Subscribe to the premium newsletter for coverage of portfolio holdings:

Or, check out the database of value investments:

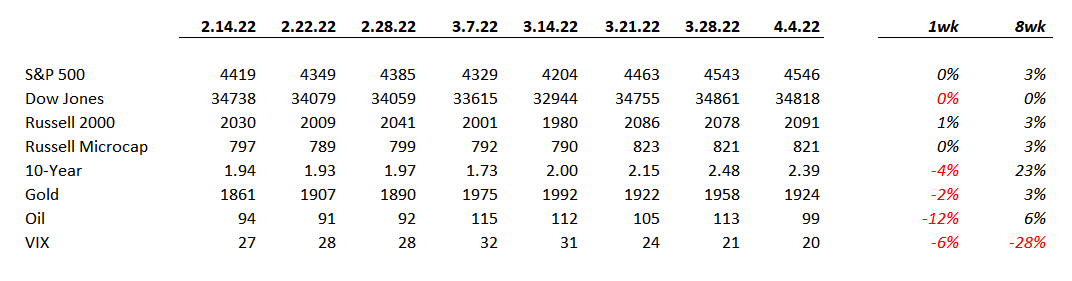

Market Performance

Market Stats

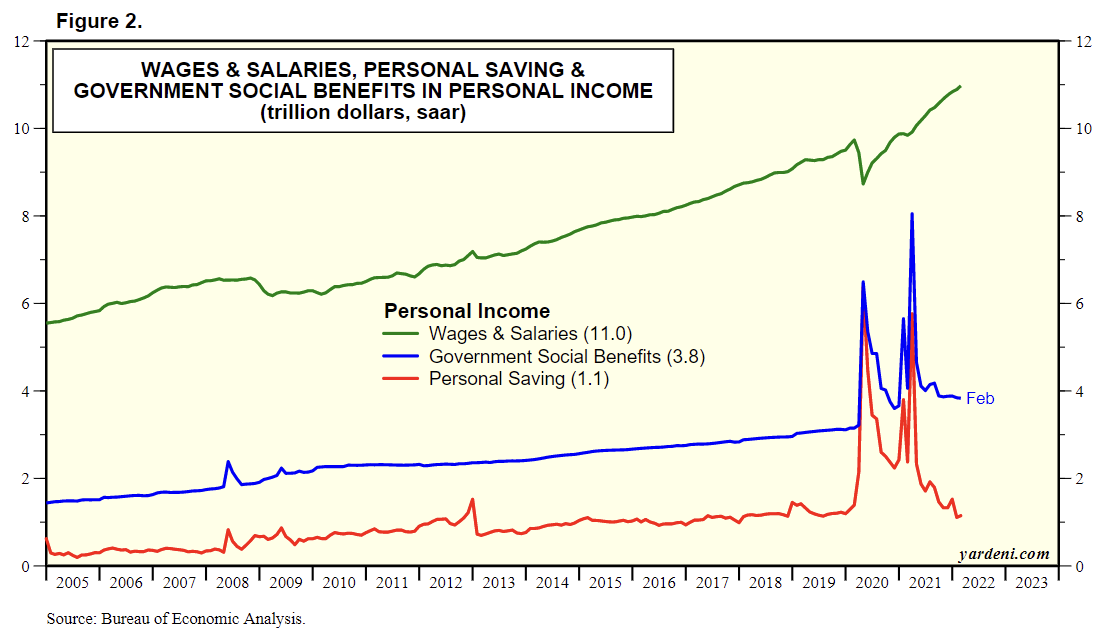

Personal savings rate dropped to 6.3% and is now running below 2013-2019 average of 7.3%

…but not because wages are lower!

…rather it seems we’re all spending madly…

Quick Value

Perrigo ($PRGO)

I’ve been reading Capital Returns lately and it has me thinking again about the pharmaceutical industry with supply / demand changes. Long story short, capital has been fleeing the generic drug industry and returns have been poor for many years.

