A Guide to Activist Investing

Investment themes Pt. 6 of 15 = activist investing

Aside from spin-offs, activist investments are perhaps my favorite form of catalyst-driven investing.

This is part 6 covering the 15 investment themes I look for. As a recap, we’ve already covered:

Part 1 — beaten down shares (my favorite source of idea gen)

Part 2 — spin-offs (my favorite source for actionable investments)

Part 3 — post-reorg equities (infrequent but actionable)

Part 4 — management changes (good ones are uncommon but actionable)

Part 5 — insider buying (a checklist of what to watch for)

6) Activist Investing

Activist investing is an investor or group of investors publicly calling for change at a company (i.e. holding management accountable for past actions).

The typical activist investment looks something like this:

Shares underperform the market/peers for a stretch of time, or there is a mispriced division within the company, or management is being nefarious

An investor (usually hedge fund) buys up a large stake of 2-20% and files a 13D (SEC filing disclosing ownership and activist intent)

That investor calls for board seats and operational/strategic changes at the company

Activist wins board seats and CEO is replaced (possibly)

Changes are slowly made and the stock may or may not work

This is an excellent hunting ground for new investments, and they’re usually highly actionable because the activist investor(s) want to work quickly to execute their thesis/plan. As a small/passive investor, it’s great to have another shareholder working on your behalf to create change.

My checklist of what to look at in activist situations:

Standalone business merits — Are the business & share price interesting without the activist situation? I’d much prefer my investment not hinge entirely on activist success.

Activist value creation math — What is the case for value creation? An activist thesis could include: spin-off, separation, or sale of a business unit (especially for underperforming conglomerates), turnaround plan stemming from incompetent operators, more aggressive capital allocation, sale of entire company, etc. The investor usually (but not always) lays out their thesis and the upside math behind it.

Ownership structure — How much does the activist own? What does the rest of the cap table look like? I’m trying to place odds on the probability of a successful activist campaign here. Several activist funds is usually a better signal than a 1% owner trying to push for change.

Long-term share performance — The longer shares have underperformed, the more likely an activist will have success in their campaign. Long-time shareholders become frustrated at long stretches of underperformance and swing their votes toward “change.”

It’s not too late — Don’t get discouraged if the share price jumps after an activist announces their involvement. These situations typically take time to play out (12-36 months?). There’s usually plenty of upside after these situations go public.

Avoid personal situations — Try to avoid activist situations where the driving force is a personal grudge or emotionally charged and less about the business fundamentals / creating upside.

Examples:

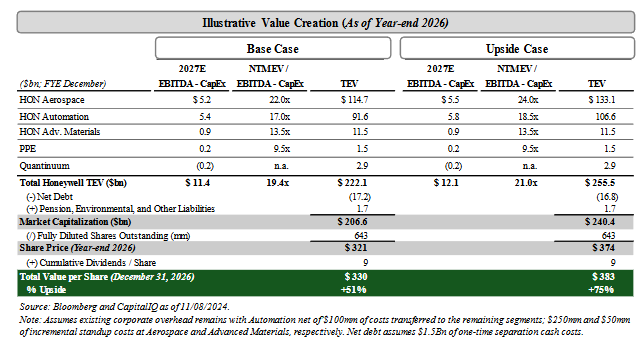

Honeywell (HON) — Elliott Management laid out their thesis for a separation in a November 2024 letter to the board.

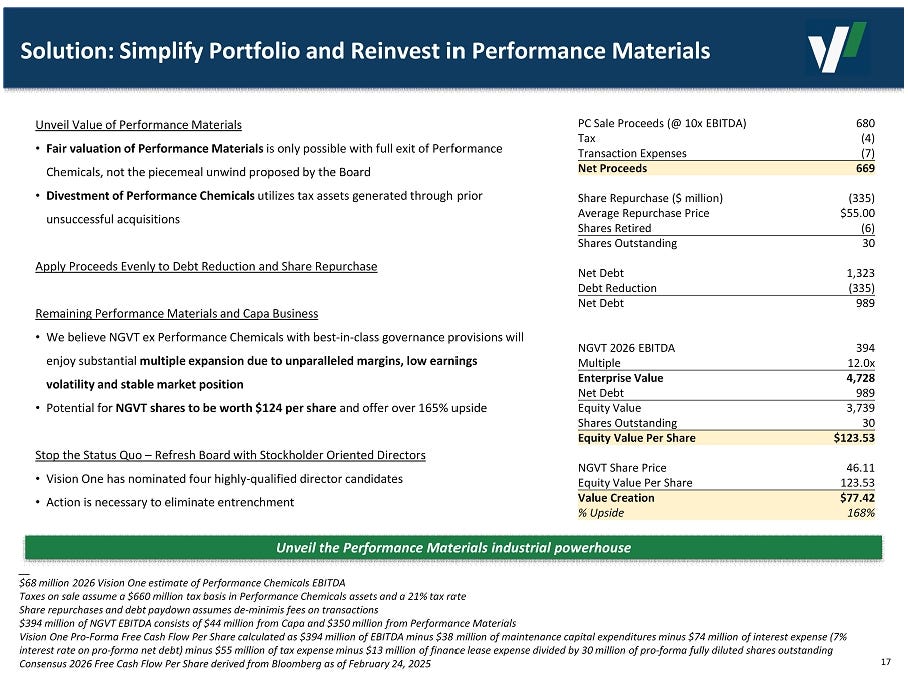

Ingevity (NGVT) — Vision One Management Partners (former Icahn protege) owned ~1% of NGVT shares and called for divestitures and a new CEO in February 2025. The upside math centered around: divestitures, buybacks, and a re-rating of the core Performance Materials business. The activist was targeting upside of $124 from a then share price of $46. (Link to my March 2025 write-up at $47.)

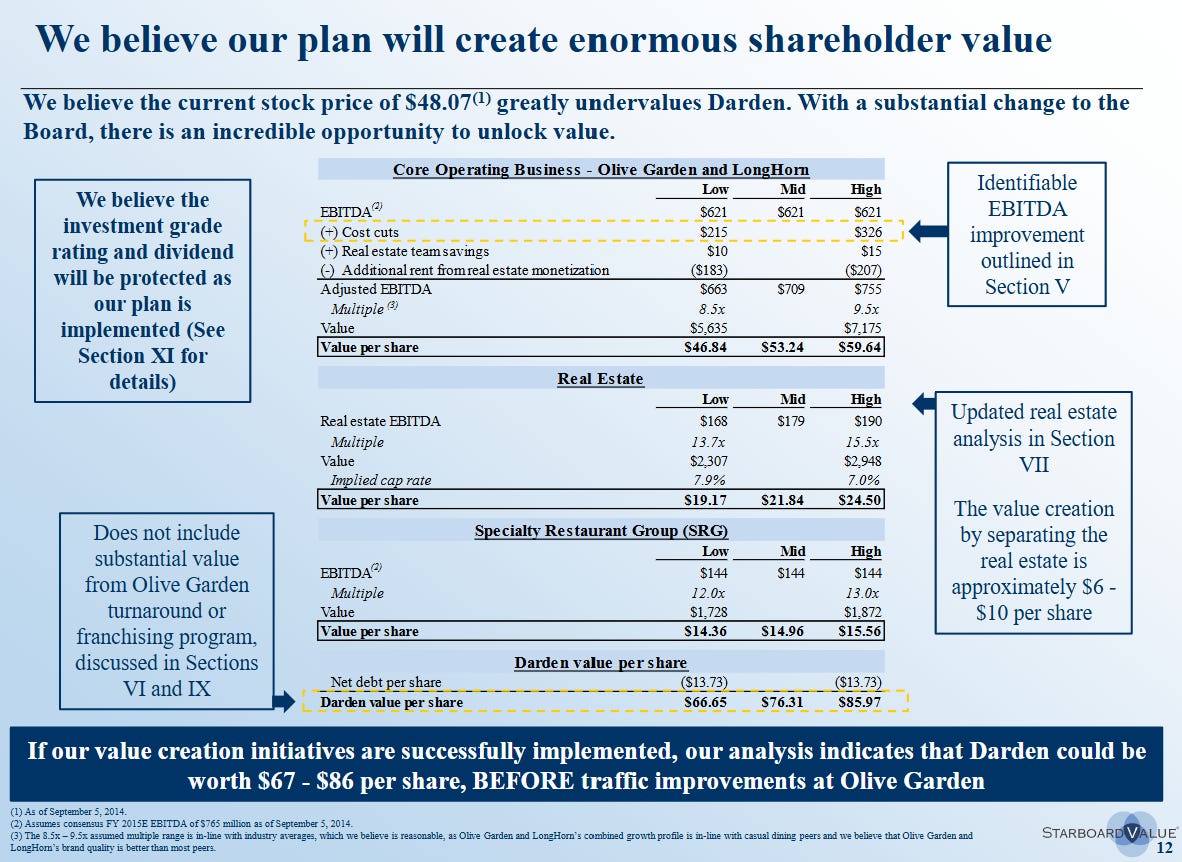

Darden (DRI) — Starboard laid out their thesis in a 294-slide presentation in September 2014.

Canadian Pacific Railway (CP) — A very successful investment from Bill Ackman’s Pershing Square hedge fund. They installed veteran railroader Hunter Harrison to run the company using a straightforward playbook to become a more efficient railroad.

JCPenney — A famously unsuccessful activist investment from Ackman. Installed an Apple executive to run the business with retailing strategies that never took hold.

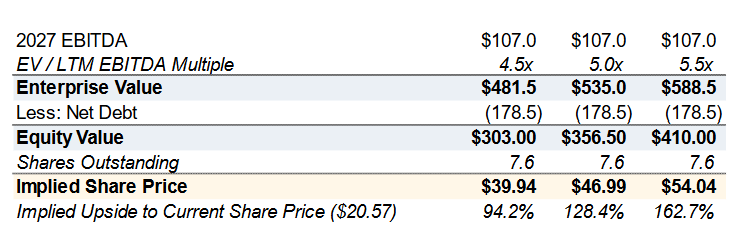

Civeo (CVEO) — In March 2025, Engine Capital purchased a 9.8% stake in CVEO and pushed for: 1) eliminating the dividend, 2) aggressively buying back shares; and 3) a sale of the company. Without hesitation, management agreed and adopted #1-2 on their list. (Link to my July 2023 primer on the accommodations industry.)

Jack in the Box (JACK) — A few activist investors are showing up on the holder list at JACK (including Biglari with a ~10% stake). This is an actionable worth following.

Where to find activist ideas — These are a bit harder to chase down. Starboard Value, Pershing Square, Engine Capital, ValueAct, Corvex, Trian, Elliott Management, Engaged Capital, and Jana Partners are notable activist hedge funds focused on activism. I follow the holdings from these funds, watch for headlines around funds calling for board seats, and keep an eye on general financial media (WSJ, briefing.com, etc.).

Thanks for your support! If you’re not already a subscriber, consider joining:

Great Primer !! Have you looked at Rapid7? Jana pulling the strings.

HSIC also really interesting

That's great! Glad you liked them. I have written up short notes on each ! Give them a read & let me know what you think. 👍