Quick Value #261 - Ziff Davis (ZD)

Ultra cheap digital media and subscription business (4x EBITDA / 6x FCF); capital allocation starting to inflect

Today’s idea:

Conglomerate of old school internet brands

Capital allocation inflection underway

Shares down 70% from 2021 peak

Trading at 4x EBITDA / 6x FCF

These write-ups are surface scratchers meant to keep your idea generation flowing. For newer subscribers, check out the VDL “home base” for background info, links to key resources, articles, trackers, etc. As always, leave a comment with thoughts or stocks you want to see covered and check out past posts here to get a flavor for recent write-ups.

Quick Value

Ziff Davis (ZD)

Today, I’m revisiting an idea I looked at ~2 years ago. Why? Partly because shares are down ~57% from that write-up and partly because it has an incredible combo of low valuation and high margins.

What they do…

Ziff is a technology conglomerate of sorts. They own a collection of internet brands across several verticals.

Brands include: CNET, PCMag, RetailMeNot, IGN, MOZ, downdetector, VIPRE, and many others (too many to list them all so I’d suggest skimming the 10-K). These brands are grouped into 5 verticals thanks to new segment reporting as of 2024:

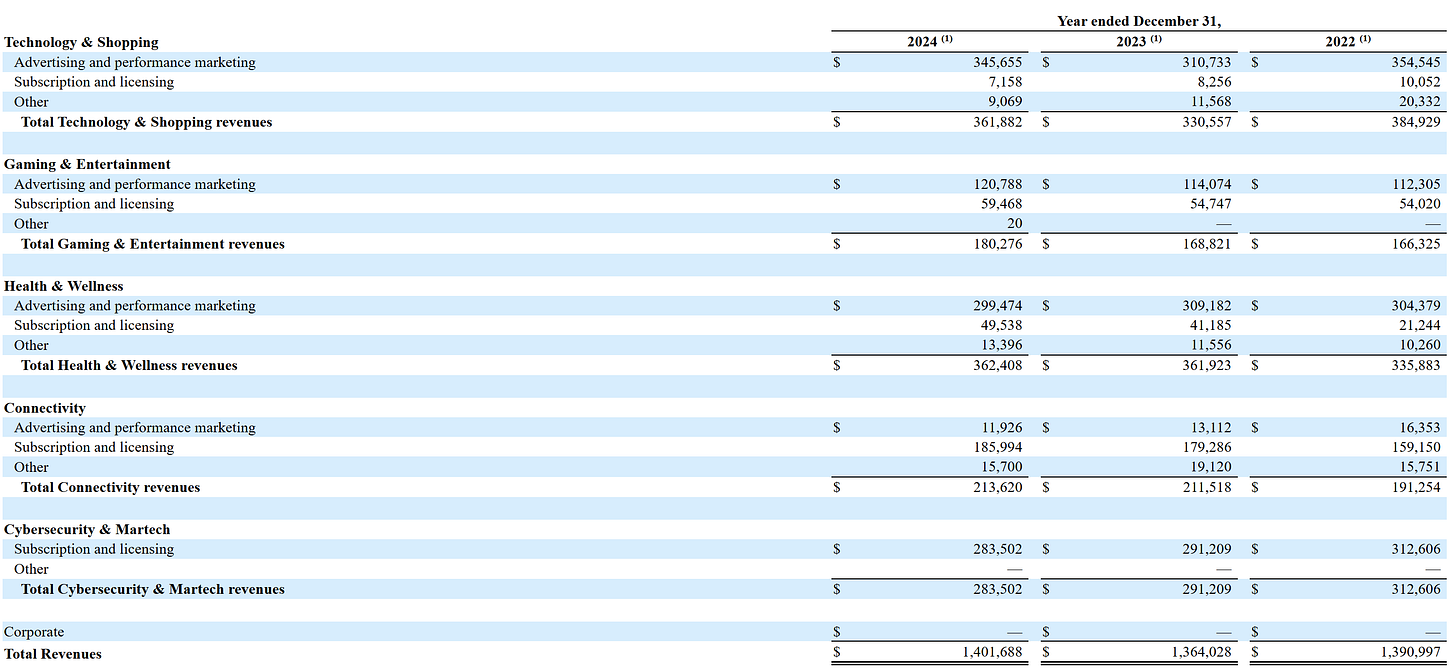

Gaming and Connectivity segments have been the most consistent growers while Technology & Shopping and Health & Wellness are the largest by revenue.

