Quick Value #265 - Amrize (AMRZ)

Upcoming spin-off in the cement, aggregates, building supplies industry

Today’s post:

Holcim will spin-off North American cement, aggregates, building supplies business in 1H25

Fundamentals representative of a high quality business (27% EBITDA margins, >50% FCF conversion from EBITDA, growing)

A look at some valuation scenarios and the investor day presentation

For newer subscribers, check out the VDL “home base” for background info, links to key resources, articles, trackers, etc. As always, leave a comment with thoughts or stocks you want to see covered.

Quick Value

Amrize (AMRZ)

Holcim is a global cement producer trading in Switzerland and today I’m looking at the upcoming spin-off of their North American business to be named Amrize. The spin is expected by the end of 1H25.

What they do…

Amrize is the largest provider of cement in the US and Canada (both sales and production volume) and a leader in roofing, wall systems, aggregates, and ready-mix concrete.

There are 2 segments —

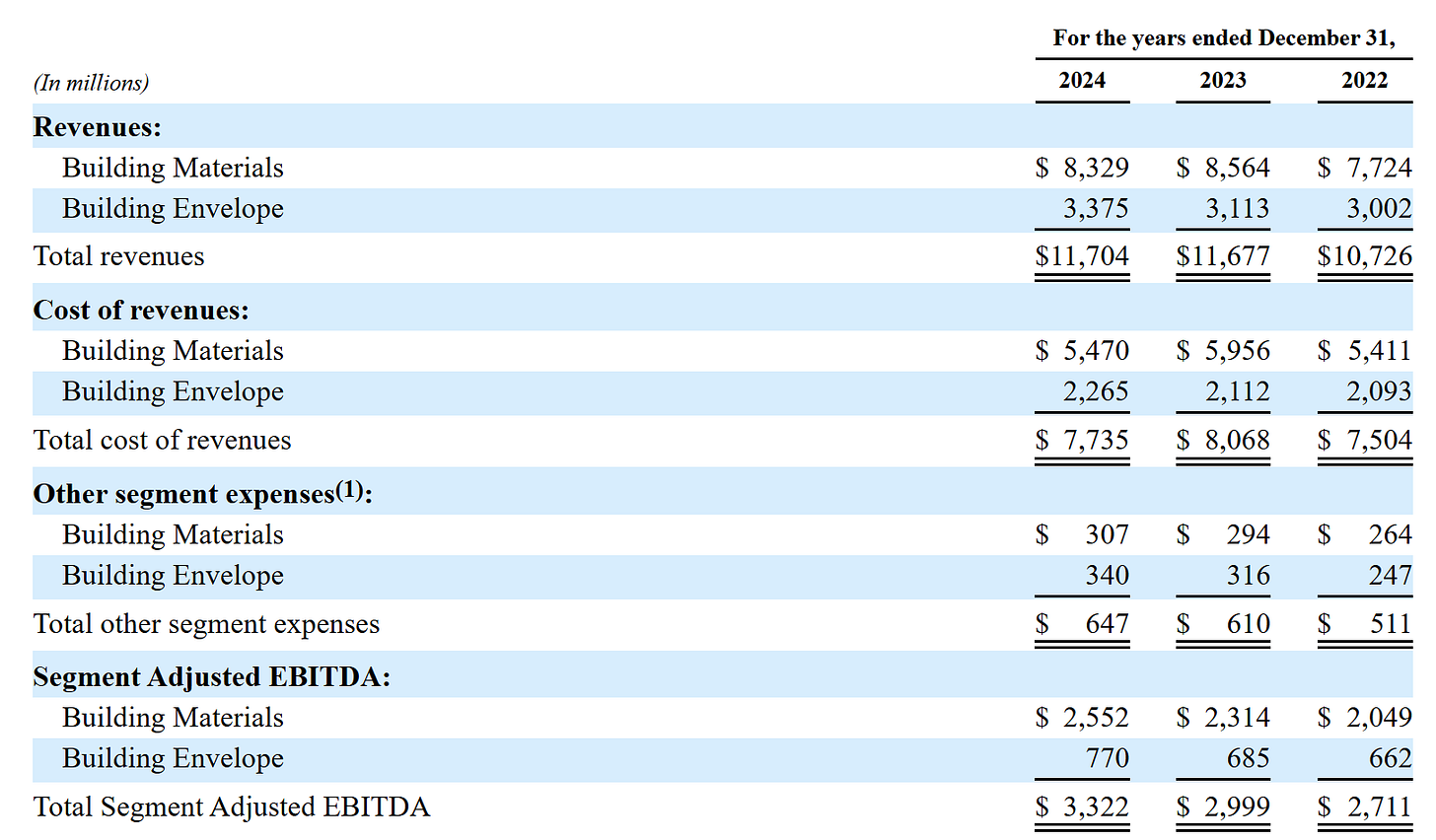

Building Materials — $8.3bn revenue / $2.6bn EBITDA — Cement, aggregates, ready-mix, asphalt, etc.

Building Envelope — $3.4bn revenue / $770m EBITDA — Roofing and wall systems (single-ply membranes, insulation, shingles, sheathing, protective coatings, adhesives, tapes, and sealants).

Building Materials is split roughly equally between cement and aggregates. Mining reserves are 71 years and 46 years apiece. These are still pretty fragmented markets with the top 5 operators having only 37% share of aggregates and 19% share of ready-mix concrete.

Building Envelope is a relatively new platform within Amrize built via 7 acquisitions starting with Firestone Building Products in 2021. Management touts $200m total capital deployed (organic and inorganic) on this $770m EBITDA segment.

On a combined basis, the business mix by end-market is 49% commercial construction, 28% infrastructure, 23% residential construction and 56% new construction, 44% repair and remodel (R&R).

Why it’s interesting…

Amrize has the financial backdrop of a very high quality business with a long runway for acquisitions and maybe another spin-off down the road.

