Quick Value #248 - Peabody Energy (BTU)

Today’s idea:

Coal producer trading at 3x EBITDA

Major acquisition changes business profile

Option-like upside potential (and downside too)

Call option on development of new coal mines (~2026)

Sign-up below for all VDL posts… next week we’ll cover an actionable small-cap idea that I’ve been buying recently.

Quick Value

Peabody Energy Corp (BTU)

Revisiting this name for the first time in 12 months. The reason? 1) the share price is virtually unchanged for 2.5 years now (a setup I typically like); and 2) Peabody is acquiring met coal assets from Anglo American for $2.3bn + earnouts (vs. current market cap of ~$2.7bn).

What they do…

Peabody operates coal mines in the U.S. and Australia producing both thermal coal (used in power generation) and metallurgical coal (used in steel production).

Roughly 2/3 of 2023 EBITDA came from thermal coal production (US and International) and 1/3 from met coal production.

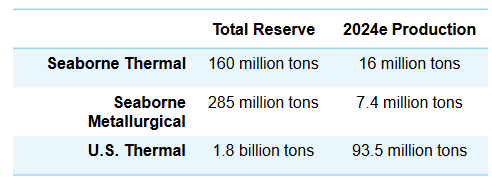

Reserves are significant at more than 20 years at current production levels

Coal prices were volatile pre-and-post-COVID and spot prices are still declining across virtually every market BTU operates in. These are high fixed cost businesses with tons of operating leverage so naturally cash was flowing in 2022-2023.

Coal prices (and earnings) are coming down in 2024 and capex is ramping at the same time as BTU invests in building out a major new mine (Centurion).

Why it’s interesting…

If I could attempt to simplify this situation, I’d phrase it this way — BTU is probably the cheapest stock in the coal sector but they’re opting for mine development (capex) and levered M&A instead of buybacks or capital returns. The effect is a business with: 1) lots of upside optionality from new mines coming online (Centurion and acquired Grosvenor); 2) more risk than peers as the only player with net debt; and 3) likely a few years of no buybacks.

Below are summary fundamentals and capital allocation from 2016-9M24:

The Anglo acquisition changes the picture significantly. Peabody will get 4 mines, 3 of which are operating and a 4th that’s temporarily shut down from an underground fire. Those 3 operating mines add 11.2m tons of met coal production on 2026 estimates.

Met coal becomes a much bigger piece of the overall business, likely contributing 2/3 of EBITDA by 2026. Management is touting an attractive acquisition price of 3.1x EBITDA based on $100m cost synergies and $65-70 EBITDA per ton at $225 coal prices.

So what does the post-close picture look like?

I have BTU at a $2.7bn market cap with 122m shares outstanding and a $22 share price. Net cash is $430m (excluding asset retirement or pension liabilities which are mostly funded) for a $2.27bn enterprise value.

The Anglo acquisition calls for $1.7bn upfront cash and various deferred payments / earnouts. Bridge financing adds $2.08bn to cover the purchase price, transaction costs, and liability funding. So net debt jumps to $1.65bn by 1H25 assuming zero FCF from 3Q24 to the 1H25 closing timeframe.

When thinking about normalized earnings, there are essentially 3 pieces here:

Core BTU operating mines — Analyst estimates are $865m EBITDA in 2024 which seems like a conservative baseline

Acquired Anglo operating mines — 3 mines producing 11.2m tons per year at $65-70 EBITDA per ton = $730-780m (maybe some discount factor appropriate here?)

Offline mine “call options” — Centurion is expected to produce ~3.5m tons of met coal in 2026 and Grosvenor, if reactivated, could add 3-4m tons per year = $400m EBITDA at $60 EBITDA per ton

All-in, that’s $1.6bn for the core businesses and $400m of “optionality.” On an EV of $4.35bn, shares trade at 2.7x EBITDA (on 2026 projections). That multiple drops to 2.2x if they can achieve those upside options without incurring more net debt. A big question mark which needs investigation is how much of that EBITDA will convert into cash flow by 2026.

At 3.5x $1.6bn EBITDA less $1.65bn net debt = $3.95bn market cap or $33/share (+50% from current price). That target jumps to $44/share at $2bn EBITDA.

Summing it up…

All I’ve done is paint a rosy picture with big upside potential… but the path of coal prices will matter a lot. The combination of leverage and capex means they’re highly vulnerable to low or volatile commodity prices. Management is optimistic they’ll have excess cash for shareholders but my guess is the room for error is razor thin.

It feels a bit like a call option on high or stable coal prices; and at that point, I might just look at 2027 LEAPS (there are a few interesting opportunities there).

Is this one worthy of a spot on the watchlist? Hmm…

Made a companion video on YouTube for this write-up... check it out:

https://www.youtube.com/watch?v=VY6ibXZncVE

I like BTU and have a small position since 2021 where the stock was less than $5. Planning to let this run for many years. Thank you for the article.