Quick Value 3.13.23

Underfollowed small cap run by activist investor

Last week’s Quick Value on DigitalBridge (DBRG) was a free Quick Value so this week we’re back to paid subscribers. As a reminder, these Quick Value posts are meant to be a jumping off point for the idea generation process…

There are some very interesting ideas popping up with the Russell 2000 selling off pretty hard last week so I’ll try to keep up with my growing watchlist. Today’s stock is a pretty interesting off-the-run small cap without any coverage and no earnings calls (pretty strange for a $700m company).

If you’re already subscribed, enjoy. If not, hit subscribe for all weekly Quick Value posts and ongoing coverage of ~30 stocks.

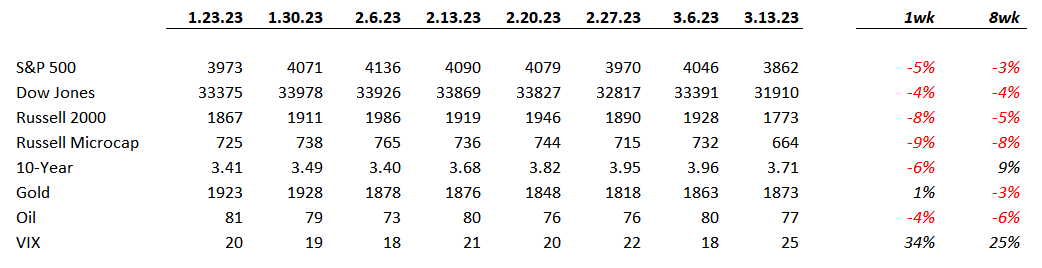

Market Performance

Market Stats

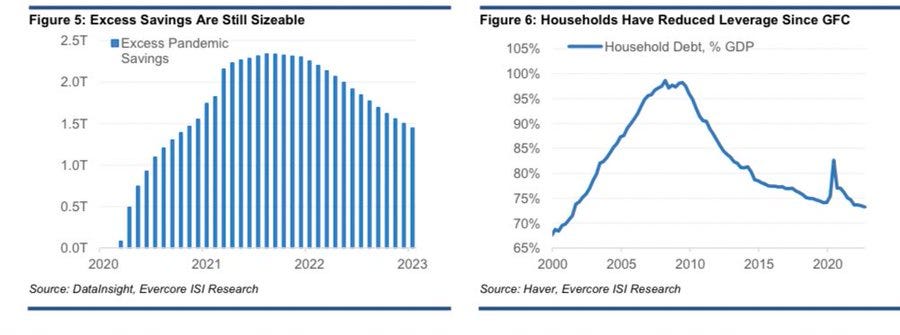

Excess savings still sizeable and could lead to more equity upside (per Evercore from @CarlQuintanilla tweet)

Quick Value

Innoviva Inc ($INVA)

I can’t recall exactly how this one made my watchlist but I think it might have been a generic screen for highly cash generative companies, and of course a flatlining chart like this gets me excited.

What they do…

INVA was a spin-off back in 2014 when Theravance split their biotech assets and royalty portfolio into separate companies. Today, INVA is a collection of royalty assets on drugs from GSK. Recently they’ve begun making investments into operating companies.

There are also a handful of equity and debt investments to other healthcare/pharma businesses on the balance sheet. I would call INVA a holding company of 1) a royalty portfolio; 2) activist healthcare investments; and 3) pharmaceutical operating businesses.

Why it’s interesting…

1) Ownership / management / investments

Sarissa Capital, an activist hedge fund in the healthcare space, owns ~10% of the company and current CEO Pavel Raifield came from the Sarissa investment team before taking the CEO job in May 2020. So we have a relatively new management team installed from an activist hedge fund investor.

Taking it a bit further, this has essentially become a controlled entity for Sarissa… In 2020, INVA sent $300m to Sarissa to invest in healthcare/pharma stocks.

Cash and investments balance grew from $129m in 2017 to $694m in 2022. We can see a big chunk of that invested in Sarissa’s fund and several smaller equity and debt investments in other businesses.

2) Business transition

It looks like management is shaking up the portfolio lately.

First, they sold a royalty asset in 2022 for net proceeds of ~$250m (now down to 2 royalty assets).

Then, they repurchased a block of 32m shares held by GSK for ~$400m — over 1/3 of outstanding

Next, they made 2 acquisitions of operating businesses — the first, La Jolla Pharmaceuticals, has commercialized products; the second, Entasis, is pre-revenue.

That’s a pretty balanced capital allocation mix including selling ($275m), buying ($400m), and share repurchase ($400m). And while INVA was solely a stream of royalty income with a small back office team and no R&D; now they have a fully functioning pharmaceutical business with a salesforce and R&D team. This is a big shift for the company.

3) Cash flow profile

During the 6 year period from 2017-2022, INVA generated $1.3bn in FCF (net of non-controlling interest payments) vs. today’s market cap of $730m. Where did that cash flow go?

$500m into repurchases

$478m into investments

$207m debt repaid

$215m into acquisitions

$250m generated from divestitures

Cash flow comes from their royalty portfolio. The 2 main products sold by GSK have been relatively consistent over the years and enjoy patent protection until ~2030 (with some secondary patents that run beyond that).

The royalty stream from Breo/Anoro seem to be doing ~$250m per year on average (from 2017-2022) so if they have another 5 years at $250m = $1.5bn royalty income from this portfolio. Beyond that, it’s likely those drugs continue to produce some level of cash but perhaps at 1/10th the average.

Understanding the cash flow profile of newly acquired La Jolla/Entasis will be another matter. Management commented during a recent investor presentation that La Jolla is operating at breakeven while Entasis is burning cash… a few new product launches are on the horizon in 2023-2024 but this is difficult to handicap.

Final thoughts…

This isn’t a typical operating business with earnings to slap on a PE multiple and call it a day. The royalty portfolio will lose exclusivity at some point in the next 5-10 years and cash flow will fall dramatically. Until then, management will have a huge slug of cash to deploy… likely well in excess of the current market cap.

Having an opinion on this stock is akin to having an opinion on management/Sarissa and what they plan to do with the capital. It reminds me of SWKH which was a specialty lender to small pharmaceutical and biotech companies.

I’m really intrigued by this one because Sarissa/management have plenty of incentives to be successful and they seem to know the healthcare industry extremely well. It’s an odd/unique collection of assets that won’t get a lot of attention (they don’t even hold earnings calls). So it boils down to whether you can trust them to spend the next few years’ worth of cash flow…