A quick look at fundamentals show:

Revenue growth (13% CAGR from 2021-2024)

EBITDA growth (16% CAGR)

Margin expansion (25% to 27%)

Excellent FCF conversion (>50% EBITDA to FCF)

Consistent GAAP net income with minimal add-backs

[Side note: I wish every spin-off would present a clean 4-year summary view of financials like this one… we have a clear picture of EBITDA, segment performance, margin performance, net income, and cash flow + conversion.]

The underlying businesses have #1 or #2 positions in each market with solid growth prospects in part from federal spending programs but also aging infrastructure.

Amrize is the leader in cement by a wide margin with 1.7x the production volume of the next biggest competitor. Aggregates are a $4.2bn revenue business which ranks them 3rd in that industry behind VMC and MLM. Relative to other building suppliers, these businesses look less impacted by a pandemic demand spike… pricing steadily increasing without a period of “supernormal earnings” (i.e. like at ATKR).

Building Envelope is a roofing business that looks like a close peer to BECN which is being acquired at a big multiple. Total addressable market is $60bn annually with management focused exclusively on roof / walls. This thesis is driven by aging commercial buildings (75% are 25+ years old) and residential repair and remodel spending.

Outlook

Over the next 4 years, management is targeting:

5-8% revenue growth = $14-16bn by FY28 ($11.7bn FY24)

8-11% EBITDA growth = $4.3-4.8bn ($3.1bn FY24)

50% FCF conversion = $2.2-2.4bn ($1.7bn FY24)

These are impressive considering the state of new construction markets. Infrastructure looks best positioned with federal funding but on the commercial side, the ABI (architecture billings index) has been below 50 for a few years running. This is a leading indicator of new commercial construction.

Management didn’t explicitly call out how much acquisitions would contribute to those numbers but they’ll be a big part of future capital allocation. Since 2018, Amrize made 35 acquisitions (28 in aggregates and 7 in BE segment) which contributed $3.8bn revenue. That’s roughly a third of today’s revenue coming from M&A during the past 6 years and >60% of FCF allocated to M&A.

