance lately but I’d want to unpack that before investing in this one.

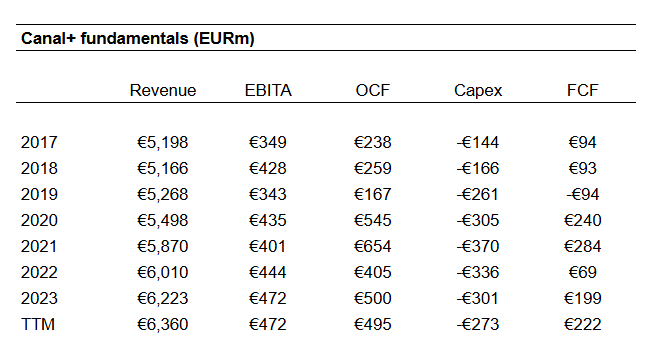

What about the core Canal+ business?

I pulled segment financials for pre-2021 and used the prospectus for 2021-1H24. Revenue wasn’t growing much pre-COVID and EBITA has generally been flat in recent years. Capex is significantly higher at Canal (5-6% of sales) when compared to MultiChoice (~2%).

From here, I’d want to review their capital markets day presentation to get a sense for the outlook. Recent trends at Canal look fine while MultiChoice looks to be struggling.

How about the combined pro-forma business?

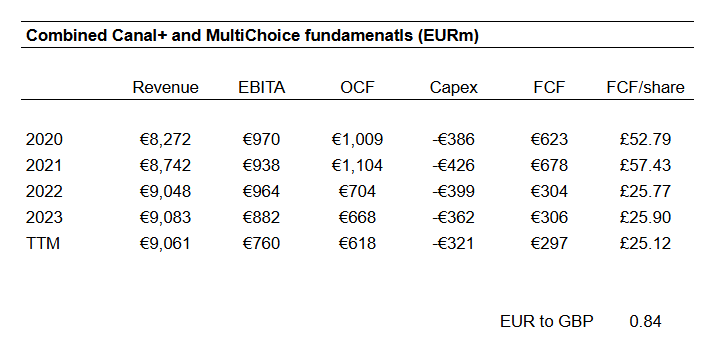

This is the view that really matters… Probably imperfect calculations but I have €9bn combined revenue, €760m EBITA, and ~€300m FCF (ignoring pro-forma balance sheets).

Including changes to the capital structure, I get a €2.35bn market cap with €2.53bn net debt and ~€400m worth of equity investments. If you’re willing to include the equity investments in enterprise value it works out to a €4.5bn EV.

On a combined basis, the stock is trading at ~6x EBITA, <8x FCF, with 3.3x net leverage (debt/EBITA). Looks cheap. Perhaps the only question that really matters is whether MultiChoice can get earnings back to 2020-2022 levels. In that scenario, shares of Canal look really cheap with excellent cash flow.

So far, I’ve ignored future capital structure in looking at historic results. Assuming €1.6bn borrowed to buyout the remaining 55% of MC, plus MC’s €625m gross debt assumed by Canal; what could FCF be?

Starting with €760m EBITA (which has $300m depreciation in it) less ~€250m interest less 30% taxes = €350m earnings or £30/share on a £200 share price = 6.7x P/E. If EBITA came back to €1bn, that would translate into £44/share (4.5x earnings).

Telecom/IT stocks on the Johannesburg exchange are trading at a median 10x earnings which would be £300/share for 50% upside. Caveat: there’s a big assumption on results holding/improving from here which might be a stretch…

What’s the outlook?

Here’s what MC said about results in their 1H25 trading statement:

The group’s 1H FY25 financial performance has been negatively impacted by severe pressure in the macro-economic, foreign exchange rate and consumer environment in key markets, most notably Nigeria and Zambia. As guided in the group’s full-year results for the year ended 31 March 2024, MultiChoice is pursuing an inflationary pricing strategy and targeting ZAR2.0bn in cost savings in the group’s full-year results ending 31 March 2025 in order to offset weaker subscriber activity and foreign exchange pressures. The group has made strong progress against these objectives on a year-to-date basis.

In a later paragraph, they described it as “the most challenging operating environment in the group’s history.” Yikes. Maybe buyers are getting Canal/MC at close to trough numbers or peak pessimism?

Summing it up…

Despite a (potentially) very cheap share price, this one is likely in the too hard pile for me. It looks like this is mostly a content / cable TV business facing the same global headwinds seen by WBD, AMCX, PARA, et. al. Also, you’re getting significant exposure to African / emerging markets with huge inflation/FX risks meaning this stock likely deserves to trade at an emerging markets multiple.

I don’t own it but I’ll watch the capital markets day and keep it on my watchlist for post-acquisition results and balance sheet.

Resources:

Hi, it seems 300m of depreciation is too low? They spent much more in capex and lease payments in the historical financials disclosed. Seems to me one of these examples where the company wants you to focus on the EBITDA metric but the unlevered cash earnings are significantly lower.

Any opinion for Hava?