Quick Value 6.19.23 ($ATMU)

Filtration split-off from Cummins trading at 13x earnings

Today’s Quick Value walks through a recent split-off from Cummins — Atmus Filtration — an inexpensive stock serving on and off highway commercial vehicles.

Subscribe to the full newsletter below for access to all Quick Value reports!

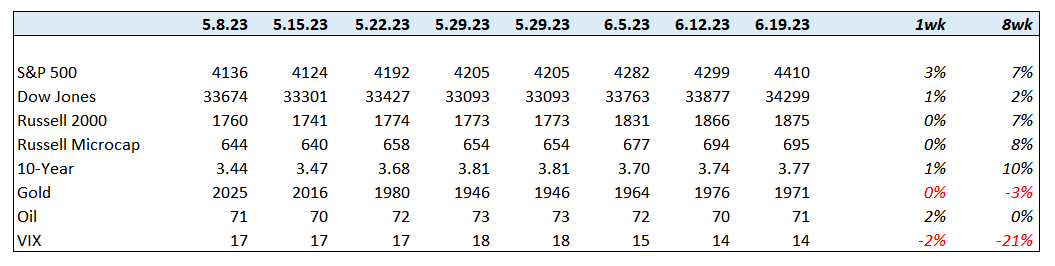

Market Performance

Market Stats

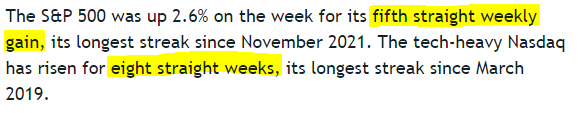

5 straight weeks of gains for the S&P 500 and 8 straight weeks for Nasdaq… This was the header from a daily Barron’s newsletter last week… I had previously commented on the precarious setup of the VIX below 14

Quick Value

Atmus Filtration ($ATMU)

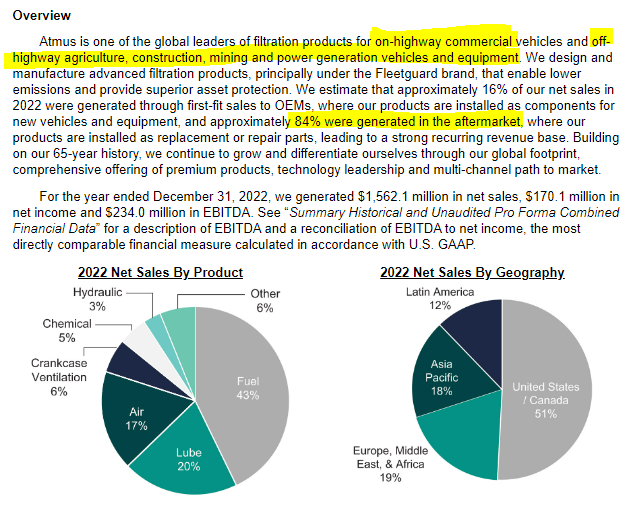

What they do…

Atmus is a spin-off (technically an IPO plus split-off) from Cummins (CMI). It fits a similar pattern to last week’s post on BorgWarner spin-off where these ICE-heavy legacy businesses are looking to shed entire businesses or revenue streams to improve their sales mix toward EV.

This is a largely aftermarket business (84% of revenue) selling a variety of filters for fuel, lube, air, etc. used in large commercial vehicles both on-highway and off-highway. Management estimates the market at ~$13bn in 2021 of which ATMU did $1.56bn (12% market share). Donaldson is a main competitor in the space with $2.1bn in their competing segment in FY22 at comparable margins.

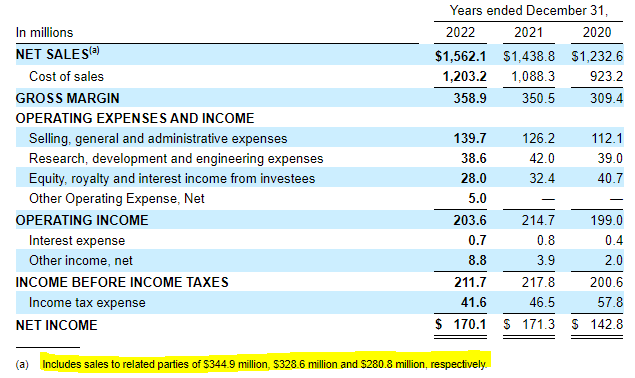

Revenue grew 13% annually from 2020-2022 to $1.6bn. Sales to parent Cummins are significant at 22%.

ATMU generates plenty of cash flow on those aftermarket sales… over the past 3 years, FCF totaled:

FY20 — $186m

FY21 — $170m

FY22 — $141m

Those figures are before any additional corporate costs as a standalone company (dis-synergies) which are estimated at $10m and before interest on the new $650m debt package (~$41m per year).

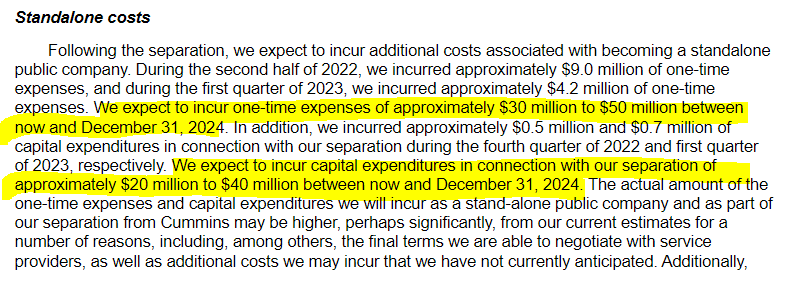

Cash flow for the rest of 2023 and into 2024 will also be hampered by some one-time standup costs as a new public company. Management is ballparking $50-90m of expense + capex impact through 12/31/24. It’s possible that cash flow will look artificially low through 2024.

On the valuation front… Cummins, an engine maker, is relatively cyclical bouncing between 10-15x earnings. Filtration comp Donaldson consistently trades at 20x earnings.

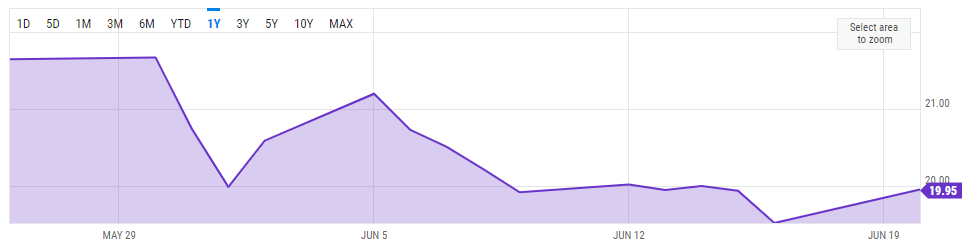

Pro-forma net income was $128m or $1.52 per share in 2022. That included some non-recurring items pushed down from Cummins but it excludes the $50-90m opex + capex items mentioned earlier. If those costs roll in evenly over the next 6 quarters, then $1.50 EPS might be a good starting point…

The question is whether shares of ATMU should trade closer to Donaldson at 20x ($30 share price) or closer to legacy Cummins at 14-15x (~$23 share price).

Is Cummins trying to shed some ICE exposure and at the same time looking at the valuation of Donaldson’s filtration business thinking Atmus could get a big uplift in valuation?

Donaldson isn’t perfectly comparable but at ~20x earnings vs. ATMU at a ~13x it’s hard to ignore…