What about valuation?

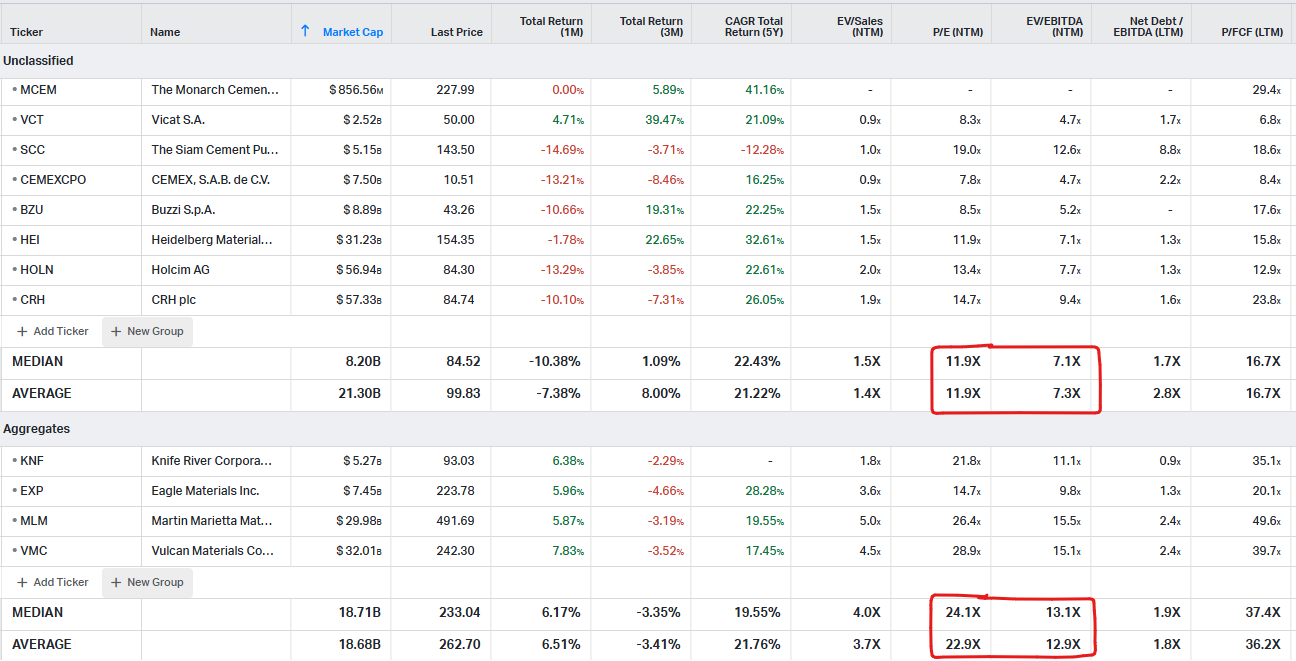

Global cement peers are trading at 12x earnings and 7-7.5x EBITDA while US aggregates are at 22-24x earnings and 13x EBITDA. Building suppliers (not shown) are all over the place from 6-12x EBITDA.

Here are some basic valuation scenarios using 553.3m shares outstanding and $2.58bn net debt per the Form 10 filing. It’s a wide range using a combination of cement, aggregates, and building supplier peers.

Summing it up…

I’d be interested in this at a price below $40 per share but I’d be surprised if it trades there. Realistically, I’d expect to see this come out around $50-70 per share which would be 16-20x FCF and 9-12x EBITDA.

Lastly, I find it interesting that Holcim flipped the switch into acquisition mode starting in 2021 after a long stretch of virtually no acquisitions. So far, the fundamentals look good but there’s always the possibility of acquisition mistakes when moving this fast. Here’s a look at cumulative pre-spin M&A spend since 2013:

Will check back when shares begin trading! Thanks for reading!

Resources: