Quick Value 5.10.21 ($PM)

Phillip Morris - International tobacco giant at 16x earnings

Market Performance

Market Stats

Payrolls rose 266,000 in April which was a far cry from the 1m or so expected…

Quick Value

Phillip Morris ($PM)

Phillip Morris was spun off from Altria in 2008 as the international operations for the Marlboro brand… All revenue comes from foreign markets and the EU represents some 37% of total sales.

Here are some excerpts from the 10-K…

We are a leading international tobacco company engaged in the manufacture and sale of cigarettes, as well as smoke-free products, associated electronic devices and accessories, and other nicotine-containing products in markets outside the United States of America. In addition, we ship versions of our Platform 1 device and consumables to Altria Group, Inc. for sale under license in the United States, where these products have received marketing authorizations from the U.S. Food and Drug Administration ("FDA")… Reduced-risk products ("RRPs") is the term we use to refer to products that present, are likely to present, or have the potential to present less risk of harm to smokers who switch to these products versus continuing smoking. We have a range of RRPs in various stages of development, scientific assessment and commercialization. Because our RRPs do not burn tobacco, they produce an aerosol that contains far lower quantities of harmful and potentially harmful constituents than found in cigarette smoke… Our cigarettes are sold in more than 175 markets, and in many of these markets they hold the number one or number two market share position. We have a wide range of premium, mid-price and low-price brands. Our portfolio comprises both international and local brands and is led by Marlboro, the world’s best-selling international cigarette, which accounted for approximately 37% of our total 2020 cigarette shipment volume.1

At $97/share, PM is a $150bn company trading at ~16x forward earnings with a small amount of leverage (about 2x debt to EBITDA).

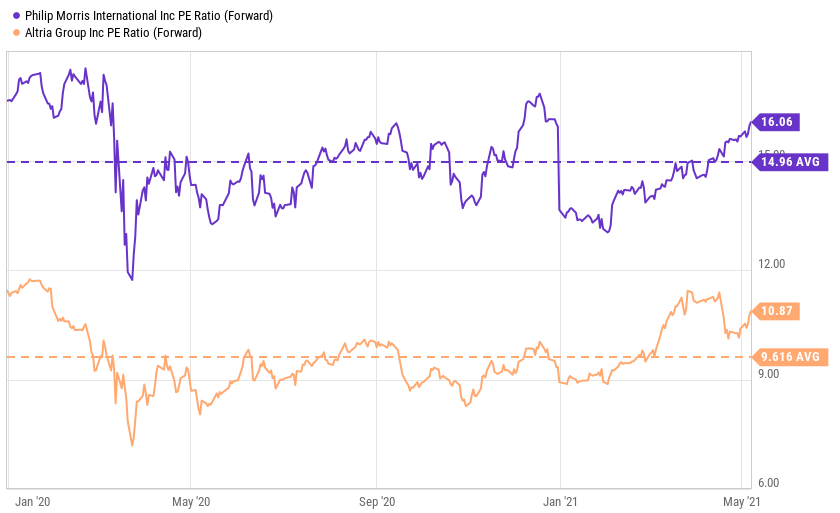

PM is entirely exposed to foreign markets but for reference, US-based Altria has historically been trading around 10x earnings — perhaps a worst-case scenario for PM?

The upside opportunity with PM lies in the “Reduced Risk Products” or RRPs as they call them which grew 22% in 2020. This category is led by IQOS, a market-leading heated tobacco product, which has 17.6m users. Management hopes to reach 50% of revenue from RRPs by 2025 vs. 24% today.

PM pays out a hefty dividend if you’re into that sort of thing. One drawback is that it leaves little room for deploying cash elsewhere. If PM is a $150bn company and generates $10bn per year in cash flow, the dividend costs them more than $7bn which leaves only a small amount of cash to reinvest or buyback stock.

On the latest investor day, management mentioned $35bn in operating cash flow over the next 3 years, a dividend payout ratio of 75%, and $5-7bn of buybacks over that period.