Revenue comes mainly from: 1) advertising and clicks on their sites; and 2) subscription fees and licensing income. These are very high margin revenue sources. Thanks to new segment reporting, we’re given all sorts of additional disclosures — most of the subscription revenue comes from Connectivity and Cybersecurity (i.e. Ookla, VIPRE, MOZ):

Acquisitions are a big part of the Ziff Davis playbook:

From 2012 through 2024, we have deployed approximately $3.3 billion on more than 90 acquisitions.

Acquisitions broadly fall into one of two categories at Ziff Davis: (1) tuck-ins or (2) platform acquisitions. Our tuck-in acquisitions are typically focused on the acquisition of: (a) a customer base, (b) a strong but under monetized media audience or (c) a new product or service that can be sold to our existing customers or audience.

Why it’s interesting…

When I looked at Ziff in Feb 2023, it was trading at $93 per share with a clean balance sheet and some COVID tailwind (everyone at home skimming the web). At the time, shares were trading at 9x EBITDA and 14x earnings which felt inexpensive, but not exciting for a serial acquirer of old school internet media and subscription brands.

Now, with shares cut in half and relatively stable revenue and earnings/FCF, the situation looks a bit more compelling. From 2021-2024, revenue and EBITDA are virtually unchanged at $1.4bn and $490m.

Anyone can look good using adjusted EBITDA, but this business converts FCF at a high clip. FCF was $230m, $211m, and $284m in 2022-2024. That’s 45-60% FCF conversion from EBITDA. With 42.9m shares outstanding, $284m FCF is $6.62 per share on a $40 stock (6x).

So part one is a massive re-rate lower in this business. It’s the same story regardless of valuation metric.

But why is valuation down if fundamentals are stable?

Part of that valuation gap might be the nature of these businesses. I look at some of these brands and question what they’ll look like in 5-6 years. Digital media business models are fleeting at best. It’s hard to quantify this risk aside from acknowledging Ziff probably deserves to trade at a discounted valuation of some kind.

Another reason for the value disconnect probably stems from the acquisitions. They tout the $3.3bn spent on 90 acquisitions since 2012, but this company is a <$2bn EV today which doesn’t scream M&A value creation.

Better yet: they’ve spent $331m on acquisitions from 2022-2024 and during that timeframe they took $169m of impairment charges. Also during that timeframe we have revenue and EBITDA completely flat. Hmm…

So what if we included acquisitions as part of capex? If they need to spend this money just to run in place, it seems like a fair approach. That would bring 2024 FCF to $173.3m or $4/share which makes the stock a much more reasonably priced 10x FCF.

So what’s the upside?

I’ve already covered the valuation reset which gives me the sense investor expectations are fully aligned with “this business may not be around 5 years from now and acquisitions may not be creating value.”

But…

Growth is coming back — Q4, full year 2024, and 2025 guidance all have solid revenue and earnings growth (though partly from recent acquisitions)

Capital allocation going back on offense — it looks like management took a hiatus from 3Q22 to 4Q23 and throughout 2024 they’ve been getting increasingly aggressive on M&A and buybacks… share count is down 10% and they’ve added >$200m in acquisitions over the past year alone

As a bonus, guidance reflects zero incremental M&A or buybacks which is suspect. At >$200m annual FCF, it seems unlikely there won’t be some of both.

A quick and dirty valuation exercise — $520m is the 2025 mid-point EBITDA guide. I’ll use 8% capex on $1.5bn revenue ($120m), $15m interest expense, and $25m annual acquisition/integration costs. With depreciation at $200m and a 25% tax rate, cash taxes should be $70m or so. Add it all up and you get $290m FCF or $6.75 per share. Using 8-10x multiple = $54-68 per share vs. $40 today. Maybe capital allocation could add $3-4 per share to that target in the next year alone?

Summing it up…

This name is getting pretty interesting and I like the ramp up in capital allocation. Buying “just because it’s cheap” hasn’t been a good strategy here as this thing slowly drifts lower, but maybe it’s getting close to an inflection point and capital allocation is the catalyst to get things moving?

With markets tanking, my watchlist is overflowing lately and this one is definitely on the extreme end of the valuation spectrum at <4x EBITDA and ~6x FCF.

I don’t own shares yet but might do a bit more work to better understand each of these businesses. If you’ve done work on this name, let me know what you think!

Resources:

We share lots of thoughts on the stock. I have a writeup coming for it this week and would love to get your two-cents

Nice write up. I just worry that without an inflection or catalyst they continues to pump $'s into m&a just to (like you say) run in place. Likely that's what the market is thinking. An activist might be needed here to filter & refine their m&a strategy & push more towards buybacks. That said perhaps without the m&a they don't generate enough fcf to ramp the buybacks.