Quick Value 9.4.23

Upcoming spin-off in healthcare sector

This week’s post is for premium subs and we’ll be back next week with a free edition of Quick Value.

Sign up below for access to all content and ongoing write-ups including: 52 weekly Quick Value ideas, 1-2x deeper dives each month, portfolio review and ongoing coverage of existing holdings. You can read a sample of the stocks I like to cover here.

There are several spin-offs coming soon and this week kicks off coverage for those that will start trading within the next 1-2 months…

Market Performance

Market Stats

Retail inventories are still rapidly increasing…

Quick Value

Sandoz Group AG ($SDZ)

Sandoz is an upcoming spin from pharmaceutical giant Novartis ($230bn+ market cap). The stock should start trading within the first week of October and they’ve already held a capital markets day highlighting the business and strategy. [Note: I took a look at Novartis in a Quick Value post nearly 2 years ago.]

What they do..

Sandoz operates in the “off patent medicines” industry which consists of Generics and Biosimilars. If you’ve followed me long enough, then you’ve likely heard a pitch on other generics makers once or twice.

The prospectus for this spin-off has a really nice overview of the industry… here’s a rehash of the important concepts:

Off-patent drugs are a $208bn industry (2022) consisting of a $186bn generics market and $23bn biosimilars market. According to IQVIA, generics are expected to grow 5% from 2022-2031, biosimilars growing 20%, and the combined market is growing at 8% per year.

Overview of Generics:

Generics are therapeutically equivalent versions of marketed branded prescription pharmaceuticals in terms of dosage form, safety, strength, route of administration, quality, performance characteristics, and intended use. Such drug products generally become available once the patents and other exclusivities on their branded original forms expire. A non-proprietary name for a drug product is also known as a generic name. Generics tend to be made available at substantially lower cost (in many cases at an estimated 80-85% discount according to the FDA) than their originator-owned brand counterparts because Generics applicants do not have to repeat animal and clinical (human) studies that would have been required for a new therapy drug. However, all Generics are required to show bioequivalence, i.e., to demonstrate the same quality, safety and effectiveness as their reference (innovator) medicines and are considered to be fully substitutable with them.

Overview of Biosimilars:

Biosimilars are lower-cost alternatives to existing and off-patent biological medical products, and are synthesized from living organisms, tissues or cells. Such products are designed to have no clinically meaningful differences in the safety and efficacy profile compared to their reference medicines, as a result of which they are considered to be interchangeable with them. They thus offer affordable opportunities for healthcare systems to expand patient access to biologic therapeutics, which are typically very expensive, thereby relieving pressured healthcare budgets. Biosimilars have a larger molecular size and more complex structure compared to small molecule Generics, adding cost and complexity to their development and manufacturing. Biosimilars development may take six to nine years and cost USD 100-300 million per candidate. A simple small molecule Generic, by contrast, can cost as little as USD 1-2 million and take approximately two years to develop. Biosimilars, albeit still a relatively new segment within the off-patent medicines industry, are typically priced at an initial list price discount of approximately 10-30% to the originator. Discount levels between each class of Biosimilars vary, primarily due to the different competitive landscapes.

I’d be remiss to skip the largest risk in this industry which is known as “price erosion” or “base erosion” — generic drugs are like an oil well, they produce good earnings in the initial years and then slowly fade away as competition enters. Say a generic maker creates the first generic drug for a recently expired blockbuster… they may be the only generic provider for a few years but eventually competitors will enter (I can’t remember the statistic but it’s something like 6-7 competitors for each drug) and prices will decline.

Why it’s interesting…

There are 3 primary reasons this (and any other Generic/Biosimilar maker is interesting today):

1) Growth outlook

First, there is a huge market opportunity of blockbuster drugs coming off patent this decade; Sandoz estimates this as a >$260bn opportunity from 2023-2027 alone.

Next, biosimilars are still a small and fledgling market. There are only 40 biosimilars currently available today and Sandoz has only 8 (total) biosimilars in their portfolio. It’s been a slow adoption in the US but that’s ramping up and has other companies like Pfizer and Teva excited. More than 70 biologic products are losing exclusivity this decade.

Guidance calls for “mid single digit” revenue growth from 2023-2028 which might sound low given the size of all those patent expirations out there… but sales have been declining for years and if 2023 actually does grow at 5%, then it would be the first year of growth since 2016. Also for what it’s worth… each competitor is calling for revenue growth inflection during that 2023-2028 period.

2) Investor expectations at rock bottom levels

This is mainly true in the form of extremely low industry valuations plus terrible sentiment. For example; I read this article from Fierce Pharma announcing the spin-off date and it epitomized the market’s perception of all generics makers… here are some excerpts (emphasis mine):

Competition and U.S. pricing pressure have been weighing on Sandoz and the broader generics industry for years.

While Sandoz has seen a revenue decline every year since 2016, that slide could soon come to an end. In June, Sandoz predicted it can generate some sales growth this year, which should continue through 2028.

It’s painfully obvious that years and years of revenue declines and leverage have created disdain for this entire group — median multiples for the group are ~6.5x EBITDA, 4.5x earnings, and 3.7x leverage.

My impression (and hope) is that no one will be paying attention to this spin nor will they care about it or the industry…

3) Excellent balance sheet

Publicly traded competitors have been plagued by bad balance sheets for many, many years thanks to expensive acquisitions at the previous cycle top. Then, Merck spun off their Generic/Biosimilar business in 2021 (Organon) and loaded it up with a then-industry-standard ~4x leverage.

Balance sheets among that group (Teva, Viatris, Organon) are still 3.5-4x net levered. I figured Sandoz would be no different and Novartis would use it as a way to rake in a big cash dividend; but they’re actually taking an opposite approach with a <2x levered Sandoz. Maybe they believe it is a decent business with good prospects? Hmm…

At the time of spin — Sandoz expects $3.75bn gross debt and ~$670m cash on hand. Call it $3.1bn net debt or 1.8x leverage.

Using 2023 guidance, I get to ~$1.75bn EBITDA and $840m FCF for net leverage of 1.8x and debt/FCF of 3.7x — both very reasonable levels.

Summing it up…

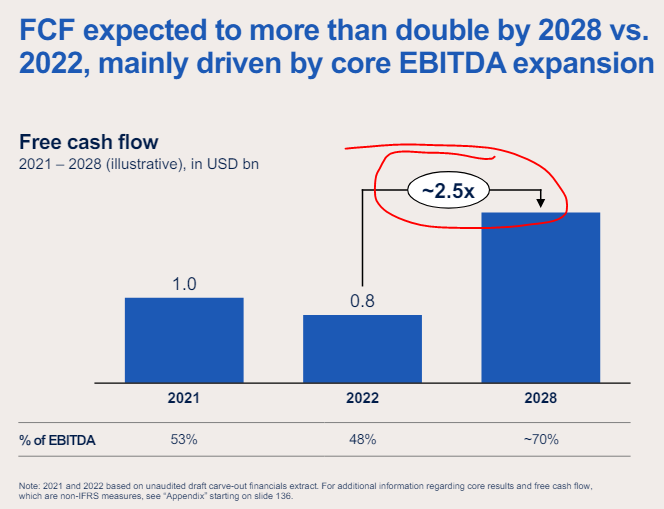

The guidance is pretty wild if achievable… expecting mid-single-digit revenue growth from 2023-2028 (including 2023 vs. 2022); EBITDA margins expanding from 18-19% in 2023 to 24-26% by 2028; and FCF conversion ramping from 48% of EBITDA in 2023 to 70% by 2028.

Just taking those at face value gets to 2023 FCF of $825m ($0.40/share on pre-spin share count of 2068m)… that figure grows to $2.2bn or $1.07/share by 2028!

Here it is in visual form:

I guess this makes sense given management is calling for FCF to more than double by 2028… you just don’t see those lofty targets in stodgy declining businesses all that often.

Peers trade at 6.5x EBITDA… starting with 2023 guide at $1.75bn = $11.4bn EV less $3.1bn in net debt for an equity value of $8.3bn or $4.00 per share (using the 1:5 spin ratio that would be $20/share). At industry valuations this one might be pretty interesting…