Perrigo has gotten lumped in with the generics group despite making huge changes in the business mix over the past few years, culminating the the 2021 sale of the remaining generics drug portfolio…

Today — PRGO is purely a consumer business of over-the-counter (i.e. not prescription) drugs. Products ranging from pain relievers, baby formula, face wash, and toothbrushes. Think off-brand products at your local grocery or drugstore.

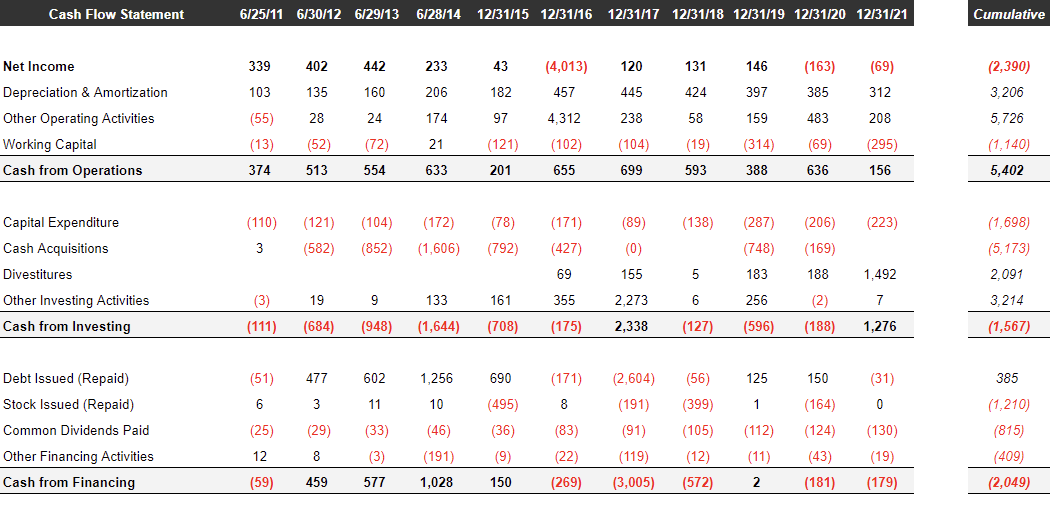

From 2013-2016 they were a levered acquirer leading up to the generic cycle peak in ~2016. Since then they’ve been mostly a seller of assets. After reloading the balance sheet, they’ve again announced a $2.1bn acquisition closing in 2022.

With the latest acquisition, they’ve essentially swapped all Rx/prescription exposure to OTC/CPG products. From a 2019 investor presentation outlining their transformation plan and taking EPS from $3.65-3.95 to the same $3.65-3.95 although with generic exposure.

I get it, pharma stocks are trading at 10x or worse PE multiples while CPG and consumer health companies are at 20x PE or better. This is a perception thing that Perrigo is aiming at.

There are 134m shares out and a $38 price = $5.1bn market cap. Net debt is soon to be ~$3.7bn following the HRA acquisition for $2.1bn. So call it an $8.8b enterprise value.

Analysts estimate $855m in 2023 EBITDA which would make a 10x+ EBITDA multiple and 4x+ leverage. Management hopes to get leverage down to 2-2.5x by 2025.

A couple of positive and negative comments on the situation that make it interesting and maybe worth following:

Analyst estimates call for $3.38 in 2023 EPS so expectations are clearly that the company will miss the $3.65-3.95 targeted earnings by 2023

The stock has gone nowhere since 2019 (and the last 10-15 years for that matter) but it isn’t a falling knife

Several large competitors are spinning off consumer health businesses — Glaxo and J&J most notably

PRGO sold their generics business at a low multiple (<9x EBIT) in exchange for a OTC business at 18x EBITDA — this seems silly in an attempt to chase a higher multiple when

PRGO has outperformed generics but still wildly underperformed the overall market entirely throughout this “transformation” process

Perrigo is an OTC/CPG business (with few if any #1 brands?) trading at ~11x earnings and 4x+ leverage but improved revenue growth (guiding 7-8% organic growth in 2022).

Perhaps management is building something that could be acquired by the newly spun Glaxo/J&J consumer health units?

Interesting. Is there a supply vs demand forecast for the generic pharma market? Didn’t think generics were that cyclical, but way outside my lane.