Quick Value 4.10.23 ($MDU)

Utility breaking up - spin/sale of non-utility businesses coming soon

Today’s post highlights an interesting special situation in the utility sector with a fast approaching spin/sale of some unrelated businesses…

I’m always looking for Quick Value suggestions and had a few good ideas come through Twitter — leave a reply if you have a stock to add to the list!

Subscribe below for access to all Quick Value posts and other writings:

Market Performance

Market Stats

Big caps still valued at a premium to history and mid/small caps

Growth vs value multiples have been converging lately

Quick Value

MDU Resources ($MDU)

This stock found it’s way to my watchlist after their Form 10 filing to spin off the aggregates segment, Knife River. There’s a good writeup on VIC from Feb 2022 that covers the business in detail.

What they do…

MDU is a conglomerate with 4 lines of business:

Regulated utility — Gas and electric utility serving the Dakotas, Montana, and Wyoming.

Natural gas pipeline — 3800 miles of nat gas pipeline serving Northern US states including the regulated utility.

Construction services — Construction, electrical, and mechanical work mostly to utilities but also serving manufacturing, transportation, industrial, etc. customers.

Construction materials — Mines and sells aggregates (stone, sand, gravel, etc.) and construction products like asphalt and ready-mix concreate.

A quick look at revenue for each segment:

This infographic is a bit detailed but highlights 2022 performance and the 2023 outlook for each segment. In sum, each segment has a positive outlook going into this year.

Why it’s interesting…

1) Breaking up

Activists are pushing the company to break up the largely unrelated business units. A spin off is nearing completion and options (sale or spin) are still on the table for the construction services segment.

For starters, the Form 10 has already been filed for Knife River (construction materials) and the spin should wrap in 2Q23. Materials peers VMC, MLM, and EXP trade at big multiples, close to 15x EBITDA. (There are likely reasons for the discount to EXP that I’m unaware of at the moment.)

Knife River is a stable but unremarkable business, at least within MDU that’s been the case. It will be spun with ~$660m net debt. EBITDA was ~$300m in 2022 including some pro-forma adjustments for the spin-off.

These are capital intensive businesses with depleting reserves (similar to oil producers) yet trade at high multiples. At 12-14x EBITDA, a slight discount to peers, SpinCo is worth $3.6-4.2bn or $14-17/share.

2) Activist involvement

Activist investor Corvex Management owns ~5% of the company and had success with a similar playbook at regulated utility Exelon (which spun off their nuclear-fueled merchant power business Constellation Energy). MDU is the 2nd largest position in the Corvex portfolio at a ~17% weight.

3) Stub valuation

It’s important to review these situations pre-spin to get a sense for where the mispricing opportunity might lie (if any).

MDU has 204m shares outstanding at $30/share = $6.1bn market cap. Net debt is right around $3bn for a $9.1bn enterprise value.

If the Knife River spin comes out at a high multiple, say 12-14x EBTIDA or $3.6-4.2bn, then we’ll get shares of the stub at a very cheap valuation, $4.9-5.5bn or 8.2-9.2x EBITDA.

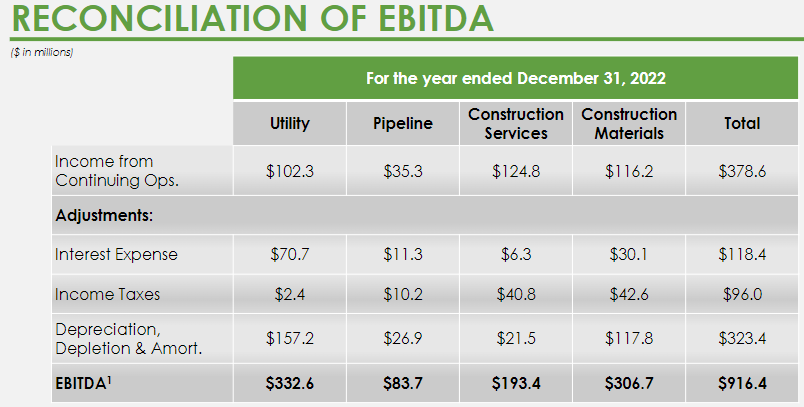

Utilities typically trade at 12x EBITDA or more given the regulated nature of those businesses. Construction services peers vary a bit more but generally call it 8-9x EBITDA. Here’s a breakdown of segment EBITDA for 2022:

So we have:

$415m utility/pipeline EBITDA at 12x = $5bn

$193m construction services EBITDA at 8-9x = $1.5-1.7bn

$300m materials (SpinCo) EBITDA at 12-14x = $3.6-4.2bn

I get an equity value of $7.1-7.9bn, or $35-39/share, after backing out the $3bn net debt. Not crazy undervalued from today’s price. Note that the math above implies $21-22/share for RemainCo and $14-17/share for SpinCo.

Summing it up…

I’m tempted to own something like this pre-spin and then make a decision to reallocate once I receive each stock. I don’t like banking on a high multiple business trading near fair value into a spin-off given the unseasoned nature of these securities.

The right way to watch this one might be to sit back and observe initial trading. I’d much rather buy RemainCo at an implied $13-16 when it might be worth $21-22 without having to deal with the materials business. On top of that, there’s some “bonus” opportunity in what happens to the services business.

This one will stay high up on the watchlist for now…