Quick Value #254 - Microcap Spin at 3x EBITDA

A misunderstood asset sitting within a larger and higher multiple business

Today’s idea:

This is an upcoming spin-off where RemainCo has negative implied value.

What’s the catch?

RemainCo is definitely an “ick” investment in an “ick” industry

It’s complex (prospectus is just shy of 1,000 pages)

It’s under the radar (no flashy capital markets day)

But at the same time this is one of the more interesting spins I’ve seen in a while…

Simple thesis — RemainCo was used as a revenue and cash stream for SpinCo

Large spin ratio — tiny stub position could lead to heavy selling

Small/microcap — post-split market cap likely $100-400m

Quick Value

Starz Entertainment Corp (STRZ)

Starz is a really misunderstood asset sitting within Lionsgate. — CEO Jeff Hirsch

The quick pitch is that the implied value of STRZ is near zero (maybe negative), fundamentals are turning a corner, the business model is superior to competitors, and the unique spin dynamic should give us a chance to pickup shares ultra cheap.

Let’s cover:

Spin details

Business model

What to like

What it’s worth

How to play it

Background on the spin…

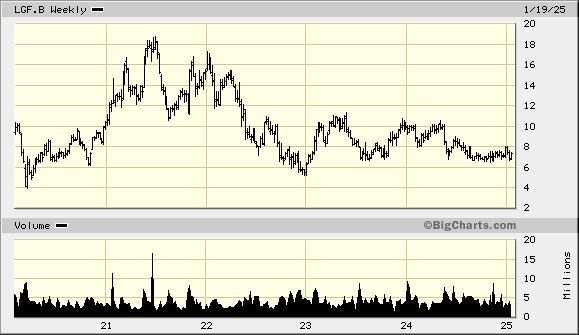

Lions Gate Entertainment (LGF) consists of 2 segments: a studio business and media network. The studio is already trading as Lionsgate Studios (LION) thanks to a May 2024 SPAC transaction. LGF currently owns 87.8% of LION and will distribute those shares to LGF holders (the spin-off). Afterward, RemainCo LGF will rename itself Starz Entertainment Corp, undergo a 1-for-15 reverse split, and trade under the ticker: STRZ.

LGF/A shareholders will get 1.12 shares of LION and 1.12 shares of STRZ while LGF/B holders get 1 share each of LION and STRZ. The A/B class structure will go away as a result of the spin.

There are 83.6m A shares and 156.5m B shares of LGF = 250.1m pre-spin share count and 16.7m post-spin share count for STRZ.

Here is my attempt at calculating the value of LION shares received and implied stub value:

Timing was originally expected by yearend 2024, then management commented it was “5-6 weeks away” during the December 10th UBS conference presentation. I’m anticipating the spin sometime in Feb 2025.

Starz business model…

Starz is a primarily domestic streaming service with 80% of subscribers in North America and the 10th largest streaming service in the US (data a bit stale but still accurate).

A few reasons this business is unique compared to peers:

First, they were an early adopter in transitioning away from linear and over to streaming with 17.9m OTT subscribers (70% of total) and only 30% of subs from linear. Linear subscribers are declining a consistent 10% per year since 2018 (LGF/STRZ is a 3/31 yearend).

Programming is geared toward a very tight niche with zero desire to extend beyond core demographics (women and African-American women). Management views their product as a niche / complementary offering within the streaming market:

Because we're a focused small complementary service that we're not broadcast, we're not trying to serve everybody in the home, we are very complementary. And so the goal is to always be priced below the broad-based streamers out there.

Revenue comes entirely from subscriptions — Peers have large advertising revenue streams while Starz gets all of their revenue from subscriptions. This is important for a few reasons: 1) ad revenue is generally lumped together with linear which exposes it to a declining subscriber base; 2) ad revenue is lumpy and more macro-exposed (political years, events, etc.); and 3) ad dollars (even on streaming) are typically competing with scaled players like Meta, Google, social apps, etc.

Management has a contrarian philosophy when it comes to licensing and distribution too. While peers like AMCX are pursuing licensing deals with Netflix for financial and distribution reasons, Starz wants content exclusivity/scarcity for their app. Instead of the traditional approach to licensing older seasons, they’re pursuing distribution deals to carry their app within streaming aggregators like Hulu, YouTube TV, Roku, and Walmart’s Vizio platform. Distribution for the channel, not for the content.

What to like here…

1) Spin dynamic

Here are some reasons I like the setup going into this spin:

Arb — You can buy shares of LGF and short out LION to create RemainCo stub a negative implied value

The spin ratio is massive — LGF holders will get a tiny position relative to their LGF holding in STRZ shares (I’m hoping this gets clobbered out of the gate)

Microcap — At 3-6x EBITDA, the implied market cap would be $50-600m (huge range!)

Little fanfare — Minimal coverage/discussion, no capital markets day, no flashy presentation, no multi-year guidance/outlook… this feels very under-the-radar

Tons of complexity — Again, the prospectus is nearly 1,000 pages long… it took me a while to figure out the share count structure going into and coming out of the spin

Starz was captive within the studio business and therefore economics / cash flows were funneled to the larger and higher multiple studio business. Much of this will unwind over the next 1-3yrs leading to higher cash flow and margins for Starz.

2) Fundamental inflection

This feels like another COVID hangover story where demand spiked in 2021-2022 and fell in 2023-2024; we’re still waiting for a “normal” year of operations. Here’s a look at segment results between Studio and Starz (Media) within LGF:

Revenue is very stable (though not growing) and earnings are mostly stable following a big drop from 2018-2019 to 2020-2021 (OTT transition). Intersegment mainly represents the business flowing from Media over to Studio. FY25 (3/31/25 yearend) guidance calls for $200m OIBDA and OTT subscriber count growth in 2H25. Stable and inflecting.

If you skip to the Starz carve-out financials, things look a little dodgy — falling revenue, big impairment losses, restructuring charges, discontinued ops, etc.

Much of this came from closing down their international business (disc ops in the picture above), impairing all goodwill from the original LGF acquisition of Starz back in 2016, and writing down content overspend from COVID years.

1H25 results paint a picture of improvement — revenue is up (pricing), restructuring and impairment charges done, OIBDA growth ($74m vs. $58m) — it looks like much of the heavy lifting was done pre-separation:

Formal guidance is $200m FY25 OIBDA and OTT subscriber growth in 2H25. The unofficial guide is 1-3% top line growth and margin improvement from 15% to 20% over the next few years.

Cash flow inflection…

This is a huge piece of the thesis. Cash flow was strained within LGF as Starz funneled content production to the higher multiple studio business.

Management thinks a normal year of content spend should be $600-700m vs. $850-900m annual spend from FY22-25:

That’s a ton of FCF getting consumed into new content when annual content expense on the P&L is running $630m annually.

What would FCF look like at that $700m level? I get $125m during the TTM period:

So we have $0.50/share of normalized FCF at $700m per year in content spending ($7.50/share on post-spin count). This is just highlighting the annual cash spend, not the price paid for content which is another lever to pull.

Overall, we should see subscriber stability, improved cash flow, and a return to growth.

3) Earnings upside

We’ve already covered the normalizing content spend which will mainly impact cash flow and not earnings. Management is targeting OIBDA margin improvement from 15% to 20% over the next few years. (Current $200m OIBDA guide on $1.4bn revenue = 15%).

Where does that earnings improvement come from and is it achievable?

Lower content costs — shifting spend away from LG Studios should net $40-50m savings (see CEO comments on content spending)

Pricing — Likely not a short-term lever given the recent increases (see comments from business model section on management’s philosophy of holding their “price gap”)

Bundling/distribution — Less than 1% of revenue from bundles today but a large opportunity as streamers like Hulu, YouTube TV, Vizio act as platforms aggregating channels as opposed to channels themselves.

M&A — Management is targeting tuck-in deals of neglected brands that align with their key demos.

I do think there's an opportunity once we separate, once we have our own balance sheet and a currency to go out and acquire some of those linear assets that I don't view as linear assets, but I view them as ad-supported content that sits at our demo that's surrounded by linear cost that I already have.

So I do think there's an opportunity to expand the revenue base away from SVOD to have an AVOD and an SVOD that focuses on the demos that we have through a little bit of an M&A.

Last comment on what I like here… Starz will be led by CEO Jeff Hirsch, a 15-year cable veteran and former Time Warner Cable marketing executive. He’s led Starz as CEO since 2019. Although the results within LGF aren’t amazing, it sounds as though the strategy is dialed in…

this is a hard business, right? It's even harder today based on the disruption, and it's very hard to do 100 things well. And so things that you can't focus on that you made are actually great opportunities for us that we are focused on.

What are shares worth…

Net debt is expected to be $600m at time of spin, so if the implied equity value is zero, then this is trading at 3x OIBDA right now. Management expects OIBDA to convert into unlevered FCF at a 70% clip = $140m. With interest at $11m per quarter that’s $95m FCF per year or $0.38/share (close to my normalized estimate).

Peer valuations vary widely since the bigger players have more diverse businesses (DIS, CMCSA, WBD, FOX). Generally, they trade at 4-7x EBITDA with a good amount of leverage.

AMCX is the easiest reference point since they’re smaller and have similar leverage — I’ll use their 4.4x EBITDA multiple as a base case valuation for STRZ. That would imply $1.20/share pre-spin or $18/share post-spin.

Why does STRZ deserve to trade at a premium despite a similar leverage profile of 3x? Remember, STRZ generates 100% of sales and earnings from subscriptions; AMCX gets 1/3 from subscription revenue and 2/3 from linear + ads + licensing. With that model, Starz will have much more flexibility pursuing growth.

Here are some share prices using 3-6x multiples at $200m and $250m annual OIBDA:

A 5-6x EBITDA multiple would put shares somewhere between $1.60-3.00 on pre-spin share count ($24-50/share post-spin). This is ignoring any future capital allocation, deleveraging, M&A, buybacks, etc. The only capital allocation commentary we’ve seen is getting leverage down from 3x to 2.8x which might be 1-2 quarters out.

Frankly, Starz looks like a good takeout candidate themselves.

Summing it up…

Here’s the summary pitch straight from CEO Jeff Hirsch:

It’s a simple thesis — differentiated business neglected within larger company, profitable and cash-flowing with several upside levers over the next few years.

Where I’ve been racking my brain is how to approach this. Do you buy shares of LGF and just sell LION shares after receiving them? Do you buy LGF and short LION for just the STRZ stake? Not easy to accomplish when you need $7 for every 1-5c of STRZ position. Or do you wait and see if STRZ sells off post spin?

I’m going down each path — Purchasing both LGF/A and LGF/B while shorting some LION but not all exposure. I’ll wait for the spin to see what happens to STRZ shares and hopefully add at better prices.

What am I missing here?

Disclosure: I own shares of LGF/A and LGF/B and I’m short LION

Resources:

Considering this CPPIB lawsuit I would think from r/r view would be somewhat better to take a position once it all shakes out. This could make the spin completion linger for a while, no? https://www.bnnbloomberg.ca/business/company-news/2024/08/27/lions-gate-sued-by-pension-fund-seeking-to-block-starz-split/

Isn't the obvious move to buy LGFA and short your LION exposure? I don't understand your comment "to you buy LGF and short LION for just the STRZ stake? Not easy to accomplish when you need $7 for every 1-5c of STRZ position." Today I can buy 100 shares of LGFA for $825. I can short 112 shares of LION $817.60. This implies that I'm paying $7.40 for 100 shares (pre-split) for LFG RemainCo / Starz. This works out to $0.074 per share. If you are right with your analysis (I think it's right), LFG RemainCo / Starz is worth $1.50-$3.00. And you are buying it today for $0.074. What am I missing?